OIL PRICE: ABOVE $52 YET

REUTERS , BLOOMBERG , OILPRICE - Oil prices rose on Thursday, lifted by signs of a tightening U.S. market, although high supplies from OPEC producers weighed on sentiment.

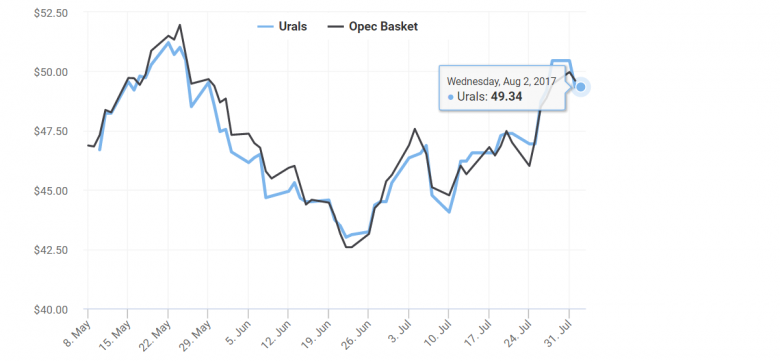

Benchmark Brent crude was up 20 cents a barrel at $52.56 by 0920 GMT. U.S. light crude was 20 cents higher at $49.79.

Strong demand in the United States has been supporting prices. The U.S. Energy Information Administration reported record gasoline demand of 9.84 million barrels per day (bpd) for last week, and a fall in commercial crude inventories of 1.5 million barrels to 481.9 million barrels.

That's below levels seen this time last year, an indication of a tightening U.S. market.

But traders say high production by the Organization of the Petroleum Exporting Countries is capping prices.

OPEC and other producers including Russia have promised to restrict output by 1.8 million bpd until March 2018 to help support prices and draw down inventories.

Yet OPEC output hit a 2017 high of 33 million bpd in July, up 90,000 bpd from the previous month, a Reuters survey showed earlier this week, led by a further recovery in supply from Libya, one of the countries exempt from a production-cutting deal.

Ample supply is likely to keep a lid on prices, many analysts say.

"Our view of the oil market is that a major rally is unlikely in 2017," National Australia Bank analysts said in a note to clients. "Absent further production cuts or a sustained uptick in demand, prices are likely to remain in the low to mid $50s for the remainder of the year."

There are signs that the oil industry has adapted to an era of low prices and can produce and operate at levels that would previously have been uneconomic.

"Of the major projects sanctioned by the big five oil companies (ExxonMobil, Royal Dutch Shell, Chevron, BP and Total) over H1 2017, there has been a clear breakeven target price of $40 per barrel or lower at offshore oil projects," BMI Research said.

U.S. investment bank Goldman Sachs said this week that the oil industry had successfully adapted to oil prices around $50 per barrel.

-----

Earlier:

OIL PRICE: ABOVE $52

U.S. West Texas Intermediate (WTI) futures briefly jumped over $50 per barrel on Monday and were at $49.97 per barrel at 0654 GMT, still up 25 cents, or 0.5 percent from their last close. That means that virtually the entire WTI curve has moved over $50 per barrel. Brent crude futures were at $52.85 per barrel, up 33 cents or 0.6 percent. Prices hit $52.90 per barrel earlier in the day, their highest since May 25.

НЕФТЬ: БОЛЬШЕ ИНВЕСТИЦИЙ

«Ранее мы видели, что на 1 триллион долларов сократились инвестиции в период с 2014-го по 2016 годы включительно, в 2017 году этот тренд пошел уже на увеличение инвестиций в нефтяном секторе. Мы видим также, что снизилась волатильность на рынке, и можно сказать о том, что цена в первом полугодии 2017 года нефти марки Brent была на 30% выше первого полугодия 2016 года. И это стало существенным фактором, который способствовал, в том числе и росту доходов бюджета, улучшению торгового баланса экономики», - рассказал глава российского Минэнерго.

OIL PRICE: ABOVE $51

Brent crude futures were down 8 cents, or 0.2 percent, at $51.41 per barrel at 0651 GMT. U.S. West Texas Intermediate (WTI) crude futures were down 10 cents, or 0.2 percent, at $48.94 per barrel.

OIL PRICES: ABOVE $50

Brent crude futures LCOc1 rose 30 cents to $50.50 a barrel by 0959 GMT, after rallying more than 3 percent on Tuesday. U.S. West Texas Intermediate futures CLc1 climbed 40 cents to $48.29 a barrel.

РАВНОВЕСИЕ РЫНКА

Министерский комитет рассмотрел отчет Совместного технического комитета (СТК) и отметил, что рынок нефти уверенно делает шаги в сторону восстановления равновесия. По мнению экспертов, продолжается оздоровление мирового нефтяного рынка: за последние недели волатильность рынка снизилась, и поток инвестиций в нефтяную промышленность заметно увеличился.

ВЫСОКИЙ УРОВЕНЬ СОТРУДНИЧЕСТВА

В прямом эфире телеканала «Россия 24» Министр энергетики Российской Федерации Александр Новак подвел итоги 4-ого заседания Министерского комитета по мониторингу исполнения соглашения о сокращении добычи нефти стран ОПЕК и не-ОПЕК.

OIL PRICES: ABOVE $48 AGAIN

Brent September crude futures fell 18 cents on the day to $47.88 a barrel by 0850 GMT. The price fell 2.5 percent on Friday after a consultancy forecast a rise in OPEC production for July. NYMEX crude for September delivery fell 20 cents to $45.57 a barrel.