IMF: U.S. ISN'T WORKING WELL

IMF - The backdrop for the consultation this year was one of a U.S. economy that has achieved much since the Global Financial Crisis. This is the third-longest expansion since 1850, job growth has been persistently strong, and the economy looks like it is effectively back at full employment.

As you may know, in January we updated our growth outlook to incorporate an assumed fiscal stimulus that would roll out over the next few years. However, after discussions with the U.S. authorities, and given the still-evolving policy plans, we have decided to remove that assumed stimulus from our forecast and base our projections on unchanged policies. This in large part reflects the uncertainty about the nature of the macroeconomic policies that will be put in place in the coming months. As a result of the change in assumptions, we have lowered our near-term growth projection relative to that which was published in the April World Economic Outlook.

Despite this relatively good near-term picture, the U.S. economy continues to face considerable challenges. Technological change is reshaping product and labor markets but, unlike in the past, we are not seeing a resulting increase in productivity growth. Demographics are increasingly creating headwinds. And there are important distributional consequences of the secular changes that are underway. These are feeding back into economic prospects on both the demand and supply side. All in all, in our judgement, the U.S. economic model is not working as well as it could in generating broadly shared income growth.

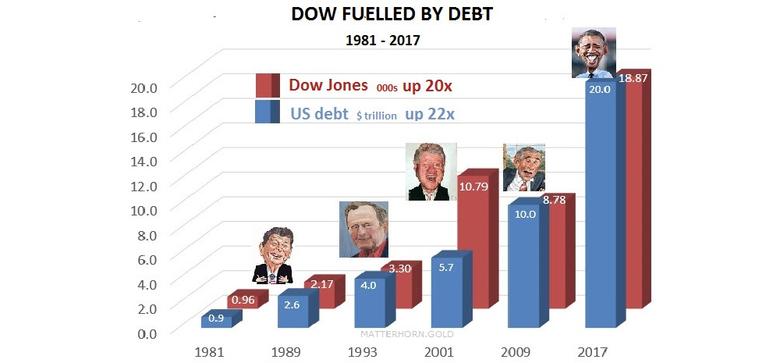

There was agreement with the U.S. authorities on the objectives that need to be achieved to ensure stronger and more inclusive growth going forward. As we have emphasized in past consultations, these include: generating faster economic and productivity growth, stimulating job creation, incentivizing business investment, balancing the budget and bringing down the public debt, and creating the fiscal space that is needed to finance priorities such as infrastructure and investments in human capital.

In our judgement, achieving these objectives will require action on many fronts. To raise living standards for the majority of Americans the key priorities are: a tax reform that simplifies the system and generates an increase in the revenue-GDP ratio, more investment in infrastructure; more trade integration; and an array of policies to enhance labor supply and skills. In this latter point, we have in mind a more effective education system; skills-based immigration reform; and policies to help low- and middle-income households maintain gainful employment—such as better social assistance programs, childcare support, and paid family leave.

These policies will need to be embedded into a sustained, gradual and balanced reduction in the fiscal deficit over the medium-term. Given where we are in the cycle, we support a gradual increase in policy rates and a normalization of the Federal Reserve's balance sheet.

Many of the policy details are laid out in the concluding statement that you have before you. We believe this set of policies will be both good for the U.S. and good for the global economy.

-----

Earlier:

U.S. - CHINA TRADE DEFICIT: +13.8%