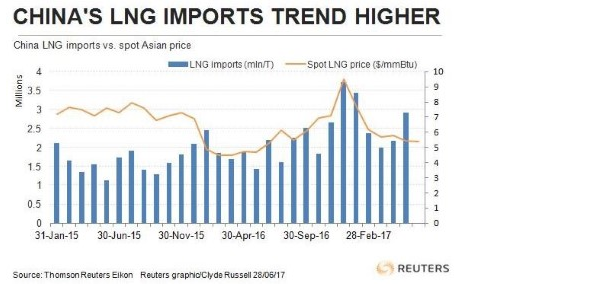

CHINA'S LNG IMPORTS UP 45%

EIA - Over the first seven months of 2017, China's imports of liquefied natural gas (LNG) averaged 4.3 billion cubic feet per day (Bcf/d), or 45% higher than during the same period in 2016. With the exception of a slight decline in 2015, LNG import into China have grown steadily over the last decade, increasing by 33% between 2015 and 2016. LNG imports growth has been supported by both government policies to replace some coal and oil use with natural gas as well as lower natural gas import prices.

In the first six months of 2017, Chinese natural gas consumption increased by 15% compared to 2016 levels, according to China's National Development and Reform Commission (NDRC). This growth was driven primarily by coal-to-gas switching in the power generation and industrial sectors to meet environmental policy targets set in China's 2013 Air Pollution Prevention and Control Action Plan, increased demand by gas-fired power plants, and increased consumption in the transportation sector. Almost all of the targets set in this plan are supposed to be met by the end of 2017, and local governments are making efforts to comply by the deadline. Additionally, flooding in central and southern China this summer led to curtailment of hydroelectric power generation, requiring additional generation by gas-fired power plants.

While domestic production in China accounted for 64% of natural gas supply in 2016, production growth lagged behind increases in LNG and pipeline imports. Between 2015 and 2016, domestic production grew by 3% (0.3 Bcf/d), while LNG imports increased by 33% (0.9 Bcf/d) and pipeline imports by 13% (0.4 Bcf/d). Strong growth in LNG imports reflected their cost-competitiveness compared to pipeline imports, particularly in China's coastal provinces, which account for the majority of natural gas consumption.

During the first seven months of 2017, average landed pipeline import prices in China averaged about $5.30 per million British thermal units ($/MMBtu), about $1.86 lower than landed LNG import prices. Most of China's natural gas pipeline imports come from Turkmenistan, Uzbekistan, and Kazakhstan in Central Asia and enter the country in the west, requiring cross-country long-haul transportation to markets in the eastern provinces. Transport of this natural gas adds about $3.50-$4.00/MMBtu to the import price. LNG regasification facilities are located closer to major Chinese consuming centers in eastern provinces and LNG regasification costs add approximately $1.00/MMBtu to the landed LNG import price of $7.10/MMBtu.

Next year, EIA projects that China will overtake South Korea as the world's second largest LNG importer, as additional regasification terminals come online and LNG supply contracts ramp up. While most of China's LNG imports are delivered under long-term contracts to specific terminals owned by major Chinese national oil companies, the volume of spot purchases is likely to increase in the future as other companies gain third-party access to regasification capacity and take advantage of the new opportunities from the growing global LNG spot market. Although the United States does not currently have long-term LNG export contracts to China, it has supplied 10 cargoes from the Sabine Pass LNG terminal between February 2016 and June 2017. Most of these cargoes were delivered as part of Shell's global supply portfolio, which includes off-take volumes from Sabine Pass, and were a part of Shell's long-term contract with China's national oil company. The remainder of the cargoes were spot deals.

-----

Earlier:

U.S. - CHINA OIL RECORDU.S. - CHINA OIL RECORD U.S. - CHINA OIL RECORD Chinas import of US crude oil crossed 1 million mt for the first time in June, an eight-fold rise year on year, as elevated Dubai prices prompted both state and independent refiners to use it as an oppo ...

|

|

CHINA'S RENEWABLE UPCHINAS RENEWABLE UP CHINAS RENEWABLE UP CHINA’S installed solar power capacity surged over the first half year amid shrinking costs and government policies. Over the first six months, 23.6 gigawatts of solar power were installed, 34.2 percent higher ...

|

|

CHINA'S ENERGY DEMAND UPCHINAS ENERGY DEMAND UP CHINAS ENERGY DEMAND UP CHINA will accelerate expanding oil and gas distribution in the next decade to ensure energy security and help boost industry, its top economic and energy planners said. CHINA will accelerate expanding ...

|

|

RUSSIAN GAS FOR CHINAРУССКИЙ ГАЗ ДЛЯ КИТАЯ RUSSIAN GAS FOR CHINA В соответствии с Дополнительным соглашением, поставки газа в Китай по газопроводу Сила Сибири начнутся в декабре 2019 года. According to the Supplementary Agreement, gas supplies to China via the Power of S ...

|

|

AUSTRALIA - CHINA LNG UPAUSTRALIA - CHINA LNG UP AUSTRALIA - CHINA LNG UP Among Chinas LNG suppliers Australia has fared best, with imports rising 42.7 percent in the first five months to 5.39 million tonnes, almost double that of second-placed Qatar at 2.84 million tonnes. ...

|

|

CHINA: THE TOP BUYER ANEWCHINA: THE TOP BUYER ANEW CHINA: THE TOP BUYER ANEW China imported 37.2 million tonnes or 8.76 million barrels per day of crude oil last month, up 15 percent from a year earlier and nearly 8 percent from April, data from the General Administration of ...

|

|

CHINA'S OIL & GAS REFORMCHINAS OIL & GAS REFORM CHINAS OIL & GAS REFORM “Market should play a decisive role in resource allocation and the government role should be better played in order to safeguard national energy security, boost productivity and meet people’s needs,” th ...

|