OPEC NEED ASIA'S MARKET

OPEC - Remarks by OPEC Secretary General

Delivered by HE Mohammad Sanusi Barkindo, OPEC Secretary General, at the 33rd Asia Pacific Petroleum Conference, 25 September 2017, Singapore.

Excellencies, delegates, ladies and gentlemen,

Good morning and greetings from the OPEC Secretariat in Vienna, Austria.

Before I begin allow me to take this opportunity to thank S&P Global Platts for this generous invitation to speak at one of Asia's premier oil and gas industry events.

Even though my schedule did not permit me to travel to Singapore for this prestigious event, which is in its 33rd edition, I am pleased to be able to deliver my remarks to you through this video, which was taped here in our broadcast studio at the OPEC headquarters.

These observations come at a strategic moment, as just last Friday, we concluded our 5th Meeting of the Joint Ministerial Monitoring Committee, or JMMC, which was set up to monitor the implementation process of the historic Declaration of Cooperation.

This unprecedented OPEC and non-OPEC cooperation is the fruit of the historic production adjustment decisions that were taken by OPEC and participating non-OPEC producing nations at the end of 2016. In May of 2017, these decisions were extended for an additional nine months until the end of March 2018.

Thus far in the process, conformity levels among the 24 participating countries in relation to their voluntary production adjustments have been remarkably high, which has sent a clear message to the world that these countries are determined to do what is necessary to bring back sustainable market stability. In fact, for the month of August 2017, the overall conformity level reached a record high of 116%.

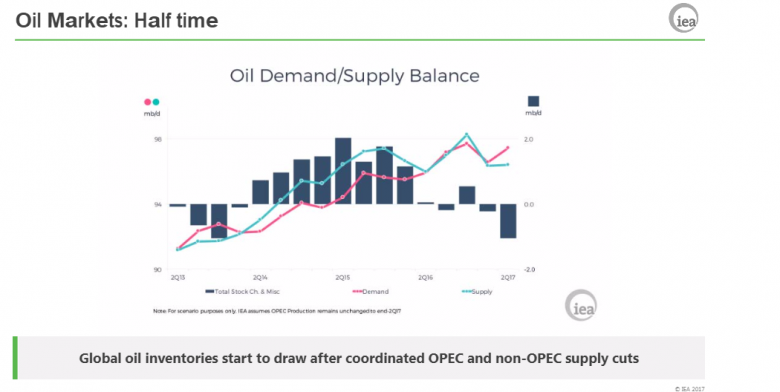

At the conclusion of last Friday's Ministerial Meeting, the JMMC issued a press release in which it stated that the joint efforts of the OPEC and non-OPEC countries were bearing fruit and that the oil market was on the road to rebalancing.

We are seeing declining OECD commercial crude inventories, which went down to 170 million barrels above the five-year average in August 2017 from 340 million barrels at the beginning of the year.

Crude in floating storage is also down by an estimated 40 million barrels since the start of the year, with the support of a narrowing contango, and even signs of backwardation in relation to ICE Brent in Europe.

These positive developments are good news, not only for our Member Countries, and other non-OPEC producers, but indeed this is equally good news for consumers who rely every day on oil and products to fuel their growing economies.

Nowhere is this more relevant than in Asia, which is expected to be the engine for future world energy growth due to its expanding economies, rapid population growth, a rising middle class as well as the swift transition to urbanization and industrialization.

We expect global demand to increase by nearly 16 million barrels a day until 2040 – at which time it could reach around 111 million barrels a day.

A remarkable 70% of this growth is forecast to come from emerging and developing economies in Asia.

The two major population growth centres in Asia will be India, which is expected to reach 1.6 billion people by 2040 and China, which will be at 1.4 billion. This amounts to 18% and 16%, respectively, of the entire world population.

As far as economic expansion goes, Asia will be the engine of growth in the years to come. GDP growth in India and China are estimated at 6.8% per year and 4.7% per year, respectively, over the forecast period up to 2040. And, separately, India and China are expected to see an increase in their combined global share of real GDP from 25% in 2016 to nearly 40% in 2040.

Expansion at these levels from the fast growing economies in Asia will require supplies from all producing regions, and OPEC Member Countries will surely play an important part in helping meet these increasing needs.

As refinery capacity grows in the region, larger quantities of crude oil will be required. This can be seen when you look at the latest data on trade flows until the year 2040, as Asia-Pacific imports will expand and the Middle East exports are set to increase. Crude exports from the Middle East to the Asia Pacific region are expected to increase by 7.5 mb/d between 2016 and 2040, rising from 14.5 mb/d to 22 mb/d. So, for the foreseeable future, we can count on the Asia-Pacific region to be the primary outlet for OPEC and Middle Eastern export barrels.

However, for these growth scenarios to materialize, we will need to see a rebalanced and stable oil market so that industry investment can return to sufficient levels necessary to secure future supply.

The historic cooperation and determined efforts of OPEC and its non-OPEC partners through the Declaration of Cooperation have clearly placed us on the right path to stability, however we must see all stakeholders in the industry rally to combat volatility and ensure that prices are supported and stabilized for the long term as this is the only way we will be able to restore long-term investment to the required levels again.

This is something that can only be achieved together through dialogue and cooperation, especially considering the interdependent and integrated nature of today's global energy market.

In the previous years, OPEC has been at the forefront of industry dialogue initiatives, and has recently added Asia to its portfolio of meetings.

In addition to the well-established ongoing energy dialogues with the European Union and the Russian Federation, China and India have been added to the series of dialogues taking place each year, reflecting the importance of the Asian continent to OPEC's Member Countries.

The latest such Asian dialogue was held in May of this year, when the second OPEC-India Energy Dialogue was convened at the OPEC Secretariat in Vienna, providing an opportunity for fruitful discussions on crucial trade relations between OPEC Member Countries and India, and on the important topic of rising energy consumption in India. When you consider that OPEC Member Countries provide an estimated 85% of the crude oil and 90% of the gas going to India, you can see why these discussions would be so relevant. And indeed, these talks are scheduled to continue next year as the next dialogue is planned for 2018 in New Delhi.

We also look forward to our next OPEC-China Energy Dialogue, which is currently scheduled to take place at the end of this year in Beijing.

These energy dialogue initiatives have set a very positive precedent for future dialogue between OPEC and its Asian partners, and our hope is that these efforts will evolve into long-term partnerships that will bring benefits to all involved stakeholders.

Delegates, ladies and gentlemen,

I am here to confirm that the future outlook for the global oil market is improving with each new day thanks to the ongoing dedicated efforts of the 24 OPEC and non-OPEC producing countries who, through the Declaration of Cooperation, are contributing to the rebalancing of the global oil market. I assure you that if it were not for this noble joint intervention that began last year, the current oil market would not be where it is today.

Now, looking ahead, we will keep pressing onwards until we reach our common goal of a fully rebalanced, growing and sustainable global oil market.

I would like to take this opportunity, in closing, to invite all Asian stakeholders to join us in these crucial efforts to restore a sustainable stability to the market so that that OPEC and its non-OPEC partners can continue to ensure a steady supply of oil and gas to help fuel Asia's future economic growth and provide prosperity for its future generations.

Thank you for your kind attention, and I wish you all a very successful conference.

-----

Earlier:

September, 13, 15:15:00

OPEC OIL PRICE UP 6% TO $49.6The OPEC Reference Basket rose for the second-consecutive month in August to average $49.60/b, representing a gain of $2.67/b or 6%. Year-to-date, the Basket was 30.9% higher at $49.73/b. Crude futures prices also saw gains with ICE Brent increasing 5.5% to $51.87/b and NYMEX WTI up 3.0% at $48.06/b. Year-to-date, crude futures prices were more than 20% higher. During the week of 29 August money managers cut WTI futures and options net long positions by 105,671 contracts to 147,303 lots, the US Commodity Futures Trading Commission (CFTC) said. Money managers slightly reduced Brent futures and options net length contracts by 1,296 to 416,551 lots during the same week. |

August, 24, 14:20:00

OIL MARKET IS RIGHTAs of July 2017, the OPEC and participating non-OPEC producing countries achieved an impressive conformity level of 94 per cent. This is a demonstration of the commitment of participating producing countries to continue their cooperation towards the rebalancing of the market. The JMMC expressed great satisfaction with the results and steady progress made towards full conformity of the production adjustments, and encouraged all participating countries to achieve full conformity, for the benefit of producers and consumers alike. The JMMC also welcomed the participation of the UAE at the recent JTC meeting, where the UAE reiterated its commitment to adhere to its production adjustments for the remaining period of the Declaration of Cooperation. |

August, 16, 09:30:00

OPEC: GLOBAL OIL DEMAND WILL UP TO 97.8 MBDOPEC said world oil demand in 2018 will grow 1.28 million b/d from 2017 levels, meaning that total oil consumption is expected to hit a new record high of 97.8 million b/d in 2018. |

August, 14, 14:25:00

OPEC OIL PRODUCTION UP 173 TBDTotal crude oil production from the Organization of Petroleum Exporting Countries increased 173,000 b/d month-over-month in July to average 32.87 million b/d. |

July, 24, 13:55:00

OIL OUTPUT CONSENSUSWith prices still languishing below the $55-$60/b that some ministers have said they are targeting, some market watchers say OPEC and its non-OPEC partners have no choice but to deepen cuts to make up for output gains from exempt Nigeria and Libya, as well as sliding compliance from other members. |

July, 7, 08:05:00

OPEC PRODUCTION UP TO 32.49 MBDThe Organization of Petroleum Exporting Countries produced 32.49 million b/d in June—an increase of 220,000 b/d from May and representing a 6-month high. |

June, 30, 08:35:00

MORE MONEY FOR OPECOPEC's first output cut in eight years has earned the group $1.64 billion a day so far this year, up more than 10 percent from the second half of 2016, according to Reuters calculations based on OPEC figures for average production and its crude basket price up until June 20. |