NOV VARCO NET LOSS $75 MLN

NOV - National Oilwell Varco, Inc. (NYSE: NOV) reported a second quarter 2017 net loss of $75 million, or $0.20 per share. Excluding other items, net loss for the quarter was $54 million, or $0.14 per share. Other items totaled $30 million, pretax, and primarily consisted of charges related to severance and facility closures.

|

NATIONAL OILWELL VARCO, INC. CONSOLIDATED STATEMENTS OF INCOME (LOSS) (Unaudited) (In $ millions, except per share data) |

|||||

| Three Months Ended | Six Months Ended | ||||

| June 30, | March 31, | June 30, | |||

| 2017 | 2016 | 2017 | 2017 | 2016 | |

| Revenue: | |||||

| Rig Systems | 346 | 564 | 393 | 739 | 1,490 |

| Rig Aftermarket | 341 | 364 | 321 | 662 | 755 |

| Wellbore Technologies | 614 | 511 | 555 | 1,169 | 1,142 |

| Completion & Production Solutions | 652 | 538 | 648 | 1,300 | 1,096 |

| Eliminations | (194) | (253) | (176) | (370) | (570) |

| Total revenue | 1,759 | 1,724 | 1,741 | 3,500 | 3,913 |

| Gross profit (1) | 231 | 35 | 209 | 440 | 279 |

| Gross profit % | 13.1 | 2.0 | 12.0 | 12.6 | 7.1 |

| Selling, general, and administrative | 293 | 305 | 306 | 599 | 738 |

| Operating loss | (62) | (270) | (97) | (159) | (459) |

| Interest and financial costs | (26) | (30) | (25) | (51) | (55) |

| Interest income | 4 | 3 | 4 | 8 | 8 |

| Equity loss in unconsolidated affiliates | (2) | (7) | - | (2) | (13) |

| Other income (expense), net | (2) | (34) | (11) | (13) | (55) |

| Loss before income taxes | (88) | (338) | (129) | (217) | (574) |

| Provision for income taxes | (14) | (121) | (9) | (23) | (239) |

| Net loss | (74) | (217) | (120) | (194) | (335) |

| Net income attributable to noncontrolling interests | 1 | - | 2 | 3 | 1 |

| Net loss attributable to Company | (75) | (217) | (122) | (197) | (336) |

| Per share data, $: | |||||

| Basic | (0.20) | (0.58) | (0.32) | (0.52) | (0.90) |

| Diluted | (0.20) | (0.58) | (0.32) | (0.52) | (0.90) |

| Weighted average shares outstanding: | |||||

| Basic | 377 | 375 | 376 | 377 | 375 |

| Diluted | 377 | 375 | 376 | 377 | 375 |

| (1) | Gross profit excluding other items was $261 million and $497 million for the three and six months ended June 30, 2017, respectively. Gross profit excluding other items was $139 million and $439 million for the three and six months ended June 30, 2016, respectively. Gross profit excluding other items was $236 million for the three months ended March 31, 2017. See GAAP to Non-GAAP reconciliation on page 10. |

Revenues for the second quarter of 2017 were $1.76 billion, an increase of one percent compared to the first quarter of 2017 and an increase of two percent from the second quarter of 2016. Operating loss for the second quarter was $62 million, or 3.5 percent of sales. Excluding other items, operating loss was $32 million, or 1.8 percent of sales. Adjusted EBITDA (operating profit excluding other items before depreciation and amortization) for the second quarter was $142 million, or 8.1 percent of sales, an increase of $37 million from the first quarter of 2017. Cash flow from operations for the second quarter was $168 million.

"Our team executed exceptionally well during the second quarter, driving substantial sequential improvements in adjusted EBITDA and free cash flow, as we continue to navigate a challenging market," commented Clay Williams, Chairman, President, and CEO. "Efficiency gains from our investments in operations through the last two years and rising demand support our drive to return the company to acceptable levels of financial performance. The second quarter results reflect our steady progress."

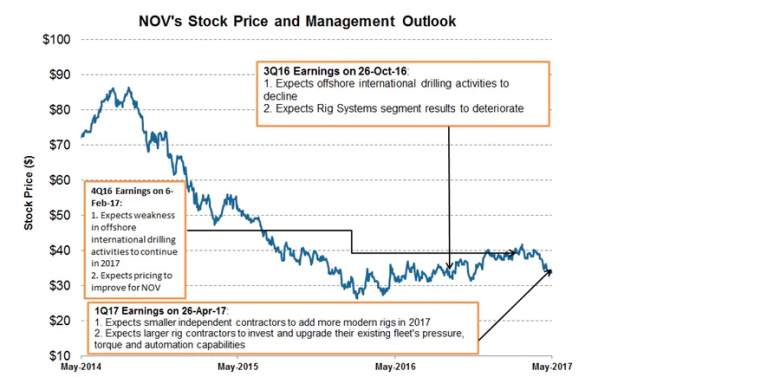

"Scarcity is returning to the oilfield, and, around the world, customers are steadily exhausting excess stocks of the critical products, equipment and technologies we supply, laying the groundwork for future demand. The strong recovery we've seen thus far in North America, combined with many international markets stabilizing and offshore markets nearing bottom, makes us optimistic in our outlook."

-----

Earlier: