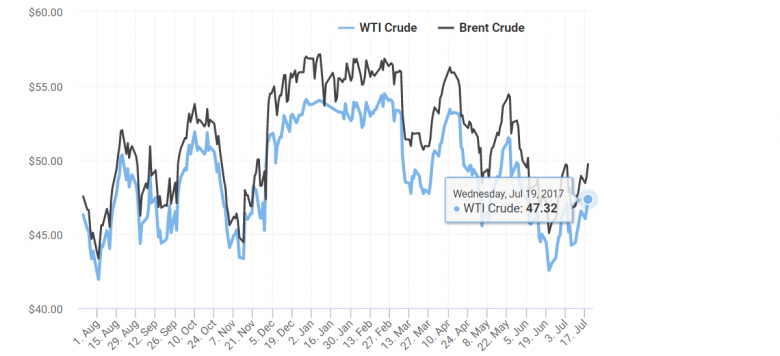

U.S. OIL PRICE: $45

FITCH, OILPRICE - Fitch Ratings anticipates most investment-grade and 'BB' category U.S. E&P companies will see minimal ratings changes in a steady $45 per barrel environment as the realization of further production efficiency gains and lower costs per barrel of oil equivalent (boe) should contribute to resilient margins and cash flow.

"Most U.S. E&P companies will continue to see production profile gains and lower costs per barrel of oil equivalent through a combination of reduced drilling days, improved wellbore placement, expanded multi-well pad drilling, longer laterals and higher intensity completions, which should help offset market price pressures," says Dino Kritikos, Senior Director, U.S. Corporates. "Oilfield services credits would be most pressured."

These topics and others were discussed on a recent investor tour throughout California, New York and Chicago, including:

--Onshore oilfield services inflation risk: Most U.S. E&Ps should be able to offset rising prices with production and efficiency gains;

--Canadian heavy oil in a lower-for-longer scenario: Lower cost nature of mining provides more cash flow resiliency compared to the higher cost, lower operating flexibility of in situ;

--Capital allocation prioritization of exploration: Lower medium-term priority given U.S. shale's lower operational risk, favorable growth opportunity, relatively deep drilling inventory and improving unit economics. However, risk tolerance is expected to expand as U.S. shale matures;

--Increased gas-on-gas competition: Increasing Appalachian, Texas, Oklahoma, and Louisiana production is expected to increase gas-on-gas competition given the bulk of demand is Gulf Coast centric, which could reduce the upside in benchmark prices and potentially introduce some regional demand-induced differentials;

--Offshore driller recovery: Fitch believes it will be protracted and the inflection point will happen around second half of 2018 (2H18). Jack-up market to experience a utilization uptick first, but competitive environment is expected to make day rate gains elusive;

--Colorado E&P outlook: Less likely than states to incite major ballot initiatives or regulation given the positive impact the industry has on the local economy in terms of job creation and taxes. However, sustained activity disruptions could be a credit risk for names with focused exposure;

--Impact of a PDVSA default: Fitch believes that CITGO entities have sufficient structural and legal separations from the Venezuelan oil giant to protect its assets and support creditor recovery. However, Fitch believes the equity pledge to PDVSA bondholders and Rosneft increase CITGO refinancing risk through the introduction of change of control issues.

-----

Earlier:

U.S. OIL&GAS PRODUCTION WILL UP