U.S. OIL PRODUCTION: 9.3 MBD

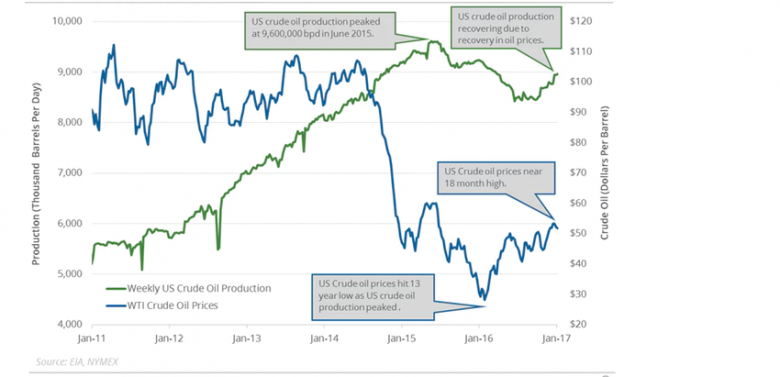

EIA - EIA forecasts that total U.S. crude oil production will average 9.3 million barrels per day (b/d) in 2017, up 0.5 million b/d from 2016. In 2018, crude oil production is expected to reach an average of 9.9 million b/d, which would surpass the previous record of 9.6 million b/d set in 1970. Most of the growth in U.S. crude oil production from June 2017 through the end of next year is expected to come from tight rock formations within the Permian region in Texas and from the Federal Offshore Gulf of Mexico (GOM) (Figure 1).

The Permian region is expected to produce 2.9 million b/d of crude oil by the end of 2018, about 0.5 million b/d above the estimated June 2017 production level, representing nearly 30% of total U.S. crude oil production in 2018. The Permian region predominately spans the Permian Basin of western Texas and southeastern New Mexico, covering 53 million acres. Within the Permian Basin are smaller sub-basins, including the Midland Basin and the Delaware Basin, all of which contain historically prolific non-tight formations as well as multiple prolific tight formations such as the Wolfcamp, Spraberry, and Bone Spring. With the large geographic area of the Permian region and stacked plays, operators can continue to drill through several tight oil layers and increase production even with sustained West Texas Intermediate (WTI) prices below $50 per barrel (b).

According to the June monthly average rig count from Baker Hughes, 366 of the 915 onshore rigs in the Lower 48 states are operating within the Permian region. EIA estimates that this number will fall slightly during the second half of 2017 to 345 at the end of 2017 and then grow to 370 by the end of 2018.

In addition to responding to changes in WTI price, increases in rig counts are also related to cash flow. In the Permian, operators have been able to maintain positive cash flow because of lower costs, higher productivity, and increased hedging activity by producers, many of whom have sold future production at prices higher than $50/b. Available cash flows could potentially contribute to the growth of rigs in this region notwithstanding relatively flat prices since December 2016.

Based on EIA's Drilling Productivity Report, productivity in the Permian, as measured by new-well oil production per rig in barrels per day, is forecast to decrease month-over-month for the 10th consecutive month in June (Figure 2). Output per rig is likely decreasing because operators are drilling more wells than they are completing. Completing a well is the process of casing, cementing, perforating, and hydraulically fracturing a well to make it ready for producing. When operators drill a well but do not complete it, the inventory of drilled but uncompleted wells (DUCs) increases, which tends to lower output per drilling rig. Oil flows only after a well is completed. The trend of operators drilling more wells than they are completing does not have a clear cause, but a widening of the WTI-Midland crude oil price discount to WTI-Cushing since the beginning of 2017 suggests the possibility of some minor transportation constraints. Lags in well completion may also reflect implementation of strategies that drill more wells from a single pad, with completion equipment not deployed until all wells are drilled.

Average output per well shows that productivity based on initial production rates continues to increase in the Permian region (Figure 3). Initial production based on average output per well year-to-date is higher than the 2016 annual average. Many operators are continuing to experiment with completion techniques to maximize output per well, suggesting the 2017 annual average initial production rate could continue to increase.

The dynamics related to drilling in the GOM differ from those in Lower 48 onshore regions. Because of the length of time needed to complete large offshore projects, oil production in the GOM is less sensitive to short-term oil price movements than Lower 48 onshore production. In 2016, eight projects came online in the GOM, contributing to production growth. Another seven projects are anticipated to come online by the end of 2018. Based on anticipated production at both new and existing fields, crude oil production in the GOM is expected to increase to an average of 1.7 million b/d in 2017 and 1.9 million b/d in 2018.

-----

Earlier:

U.S. OIL&GAS PRODUCTION WILL UP