OIL PRICE: NOT ABOVE $53

REUTERS , BLOOMBERG , OILPRICE - Oil prices steadied on Thursday, holding on to most of their recent gains after another fall in U.S. crude inventories indicated a tighter market, and as a tropical storm headed towards oil producing facilities in the Gulf of Mexico.

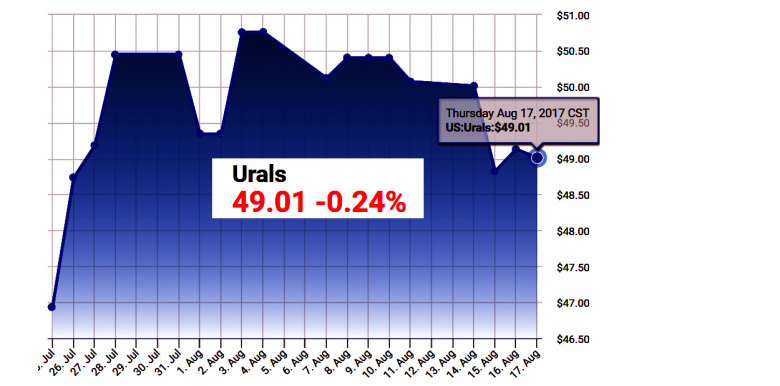

Benchmark Brent crude LCOc1 was down 5 cents a barrel at $52.52 by 0745 GMT. U.S. light, sweet crude CLc1 was 5 cents lower at $48.36 a barrel.

Both contracts had risen more than 1 percent on Wednesday, buoyed by potential output disruptions from the Gulf of Mexico storm Tropical Depression Harvey.

"For the next few days, the U.S. market is going to be focused on Texas as Tropical Depression Harvey is expected to strengthen into a Category I hurricane by Friday," said Sukrit Vijayakar, director of energy consultancy Trifecta.

"Operators in the area are already closing down platforms and evacuating workers as a precaution," he added.

Harvey strengthened into a tropical storm late on Wednesday night with winds of about 40 miles per hour (65 km per hour) and was located about 440 miles (705 km) southeast of Port Mansfield, Texas, the U.S. National Hurricane Center reported.

Royal Dutch Shell (RDSa.AS), Anadarko Petroleum (APC.N) and Exxon Mobil (XOM.N) have all taken steps to curb some oil and gas output at platforms in the Gulf.

Beyond the weather, traders said declines in U.S. commercial crude storage levels were a sign of a gradually tightening market, although another rise in output held the market back.

U.S. crude oil production hit 9.53 million barrels per day (bpd) last week, its highest since July 2015 and up over 13 percent from their most recent low in mid-2016.

Despite this, U.S. crude stocks fell last week and gasoline stocks were down as well, the Energy Information Administration said on Wednesday.

Crude inventories fell by 3.3 million barrels in the week ending Aug. 18 to 463.17 million barrels, down 13.5 percent from record levels last March.

------

Earlier:

August, 17, 15:25:00

OIL PRICE: NOT ABOVE $51Brent crude LCOc1 was unchanged at $50.27 a barrel by 0845 GMT. U.S. light crude CLc1 was 5 cents lower at $46.73. |

August, 17, 15:20:00

U.S. OIL INVENTORIES DOWN 9MBUS commercial crude oil inventories, excluding the Strategic Petroleum Reserve, decreased by 8.9 million bbl for the week ended Aug. 11 compared with the previous week, the Energy Information Administration said in its weekly oil and products inventory report. |

August, 14, 14:35:00

OIL PRICES: $51 - $52North Sea Brent crude oil spot prices averaged $48 per barrel (b) in July, $2/b higher than the June average and almost $4/b higher than in July 2016. EIA forecasts Brent spot prices to average $51/b in 2017 and $52/b in 2018. West Texas Intermediate (WTI) crude oil prices are forecast to average $2/b less than Brent prices in both 2017 and 2018. |

August, 14, 14:30:00

OIL STOCKS DOWN BY 500 TBDGlobal oil stocks fell by 500,000 b/d and preliminary data for July, particularly in the US where stocks fell by 790,000 b/d, is supportive of rebalancing supplies with demand, according to the most recent Oil Market Report from the International Energy Agency. |

August, 14, 14:25:00

OPEC OIL PRODUCTION UP 173 TBDTotal crude oil production from the Organization of Petroleum Exporting Countries increased 173,000 b/d month-over-month in July to average 32.87 million b/d. |

July, 26, 14:50:00

РАВНОВЕСИЕ РЫНКАМинистерский комитет рассмотрел отчет Совместного технического комитета (СТК) и отметил, что рынок нефти уверенно делает шаги в сторону восстановления равновесия. По мнению экспертов, продолжается оздоровление мирового нефтяного рынка: за последние недели волатильность рынка снизилась, и поток инвестиций в нефтяную промышленность заметно увеличился. |

July, 24, 13:55:00

OIL OUTPUT CONSENSUSWith prices still languishing below the $55-$60/b that some ministers have said they are targeting, some market watchers say OPEC and its non-OPEC partners have no choice but to deepen cuts to make up for output gains from exempt Nigeria and Libya, as well as sliding compliance from other members. |