U.S. GLOBAL LEADERSHIP

OGJ - Rising natural gas supplies from the US along with expanding industrial demand will dramatically shift the global market through 2022, according to the International Energy Agency's latest market analysis and 5-year gas forecast.

Global gas demand is expected to increase 1.6%/year for the next 5 years, with consumption by 2022 reaching almost 4 trillion cu m (tcm), up from 3.63 tcm in 2016. China will account for 40% of the growth. The industrial sector will emerge as the main engine of consumption growth, replacing power generation, where gas is being squeezed by growing renewables and competition from coal, IEA said.

The US, the world's largest gas consumer and producer, will account for 40% of the world's extra gas production to 2022 as its shale industry continues to expand. By 2022, US production will be 890 billion cu m, or more than a fifth of global gas output. Production from the Marcellus shale is expected to increase 45% between 2016-22 even at current low price levels as producers increase efficiency and produce more gas with fewer rigs.

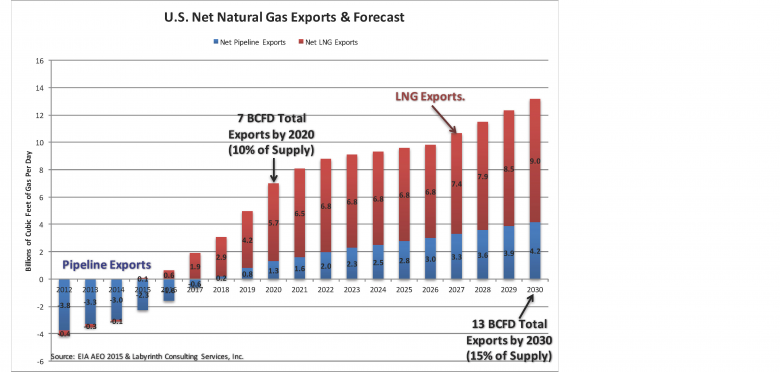

US becomes LNG export powerhouse

While US demand for gas is rising because of higher industrial consumption, more than half of the production increase will be used for LNG for export. By 2022, IEA estimates that the US will be on course to challenge Australia and Qatar for global leadership among LNG exporters.

"The US shale revolution shows no sign of running out of steam and its effects are now amplified by a second revolution of rising LNG supplies," said Fatih Birol, IEA executive director. "Also, the rising number of LNG consuming countries—from 15 in 2005 to 39 this year—shows that LNG attracts many new customers, especially in the emerging world. However, whether these countries remain long-term consumers or opportunistic buyers will depend on price competition."

IEA believes US LNG will be a catalyst for change in the international gas market, diversifying supply, challenging traditional business models and suppliers, and transforming global gas security. A new wave of liquefaction capacity is coming online at a time when the LNG market is already well supplied, and the LNG glut is already affecting price formation and traditional business models and attracting new LNG-consuming countries such as Pakistan, Thailand, and Jordan.

Meanwhile, the ample availability of LNG is also creating new competition with pipeline gas supplies, which could benefit consumers. Intense competition is loosening pricing and contractual rigidities that have traditionally characterized long-distance gas trade. The change will be accelerated by the expansion of US exports, which are not tied to any particular destination and will play a major role in increasing the liquidity and flexibility of LNG trade, IEA said.

Europe could see growing competition between LNG imports and pipeline gas as domestic production declines, creating extra uncertainty on the sources of future supply. The recent standoff involving Qatar—which supplies about a third of the world's LNG—and neighboring countries has also underscored potential risks to gas supply security. "Even in a well-supplied market, recent events remind us that gas security remains a critical issue," Birol noted.

-----

Earlier:

U.S. OIL GAS PRODUCTION WILL UP ANEW