U.S. OIL INVENTORIES DOWN

OGJ - US crude oil inventories fell for an eighth straight week and drawdowns appear to be expanding.

Excluding those in the Strategic Petroleum Reserve, commercial crude stockpiles fell 6.4 million bbl during the week ended May 26 compared with the previous week's total.

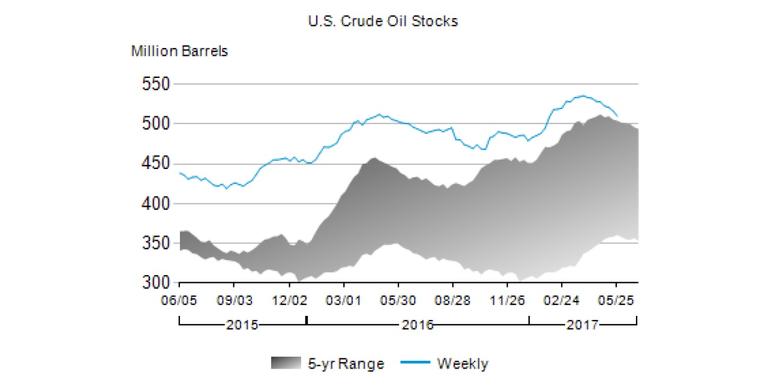

At 509.9 million bbl, US crude inventories are in the upper half of the average range for this time of year.

The American Petroleum Institute indicated US crude inventories fell 8.7 million bbl for the week.

Total motor gasoline inventories decreased 2.9 million bbl last week but are near the upper limit of the average range. Both finished gasoline inventories and blending components inventories dropped.

Distillate fuel inventories increased 400,000 bbl and are near the upper limit of the average range for this time of year. Propane-propylene inventories climbed 3.4 million bbl but are in the lower half of the average range. Total commercial petroleum inventories lost 5.2 million bbl.

US crude refinery inputs during the week averaged 17.5 million b/d, up 229,000 b/d from the previous week's average. Refineries operated at 95% of their operable capacity.

Both gasoline production and distillate fuel production increased to 10.4 million b/d and 5.2 million b/d, respectively.

US crude imports averaged 8 million b/d, down 309,000 b/d from the previous week's average. Over the last 4 weeks, crude imports averaged 8.1 million b/d, up 6.6% from the same 4-week period last year.

Total motor gasoline imports, including both finished gasoline and gasoline blending components, averaged 703,000 b/d. Distillate fuel imports averaged 105,000 b/d last week.

-----

Earlier:

U.S. OIL GAS PRODUCTION WILL UP