2017-08-14 14:20:00

SAUDI'S DEFICIT DOWN

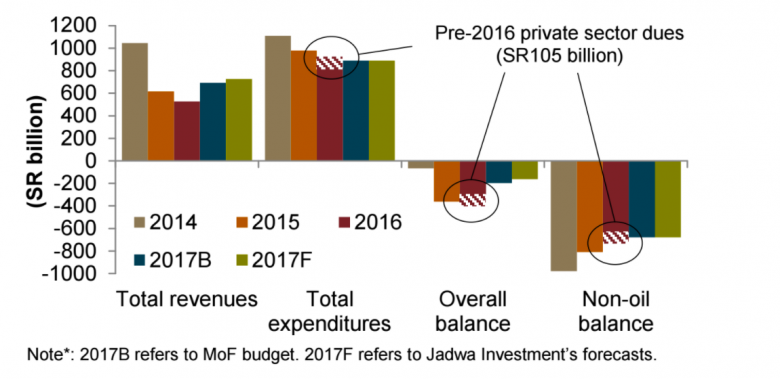

REUTERS - Saudi Arabia's state budget deficit shrank by a fifth from a year earlier in the second quarter of this year as revenues rose moderately and spending fell marginally, finance ministry figures showed on Sunday.

Revenues increased 6 percent from a year ago to 163.9 billion riyals ($43.7 billion); oil revenues jumped 28 percent to 101.0 billion riyals because of higher international oil prices.

Spending dropped 1.3 percent to 210.4 billion riyals in the second quarter, leaving a deficit of 46.5 billion riyals compared to about 58.4 billion riyals a year earlier.

------

Earlier:

SAUDI'S GDP GROWTH: ZERO

... se to zero as oil GDP declines in line with Saudi Arabia’s commitments under the OPEC+ agreement. Non-oil growth is projected to pick up to 1.7 percent in 2017, but overall real GDP growth is expected to be close to zero as oil GDP declines in line w ...

| 2017-07-24 | Read more » |

SAUDIS WILL CUT SAUDIS WILL CUT Saudi Arabia will cut crude oil shipments to its customers in August by more than 600,000 barrels per day to balance the rise in domestic consumption during the summer, while staying within its OPEC production commitme ...

| 2017-07-12 | Read more » |

... IS OIL RESOURCES UP SAUDIS OIL RESOURCES UP Saudi Arabia effectively grew its recoverable oil resources by 73 billion barrels this year after lower tax rates for state producer Saudi Aramco boosted the countrys estimated prospective resources. Saudi ...

| 2017-06-21 | Read more » |

| 2017-05-29 | Read more » |

... NO ONE ENVIES THE SAUDIS No one envies the Saudi Arabians now. Yes, the Brent price has rebounded from its of 2015-16 lows to stabilise over $50. At the Opec meeting in Vienna this week the delegates agreed to extend production curbs for another nin ...

| 2017-05-26 | Read more » |

| 2017-05-19 | Read more » |

SAUDIS OIL POLICY SAUDIS OIL POLICY Saudi Arabia’s conventional approach to market management is no longer working: crude has fallen back below $50 a barrel, US shale oil output is again on the rise and Saudi-led Opec, if anything, is worse off than ...

| 2017-05-10 | Read more » |