RUSSIA'S INVESTMENT POTENTIAL

PLATTS - Russia's energy minister Alexander Novak on Monday criticized European and US sanctions on the country's energy sector as "protectionist policy" and obstacles to Russian infrastructural project as "sabotage" stalling global industry progress, and called for greater international cooperation.

Speaking at the World Petroleum Congress in Istanbul, he urged "artificial barriers on the way to progress" be removed.

"In my view, limitations of any sort, which have become trendy lately, don't add to stability, especially territorial limitations. They spread on trade, investment, and technology areas. In essence, such policy is the continuation of the protectionist policy," he said. "Cooperation is in the interest of all countries in the world."

Russia's energy sector has been under US and European Union sanctions for three years now, with restrictions to its energy companies' access to western funds, technology and partnerships with foreign peers on shale, Arctic offshore and deepwater projects.

The US Senate last month proposed extending the sanctions, which could potentially block Russia's export pipelines and further limit fund access.

While the proposals hit a procedural roadblock in the House of Representatives, some saw them as potentially affecting the implementation of the 55 Bcm/year Nord Stream 2 pipeline, which Russia's gas giant Gazprom plans to build across the Baltic Sea and launch in late 2019.

The project has already faced hurdles in Europe, with the European Commission wary of the company's increasing role in the regions gas imports.

"We have often faced lately artificial limitations to infrastructure expansion, artificial preferences to energy sources and suppliers...in particular, with regard to the European gas market," Novak said.

The comments come amid the EC's vocal criticism of the Nord Stream 2 project on the worries it could concentrate 80% of Russia gas exports to the EU through the Baltic Sea route, and reduce flows through Ukraine.

They also follow so far still occasional US LNG flows to Europe, started earlier this year, and US President Donald Trump's talks last week of US LNG supplies prospects in Poland, one of the opponents of Nord Stream 2.

Polish opposition earlier prevented five European energy companies from partnering with Gazprom in Nord Stream 2 to set up a joint venture.

"We see open sabotage of infrastructure projects that are economically justified and attractive for consumers, such as Nord Stream 2, and interfering with the companies' commercial relations," Novak said. "We see certain deviation in energy policies of certain countries, which refuse efficient and clean energy sources -- nuclear, gas -- for political reasons."

European opposition already forced Gazprom to cancel its South Stream project across the Black Sea in 2015, which has now been replaced with a TurkStream project for a 31.5 Bcm/year natural gas pipeline to Turkey and further to southern and central Europe, with the first line to be launched in 2019.

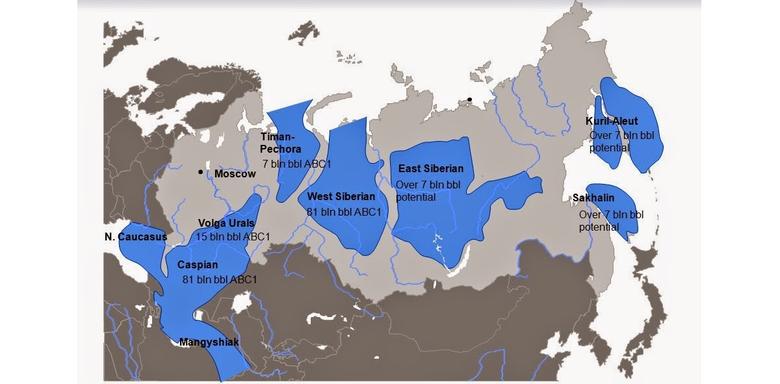

"Russia is among the leading energy countries today. We see colossal unrealized potential for cooperation, for investment -- we will continue working on implementing it with all the interested parties," Novak said.

-----

Earlier:

RUSSIAN OIL PRODUCTION DOWN 0.6%

RUSSIA - TURKEY RECONCILIATION

GAZPROM: RUSSIAN GAS FOR EUROPE