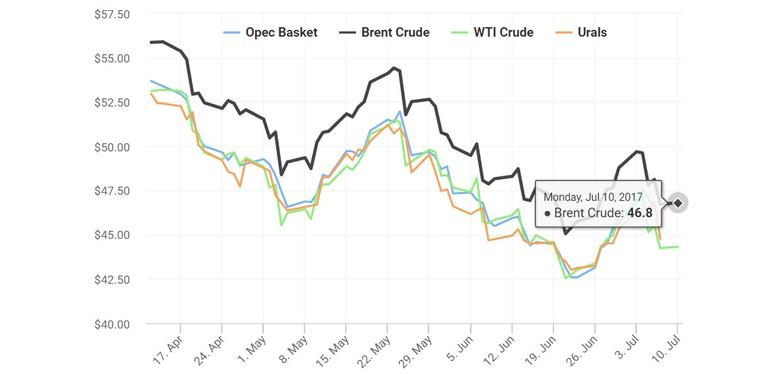

OIL PRICES: ABOVE $46

REUTERS, BLOOMBERG, OILPRICE - Oil prices recovered some losses on Monday after a 3 percent fall in the previous session, but markets remain under pressure from high drilling activity in the United States and ample supplies from producer club OPEC.

Brent crude futures, the international benchmark for oil prices, were at $47.08 per barrel at 0537 GMT, up 37 cents, or 0.8 percent, from their last close.

U.S. West Texas Intermediate (WTI) crude futures were at $44.60 per barrel, up 37 cents, or 0.8 percent.

Traders said the higher prices were reflected opportunistic buying following Friday's steep fall, but added that overall market conditions remain weak.

Brent prices are 17 percent below their 2017 opening despite a deal led by the Organization of the Petroleum Exporting Countries (OPEC) to cut production from January.

ANZ bank said on Monday that the market "continued to focus on the increasing (U.S.) drilling activity and higher production."

U.S. energy firms added seven oil drilling rigs last week, marking a 24th week of increases out of the last 25 and bringing the total count up to 763, the most since April 2015, Baker Hughes energy services company said on Friday.

U.S. oil production has risen over 10 percent since mid-2016 to 9.34 million barrels per day (bpd).

The rising U.S. output comes as supplies from OPEC also remain ample despite a pledge by the group to cut production between January this year and March 2018.

OPEC exported 25.92 million barrels per day (bpd) in June, 450,000 bpd more than in May and 1.9 million bpd more than a year earlier.

Given ongoing oversupply, analysts said that the market was still some way off from finding a closer balance between demand and available supplies.

"There seems little hope for (market) rebalancing... unless we see an exceptional increase in demand as reining in supply seems to be getting tougher," said Sukrit Vijayakar, director of energy consultancy Trifecta.

-----

Earlier:

OPEC PRODUCTION UP TO 32.49 MBD