IMF: BAHRAIN'S VULNERABILITY UP

IMF - the Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation with the Kingdom of Bahrain.

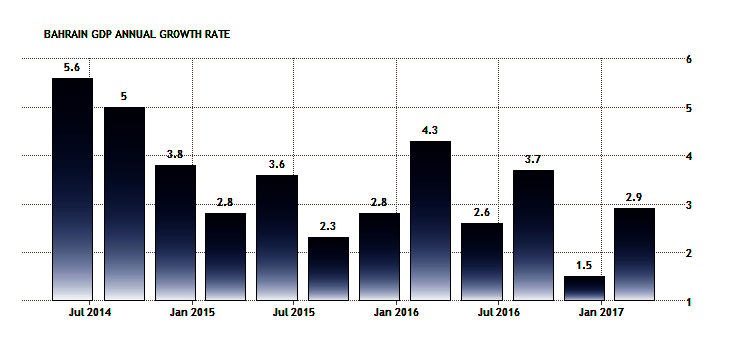

Bahrain's fiscal and external vulnerabilities have increased in the wake of the oil price decline. Overall GDP grew 3 percent in 2016, supported by strong growth of 3.7 percent in the non-oil sector aided by the implementation of GCC-funded projects. Average inflation remained moderate at 2.8 percent. Bank deposit and private sector credit growth slowed. The banking sector remains well capitalized and liquid. Despite the implementation of significant fiscal adjustment, lower oil prices meant that the overall fiscal deficit reached nearly 18 percent of GDP and government debt rose to 82 percent of GDP. The current account deficit widened to 4.7 percent. International reserves have declined.

Real GDP growth is expected to slow to 2.3 and 1.6 percent in 2017 and 2018, reflecting the ongoing fiscal consolidation and weaker investor sentiment. The fiscal deficit is projected to improve to 12.2 percent of GDP in 2017 owing to higher oil prices and continued reduction in spending. Over the medium term, the fiscal deficit is projected to narrow only slightly because of rising interest payments that offset some of the revenues from the planned implementation of the VAT. The current account deficit is estimated to reach over 3½ percent of GDP in 2017, and is projected to narrow gradually over the medium-term.

Executive Board Assessment

Executive Directors considered that, although economic activity and financial market conditions have remained positive, fiscal and external vulnerabilities have increased in the wake of the oil price decline. While welcoming the significant fiscal measures underway, they stressed that an additional sizable and frontloaded fiscal adjustment is urgently needed to restore fiscal sustainability and reduce the large fiscal and external financing needs. Sustained fiscal efforts will be needed over the medium term to put debt on a downward path and rebuild policy space.

Directors recommended measures to contain current expenditure, including the wage bill and further reducing energy subsidies, while raising non-oil revenue, including through the VAT and exploring other revenue measures. They stressed the importance of minimizing the adverse impact of these measures on vulnerable groups. Directors advised strengthening revenue administration and establishing a medium-term fiscal framework to support fiscal consolidation. They underscored the need for a strong communication campaign to explain the authorities' adjustment plans to help strengthen public awareness and support and maintain market confidence. Directors encouraged the authorities to put in place a comprehensive fiscal financing and debt management strategy to mitigate risks, and welcomed recent steps to establish a public debt management office.

Directors agreed that the exchange rate peg remains appropriate for Bahrain, noting that it has delivered monetary policy credibility and low inflation. Strong fiscal adjustment, sizable external financing, and structural reforms are needed to support the peg and strengthen the international reserve position. Gradually raising interest rate differentials vis-à-vis the United States through the stepped-up issuance of government securities could also help discourage capital outflows and rebuild reserves. Directors also stressed the importance of discontinuing central bank lending to the government.

Directors welcomed the FSAP stress test results that the banking sector appears well positioned to face moderate credit and liquidity shocks, although recapitalization needs could be significant under a severe shock scenario. Liquidity stress tests suggest that most banks' liquidity positions are relatively robust, but some wholesale banks and foreign branches hold few liquid assets. Directors welcomed the central bank's efforts to implement FSAP recommendations to strengthen the regulation and supervision of the financial sector, including steps to introduce quantitative liquidity requirements for banks and to develop a macroprudential framework. A clear legal mandate for financial stability, stronger risk-based supervision, and enhanced crisis management and resolution framework will also help support the financial sector.

Directors commended the authorities' recent initiatives to streamline business regulation and improve the legal framework. They called for additional structural reforms to promote competition and catalyze private investment, including by privatizing state-owned enterprises and promoting greater diversification. Directors welcomed efforts to remove bottlenecks in the economy to support growth.

Directors welcomed recent improvements in financial sector data, and underscored the need to further strengthen economic statistics to support the decision-making process.

-----

Earlier:

BAHRAIN: |

IMF: |

||||

OPEC & NON-OPEC AGREEMENT... ries and non-OPEC parties, Azerbaijan, Kingdom of Bahrain, Brunei Darussalam, Kazakhstan, Malaysia, Mexico, Sultanate of Oman, the Russian Federation, Republic of Sudan, and the Republic of South Sudan, taking into account the decision reached by OPE ...

|

IMF HAS IRAQIMF HAS IRAQ IMF HAS IRAQ To strengthen financial sector stability, Directors encouraged the authorities to take measures to bolster supervision, and move forward with plans to restructure the statemdash;owned banks that dominate the banking system. ...

|

||||

GAZPROM & BAHRAIN LNGGAZPROM & BAHRAIN LNG GAZPROM & BAHRAIN LNG Russian state-owned oil and gas giant Gazprom is currently working to create a liquefied natural gas (LNG) distribution hub in Bahrain. The hub will be meant to intake LNG from various sources, including Ru ...

|

IMF BUYS IRAQIMF BUYS IRAQ IMF BUYS IRAQ The completion of the second review allows the authorities to draw the equivalent of SDR 584.2 million (about US$ 824.8 million), bringing total disbursements to SDR 1494.2 million about US$ 2109.7 million. The SDR 3.831 b ...

|

||||

IMF WANT EUROPEIMF WANT EUROPE IMF WANT EUROPE The European Union could do more to convince countries to put EU reform recommendations into practice. For example, targeted support from the EU budget could be provided to incentivize reforms. The EU should also conti ...

|

|||||

CANADA'S ECONOMY UP 4%CANADAS ECONOMY UP 4% CANADAS ECONOMY UP 4% IMF: Canada’s economy expanded at an annual pace of nearly 4 percent in the first quarter of 2017—the fastest growth rate among the Group of 7 countries. With the economy’s adjustment to lower oil prices al ...

|

|||||

IMF NEED RUSSIAIMF NEED RUSSIA IMF NEED RUSSIA Directors underscored that accelerated structural reforms and broader trade relations can help promote a diversified export mix. They also urged the authorities to strengthen property rights, advance privatization, imp ...

|

|||||

IMF NEEDS SAFEGUARDIMF NEEDS SAFEGUARD IMF NEEDS SAFEGUARD “The current period of growth should be used as an opportunity: to further safeguard the financial sector--by building up capital buffers and strengthening corporate and bank balance sheets; to address the issu ...

|

|||||

IMF: U.S. ISN'T WORKING WELLIMF: U.S. ISNT WORKING WELL IMF: U.S. ISNT WORKING WELL All in all, in our judgement, the U.S. economic model is not working as well as it could in generating broadly shared income growth. All in all, in our judgement, the U.S. economic model is not ...

|

|||||