CANADA NEED $60

ENERGYNOW - A recent surge in oil prices will boost the bottom line of Canadian oil and gas producers but remains well below the minimum level needed to encourage increased investments in the oilsands or conventional oil and gas, energy analysts say.

U.S. benchmark West Texas Intermediate crude prices recovered Wednesday to US$52.14 per barrel after sliding Tuesday but stopped short of the five-month-high close of US$52.22 per barrel on Monday, which was up more than 20 per cent from lows in June.

"Fifty-dollar WTI is not high enough to support a material uptick in oilsands investments," said Randy Ollenberger, managing director of oil and gas equity research for BMO Capital Markets.

"Sustained US$60-plus oil prices are required to support most projects."

BMO links the recent run-up in crude oil prices to lower-than-expected U.S. oil production growth in the first half of 2017 but says it expects second half growth will be back on track.

That means New York-traded West Texas Intermediate prices will remain "range-bound" between US$45 and US$55 per barrel, the bank concludes.

In a report Wednesday, GMP FirstEnergy Capital affirmed its forecast for average WTI oil prices to rise to about US$56 per barrel in 2018 from US$50 this year, and to jump to the mid-US$60s per barrel by 2020.

It says that normally those prices would lead to an increase in spending on Canadian exploration and production, but producers have been reluctant to make the commitment because the market has been so volatile. It says it's assuming most capital spending programs will grow by less than 10 per cent next year.

Judith Dwarkin, chief economist at RS Energy Group, said she agrees companies will be reluctant to increase spending in budgets that will be finalized over the next few months. She is predicting that average WTI will fall below US$50s per barrel next year due to higher American shale oil production and expiry of the OPEC production cutting agreement.

"This (price) may be as good as it gets," she said.

"There are plays that are in the money at $50 but the bigger issue for producers is how stable do they think this price will be?"

Most current Canadian oilsands operations in northern Alberta are profitable at US$50 oil, according to a study released by TD Securities earlier this month.

TD found that the WTI price needed to recoup operating costs for an average thermal oilsands project — where steam is injected into wells to melt the sticky bitumen and allow it to be pumped to surface — had risen to about US$39 per barrel due to factors including a stronger Canadian dollar compared with the greenback.

It said Canadian Natural Resources Ltd.'s (TSX:CNQ) Horizon project and Suncor Energy Inc.'s (TSX:SU) base mine — both top-ranked oilsands mining projects which upgrade bitumen to create synthetic crude — have record low break evens of US$23 and US$26 per barrel, respectively.

Even at Syncrude Canada, whose mining operations were hit by planned and unplanned outages earlier this year, the average break even price will be US$40.70 per barrel of synthetic crude, well below US$50, the bank said.

Ownership of the oilsands shifted dramatically earlier this year as major international players such as Royal Dutch Shell, Norway's Statoil and Houston-based ConocoPhillips and Marathon Oil sold or reduced their stakes in favour of more profitable plays elsewhere in the world.

-----

Earlier:

September, 25, 13:00:00

U.S. RIGS DOWN 1 TO 935U.S. Rig Count is up 424 rigs from last year's count of 511, with oil rigs up 326, gas rigs up 98, and miscellaneous rigs unchanged at 1. Canada Rig Count is up 82 rigs from last year's count of 138, with oil rigs up 45 and gas rigs up 37. |

August, 3, 12:10:00

CANADIAN DRILLING UPThe Petroleum Services Association of Canada (PSAC) has updated its 2017 Canadian Drilling Activity Forecast to reflect an increase in its projected total number of wells to be drilled during the year to 7,200 from 6,680. |

July, 19, 14:40:00

CANADA'S ECONOMY UP 4%IMF: Canada’s economy expanded at an annual pace of nearly 4 percent in the first quarter of 2017—the fastest growth rate among the Group of 7 countries. With the economy’s adjustment to lower oil prices almost complete, growth is expected to accelerate to 2.5 percent this year, up from 1.5 percent in 2016. |

May, 1, 12:05:00

CANADIAN WELLS UP TO 6,680The Petroleum Services Association of Canada (PSAC), in its second update to the 2017 Canadian Drilling Activity Forecast, announced its revision of the forecasted number of wells drilled (rig released) across Canada for 2017 to 6,680 wells. This represents an increase of 2,505 wells and a 60 per cent increase from PSAC’s original 2017 Drilling Activity Forecast released in early November 2016 of 4,175 wells rig released. PSAC based its updated 2017 forecast on average natural gas prices of $3.00 CDN/mcf (AECO), crude oil prices of US$52.50/barrel (WTI) and the Canada-US exchange rate averaging $0.74. |

March, 10, 18:30:00

SHELL DIVESTS CANADA $7.25 BLNShell will sell to a subsidiary of Canadian Natural Resources Limited (“Canadian Natural”) its entire 60 percent interest in AOSP, its 100 percent interest in the Peace River Complex in-situ assets, including Carmon Creek, and a number of undeveloped oil sands leases in Alberta, Canada. The consideration to Shell from Canadian Natural is approximately $8.5 billion (C$11.1 billion), comprised of $5.4 billion in cash plus around 98 million Canadian Natural shares currently valued at $3.1 billion. Canadian Natural is one of Canada’s largest energy companies and a leader in the oil sands, with a market capitalisation of approximately $35 billion (C$46 billion). Separately and under the second agreement, Shell and Canadian Natural will jointly acquire and own equally Marathon Oil Canada Corporation (“MOCC”), which holds a 20 percent interest in AOSP, from an affiliate of Marathon Oil Corporation for $1.25 billion each, to be settled in cash. The combination of these transactions will result in a net consideration of $7.25 billion to Shell. |

June, 28, 18:05:00

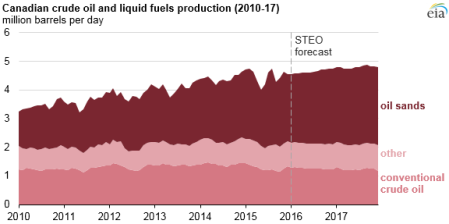

CANADA'S OIL WILL UPCanada's oil sands production will grow by 42 percent to 3.4 million barrels per day by 2025, most of which will come from the expansion of existing facilities rather than new projects |

June, 20, 18:00:00

CANADA'S HOPE PRICE: $2 BLNSince January, nearly $2 billion has been raised by Canadian non-oilsands producers on equity markets, but most of it has been geared to paying down debt or funding acquisitions, not for drilling new wells |