OIL MARKET IS RIGHT

OPEC - The Joint OPEC-Non-OPEC Ministerial Monitoring Committee (JMMC) reported that based on the Report of the Joint OPEC-Non-OPEC Technical Committee (JTC) for the month of July, efforts by OPEC and participating Non-OPEC producing countries have continued to show positive results towards the goal of rebalancing the oil market.

The JMMC was established following OPEC's 171st Ministerial Conference Decision of 30 November 2016, and the subsequent Declaration of Cooperation made at the joint OPEC-Non-OPEC Producing Countries' Ministerial Meeting held on 10 December 2016 at which 11 (now 10) non-OPEC oil producing countries cooperated with the 13 (now 14) OPEC Member Countries in a concerted effort to accelerate the stabilization of the global oil market through voluntary adjustments in total production of around 1.8 million barrels per day. The resulting Declaration, which came into effect on 1 January 2017, was for six months. The second joint OPEC-Non-OPEC Producing Countries' Ministerial Meeting, held on 25 May 2017, decided to extend the voluntary production adjustments for another nine months commencing 1 July 2017.

As of July 2017, the OPEC and participating non-OPEC producing countries achieved an impressive conformity level of 94 per cent. This is a demonstration of the commitment of participating producing countries to continue their cooperation towards the rebalancing of the market. The JMMC expressed great satisfaction with the results and steady progress made towards full conformity of the production adjustments, and encouraged all participating countries to achieve full conformity, for the benefit of producers and consumers alike. The JMMC also welcomed the participation of the UAE at the recent JTC meeting, where the UAE reiterated its commitment to adhere to its production adjustments for the remaining period of the Declaration of Cooperation.

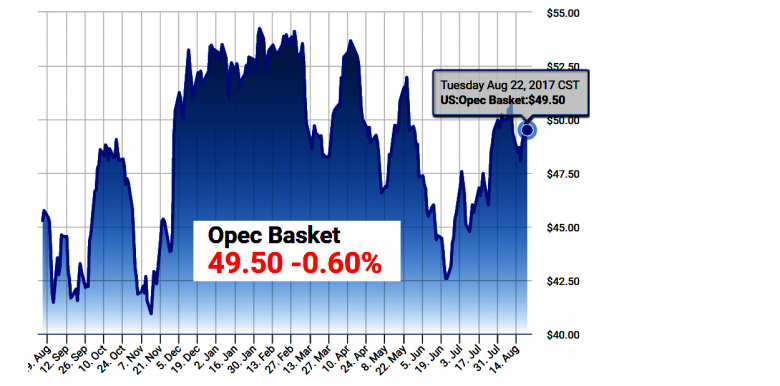

The JMMC took note of the recent market development and expressed confidence that the oil market is moving in the right direction towards the objectives of the Declaration of Cooperation. In particular, global oil demand growth in 2017 is now better than expected, while for 2018, world oil demand is anticipated to rise further.

Oil commercial stocks fell in July and the latest five-year average has been reduced from the beginning of this year. Supported by the narrowing Contango, floating storage has also been on a declining trend since June.

The JMMC will continue to monitor other factors in the oil market and their influence on the ongoing market rebalancing process. All options, including the possible extension of the Declaration of Cooperation beyond Q118, are left open to ensure that all efforts are made to rebalance the market for the benefit of all.

The JMMC also expressed its intention to invite Libya and Nigeria to attend the next meetings of the JTC and/or the JMMC.

The next JMMC Meeting is scheduled to be held in Vienna, on 22 September 2017.

-----

Earlier:

OPEC: GLOBAL OIL DEMAND WILL UP TO 97.8 MBDOPEC: GLOBAL OIL DEMAND WILL UP TO 97.8 MBD OPEC: GLOBAL OIL DEMAND WILL UP TO 97.8 MBD OPEC said world oil demand in 2018 will grow 1.28 million b/d from 2017 levels, meaning that total oil consumption is expected to hit a new record high of 97.8 mi ...

|

|

OPEC OIL PRODUCTION UP 173 TBDOPEC OIL PRODUCTION UP 173 TBD OPEC OIL PRODUCTION UP 173 TBD Total crude oil production from the Organization of Petroleum Exporting Countries increased 173,000 b/d month-over-month in July to average 32.87 million b/d. Total crude oil production fr ...

|

|

OIL OUTPUT CONSENSUS... said they are targeting, some market watchers say OPEC and its non-OPEC partners have no choice but to deepen cuts to make up for output gains from exempt Nigeria and Libya, as well as sliding compliance from other members. With prices still languish ...

|

|

MARKET WILL BE BETTER... o the five-year average thanks to the decision by OPEC and its allies to extend supply curbs from the first half of 2017 to the first quarter of 2018. ...

|

|

OPEC PRODUCTION UP TO 32.49 MBDOPEC PRODUCTION UP TO 32.49 MBD OPEC PRODUCTION UP TO 32.49 MBD The Organization of Petroleum Exporting Countries produced 32.49 million b/d in June—an increase of 220,000 b/d from May and representing a 6-month high. The Organization of Petroleum Ex ...

|

|

OPEC OIL PRODUCTION UP: 32.12 MBDOPEC OIL PRODUCTION UP: 32.12 MBD OPEC OIL PRODUCTION UP: 32.12 MBD OPEC’s crude oil production increased by 270,000 bpd in May over April, to stand at 32.12mn bpd – the highest level since January this year OPEC’s crude oil production increased by 2 ...

|

|

BAD NEWS FOR OPECBAD NEWS FOR OPEC BAD NEWS FOR OPEC As oil prices sag despite OPEC’s renewed efforts to shore up world crude markets, Wall Street banks have more bad news for the producer group: the outlook for next year isn’t great either. As oil prices sag despite ...

|