OIL PRICE: NOT ABOVE $55

REUTERS , BLOOMBERG , OILPRICE - Oil prices rose on Wednesday after the International Energy Agency (IEA) said the global oil surplus was starting to shrink due to robust global demand and an output drop from OPEC and other producers.

By 1021 GMT, international benchmark Brent crude LCOc1 was up 27 cents, or 0.5 percent, at $54.54 a barrel.

U.S. West Texas Intermediate (WTI) CLc1 was up 38 cents, or 0.8 percent, at $48.61 a barrel.

"Based on recent bets made by investors, expectations are that markets are tightening and that prices will rise, albeit very modestly," the IEA, which coordinates energy policies in industrialized nations, said in its monthly report.

"Demand growth continues to be stronger than expected, particularly in Europe and the U.S.," the IEA said, raising its 2017 global oil demand growth estimate to 1.6 million barrels per day from 1.5 million bpd.

The assessment echoed a report by the Organization of Petroleum Exporting Countries forecasting higher demand for its oil in 2018 and pointing to signs of a tighter global market.

The U.S. Energy Information Administration (EIA) also revised its 2017 and 2018 U.S. oil output forecast figures lower to reflect, in part, effects of Hurricane Harvey.

Commerzbank said in a note that the OPEC and EIA reports "came as a positive surprise and should really support prices."

"However, this also means that OPEC must not increase its production if the balance on the oil market is to be ensured. And yet this is hardly likely to happen," it said, saying OPEC states Libya and Nigeria had not agreed to production cuts.

Some worries about rising U.S. crude inventories persisted.

Industry group the American Petroleum Institute reported on Tuesday that U.S. crude inventories rose by 6.2 million barrels in the week to Sept. 8 to 468.8 million, nearly double analysts' expectations for an increase of 3.2 million barrels.

Analysts say U.S. stocks data may not give a full picture in coming weeks because of two major hurricanes - Harvey and Irma.

EIA inventory data is due out later on Wednesday.

-----

Earlier:

September, 11, 12:45:00

OIL PRICE: NOT ABOVE $53U.S. crude for October delivery CLc1 was up 41 cents, or 0.9 percent, at $47.89 a barrel by 0648 GMT, having tumbled 3.3 percent on Friday. London Brent crude for November delivery LCOc1 was up 30 cents, or 0.6 percent, at $54.08, having settled down 1.3 percent. |

September, 11, 12:40:00

ЦЕНА НЕФТИ: $40 - $43Глава "Роснефти" Игорь Сечин ожидает, что в 2018 году цена на нефть будет колебаться в пределах $40-$43 за баррель. "При предварительном анализе, в следующем году мы будем иметь цены в пределах $40-43 за баррель", - сказал он в интервью телеканалу "Россия 24". |

September, 8, 09:10:00

OIL PRICE: ABOVE $54U.S. West Texas Intermediate (WTI) crude futures were at $49.12 barrel at 0146 GMT, 4 cents below their last settlement, but not far off more than three-week highs reached in the previous session. Brent crude futures, the benchmark for oil prices outside the United States, dipped 8 cents to $54.12 a barrel, though still not far from May highs reached the previous day. |

September, 8, 08:30:00

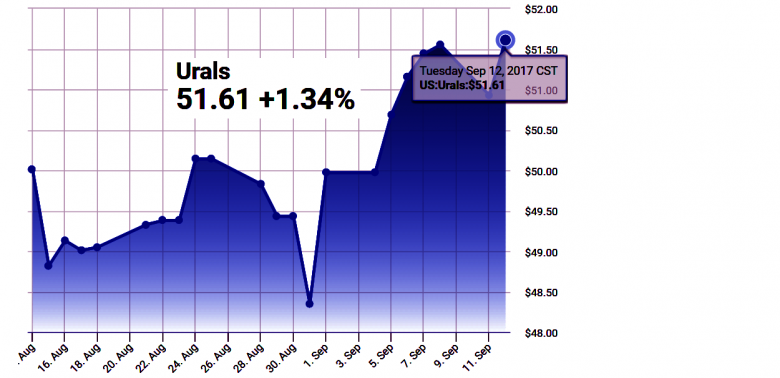

ЦЕНА URALS: $50,09Средняя цена нефти марки Urals по итогам января-августа 2017 года составила $50,09 за баррель. |

September, 6, 18:20:00

OIL PRICE: ABOVE $53Brent LCOc1 had gained 51 cents to $53.89 a barrel by 1356 GMT. U.S. West Texas Intermediate (WTI) crude futures Clc1 were up 45 cents at $49.54 a barrel. |

September, 4, 12:40:00

OIL PRICE: NOT BELOW $ 52Brent crude futures LCOc1, the international benchmark for oil prices, had fallen by almost 1 percent from their last close, or 41 cents, to $52.34 per barrel by 0655 GMT. U.S. West Texas Intermediate (WTI) Clc1 crude futures were more stable, at $47.30 barrel, close to their last settlement. |

September, 4, 12:25:00

NIGERIA'S OIL PRODUCTION: 2.2 MBDThe figure of around 2.2 million to 2.3 million b/d includes about 300,000 to 400,000 b/d of condensates, which implies that its current crude oil production is at the coveted 1.8 million b/d mark. |