OIL PRICE: NOT BELOW $ 52

REUTERS , BLOOMBERG , OILPRICE - Oil prices fell on Monday after a powerful North Korean nuclear test explosion triggered a flight of investors away from crude markets and into gold futures, which are seen as a safe haven.

Brent crude futures LCOc1, the international benchmark for oil prices, had fallen by almost 1 percent from their last close, or 41 cents, to $52.34 per barrel by 0655 GMT.

The drop came as traders were nervously eyeing developments in North Korea, where the military conducted its sixth and most powerful nuclear test over the weekend. Pyongyang said it had tested an advanced hydrogen bomb for a long-range missile, prompting the threat of a "massive" military response from the United States if it or its allies were threatened.

That put downward pressure on crude as traders moved money out of oil - seen as high-risk markets - into gold futures, traditionally viewed as a safe haven for investors. Spot gold prices rose for a third day, gaining 0.9 percent on Monday.

U.S. West Texas Intermediate (WTI) Clc1 crude futures were more stable, at $47.30 barrel, close to their last settlement.

Traders said that the more stable U.S. crude prices were a result of production outages following Hurricane Harvey.

About 5.5 percent of the U.S. Gulf of Mexico's oil production, or 96,000 barrels of daily output, remained shut on Sunday, the federal Bureau of Safety and Environmental Enforcement said.

At the same time, refineries that use crude to make fuel were gradually starting up again, along with the pipelines transporting products.

"Traders are hopeful that crude backlogs will be cleared," said Jeffrey Halley, senior market analyst at futures brokerage OANDA.

Meanwhile, U.S. gasoline prices RBc1 slumped back from a spike after the release of emergency fuel stocks and on signs that the damage from Hurricane Harvey to the Gulf coast energy infrastructure was not as bad as initially feared.

Still, many analysts say it could take months before the U.S. petroleum industry fully recovers from Harvey, and Texas Governor Greg Abbott estimated damage at $150 billion to $180 billion, calling it more costly than Hurricanes Katrina or Sandy, which hit New Orleans in 2005 and New York in 2012.

Storm Harvey made landfall along the Gulf coast of Texas and Louisiana last week, knocking out almost a quarter of the entire U.S. refining capacity, causing a price spike and supply gap for fuels like gasoline, which traders around the world have been scrambling to fill.

Overall trading activity in oil futures market is expected to be low on Monday due to the U.S. Labor Day public holiday.

-----

Earlier:

August, 31, 12:30:00

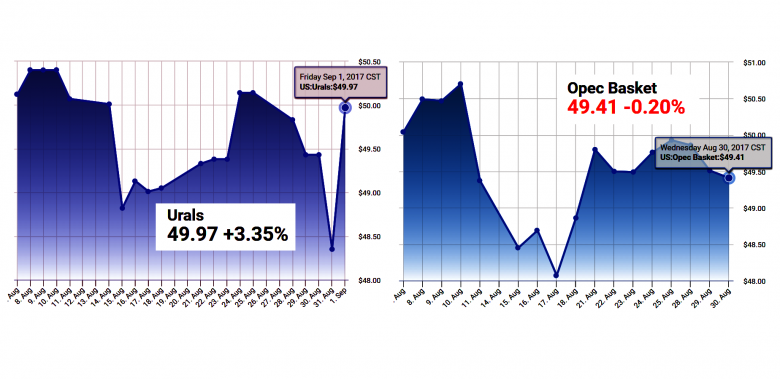

OIL PRICE: NOT ABOVE $51The October light, sweet crude contract on NYMEX fell 13¢ on Aug. 29 to settle at $46.44/bbl while the November contract was up 4¢ to settle at $47/bbl. The NYMEX natural gas price for September gained 3.6¢ to a rounded $2.96/MMbtu. The Henry Hub cash gas price was $2.88/MMbtu, down 4¢. The Brent crude contract for October on London’s ICE was up 11¢ to $52/bbl. The November contract gained 24¢ to $51.66/bbl. The September gas oil contract was $484.50/tonne on Aug. 29, up 25¢. The Organization of Petroleum Exporting Countries’ basket of crudes on Aug. 29 was $49.51/bbl, down 35¢. |

August, 31, 12:25:00

SAUDIS - RUSSIA OIL DEALTop oil producers Saudi Arabia and Russia are pushing to extend their deal to limit crude oil production for another three months, which would leave the output deal between OPEC and non-OPEC producers in place through the end of June, people familiar with the matter said. |

August, 24, 14:20:00

OIL MARKET IS RIGHTAs of July 2017, the OPEC and participating non-OPEC producing countries achieved an impressive conformity level of 94 per cent. This is a demonstration of the commitment of participating producing countries to continue their cooperation towards the rebalancing of the market. The JMMC expressed great satisfaction with the results and steady progress made towards full conformity of the production adjustments, and encouraged all participating countries to achieve full conformity, for the benefit of producers and consumers alike. The JMMC also welcomed the participation of the UAE at the recent JTC meeting, where the UAE reiterated its commitment to adhere to its production adjustments for the remaining period of the Declaration of Cooperation. |

August, 14, 14:35:00

OIL PRICES: $51 - $52North Sea Brent crude oil spot prices averaged $48 per barrel (b) in July, $2/b higher than the June average and almost $4/b higher than in July 2016. EIA forecasts Brent spot prices to average $51/b in 2017 and $52/b in 2018. West Texas Intermediate (WTI) crude oil prices are forecast to average $2/b less than Brent prices in both 2017 and 2018. |

July, 31, 14:35:00

НЕФТЬ: БОЛЬШЕ ИНВЕСТИЦИЙ«Ранее мы видели, что на 1 триллион долларов сократились инвестиции в период с 2014-го по 2016 годы включительно, в 2017 году этот тренд пошел уже на увеличение инвестиций в нефтяном секторе. Мы видим также, что снизилась волатильность на рынке, и можно сказать о том, что цена в первом полугодии 2017 года нефти марки Brent была на 30% выше первого полугодия 2016 года. И это стало существенным фактором, который способствовал, в том числе и росту доходов бюджета, улучшению торгового баланса экономики», - рассказал глава российского Минэнерго. |

July, 26, 14:50:00

РАВНОВЕСИЕ РЫНКАМинистерский комитет рассмотрел отчет Совместного технического комитета (СТК) и отметил, что рынок нефти уверенно делает шаги в сторону восстановления равновесия. По мнению экспертов, продолжается оздоровление мирового нефтяного рынка: за последние недели волатильность рынка снизилась, и поток инвестиций в нефтяную промышленность заметно увеличился. |

July, 24, 13:55:00

OIL OUTPUT CONSENSUSWith prices still languishing below the $55-$60/b that some ministers have said they are targeting, some market watchers say OPEC and its non-OPEC partners have no choice but to deepen cuts to make up for output gains from exempt Nigeria and Libya, as well as sliding compliance from other members. |