U.S. & RUSSIA: LIMITED IMPACT

WSJ - President Donald Trump is touting his policies to boost energy production and exports as a bulwark against Russia.

But some industry observers say the U.S. shale boom—which reshaped world markets for crude oil and natural gas before Mr. Trump took office—has only limited impact on Russia's standing as a major energy provider to Europe and Asia.

In a televised interview Wednesday on the Christian Broadcasting Network, Mr. Trump said the U.S. shale boom was helping to keep global energy prices low and countervailing the influence of Russian President Vladimir Putin.

"We're going to be exporting energy; he doesn't want that," Mr. Trump said.

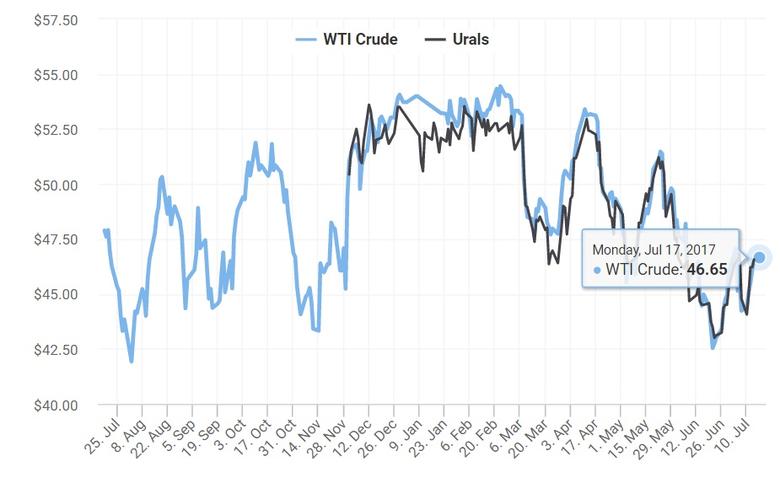

While a boom in U.S. oil-and-gas production is keeping a lid on prices and spurring exports, it's largely a function of market factors far from Washington's control. Because global oil and gas markets are already glutted, moves by the Trump administration to boost drilling and exports can only play a marginal role.

"Easing regulation can help output on the margins, but markets will dwarf policy in determining the outlook for U.S. domestic energy production and exports," said Jason Bordoff, director of the Center on Global Energy Policy at Columbia University and a former energy official in the Obama administration.

Russia dominates the European natural-gas market, and many on the Continent remember a time several years ago when Mr. Putin threatened to cut off countries, including Poland and Germany. It's a tall order to compete head to head with Russia, which operates an extensive network of pipelines into Europe.

The first large-scale gas-exporting plant in the U.S. started operating last year, and since then shipments of liquefied natural gas, or LNG, have skyrocketed.

In the first four months of 2017, U.S. LNG exports, at 198 billion cubic feet, were nearly eight times what they were in the same period last year, according to the latest federal data.

But that remains a fraction of the market. For European buyers, the biggest impact has been the ability to use LNG as leverage to get better prices on Russian gas. Before Lithuania's first LNG import terminal opened in 2014, state-controlled PAO Gazprom lowered gas prices to the country by 20%. Poland last month became the first former Soviet bloc country to receive a U.S. gas cargo, while Lithuania recently signed a deal with Cheniere Energy Inc. to receive gas exports this summer from Louisiana. Other countries in the region are building infrastructure to handle more LNG imports.

That has spurred Moscow to lower prices to compete and to try to develop its own LNG facilities. Russia wants to build another large gas pipeline into Europe, a project opposed by Washington and Brussels.

"Russia has become very flexible in the way they are marketing their gas as they compete with LNG," said Ira Joseph, head of gas and power analytics at S&P Global Platts.

Still, some see an opening for the U.S. to boost exports to Europe in coming years. Half of all long-term supply agreements into Europe—the vast majority of which involve Russia—expire in the five-year period that started in 2016, according to the International Energy Agency.

"U.S. gas is a powerful alternative to Europe's other options," IEA chief Fatih Birol said.

The sea change in U.S. oil exports occurred in December 2015, when Congress lifted a 40-year export ban on oil. Since then, U.S. oil shipments overseas have soared, topping one million barrels a day in some months of this year and moving to far-flung locations including China and India, which have voracious appetites for oil.

While the Trump administration has taken steps to remove barriers to production, some say they are unlikely to have a major impact due to lower commodity prices.

This month, Secretary of the Interior Ryan Zinke promised to speed up permitting for developing oil and gas on federal lands, but little output comes from such acreage because U.S. drillers are focused on private lands. The Trump administration has moved to expand drilling off the coast of Alaska, a U-turn from the Obama era, but with crude prices below $50 a barrel, few companies are eager to drill in the challenging Arctic environment.

The White House has also trumpeted the idea of approving more natural-gas export terminals along the Gulf Coast. Problem is, the market doesn't need them right now.

Under President Barack Obama, 23 U.S. gas export facilities were approved. Four are operating, and by 2021 a total of nearly 13 billion cubic feet of gas a day could be shipped out, said John Best, managing director of Criterion Research, a Houston energy consulting firm.

From Florida to Alaska, projects capable of exporting another 30 billion cubic feet of gas have been announced but not yet approved. Mr. Best believes approved facilities will ship out only around 8 billion cubic feet of gas, and many of the others will never be built because they no longer make financial sense.

"The world can't absorb this much gas that quickly," he said.

-----

Earlier:

| RUSSIA: | U.S.: | |

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|

||

|

|