BRITAIN NEED INVESTMENT

REUTERS - British trade minister Liam Fox said on Wednesday that London would continue to welcome foreign investment, after a U.S. panel rejected a Chinese acquisition of a U.S. money transfer company on national security concerns.

Fox was on a visit to China, the latest installment in long-running economic talks between China and Britain, which has taken on new importance for Britain as it looks to re-invent itself as a global trading nation after leaving the European Union in 2019.

The U.S. rejection of China's Ant Financial's acquisition of MoneyGram International Inc (MGI.O) is the most high-profile Chinese deal to be torpedoed under the administration of U.S. President Donald Trump.

Asked whether Britain would serve as an alternative destination for such Chinese investment, Fox told Reuters in an interview that he hoped the investment relationship would "work in two directions", but that Britain would remain open.

"Of course, we would look, as other countries would do, at our security issues in terms of investment. But the UK has traditionally been an open country, welcoming of foreign direct investment. And we'll continue to do that," Fox said.

He did not comment specifically on the U.S. panel decision.

China is one of the countries with which Britain hopes to sign a free trade pact once it leaves the EU, and London and Beijing have been keen to show that Britain's withdrawal from the bloc will not affect ties.

Fox said that the issue of China's service sector openness was a "big issue" for Britain, but that there were more options than a post-Brexit free trade agreement (FTA) to get Beijing to open, including specific service sector agreements and mutual recognition deals.

"There are a whole range of tools in the box. And people tend to talk as though an FTA is the only tool we have available in terms of trade liberalization. It's not," he said.

The focus on a "Golden Era" of relations, trumpeted by China and Britain in 2015 when then-prime minister David Cameron hosted a state visit by Chinese President Xi Jinping, has cooled under Cameron's successor, Theresa May.

In 2016, May caused a diplomatic spat by unexpectedly deciding to delay approval of a partly-Chinese funded nuclear power project. She later granted it, but not before drawing criticism from Beijing.

May is expected to visit China later this month accompanied by a business delegation, diplomatic and business sources have told Reuters, though the trip has not been formally confirmed.

------

Earlier:

2017, December, 27, 12:10:00

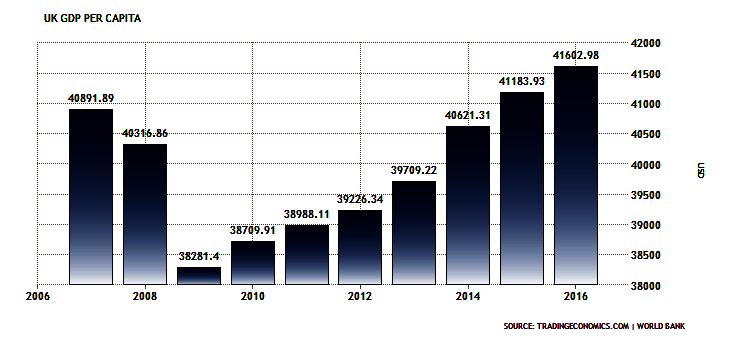

BRITAIN'S PRIMARY DETERMINANTIMF - Productivity growth will be the primary determinant of UK living standards in the long run.

|

2017, March, 30, 18:35:00

BREXIT GIVES CHANCEQatar, the world's biggest exporter of LNG, pledged almost $6.2bn worth of investment in Britain on Monday in a show of support, as UK Prime Minister Theresa May begins the formal process of negotiating a separation settlement with the European Union.

|

2016, July, 27, 18:40:00

BRITAIN HAS CUT TO 90%"We recognise that market conditions are currently very difficult but nevertheless we have a shared goal of making the basin as attractive as possible for exploration," Andy Samuel, chief executive of the OGA, said.

|

2016, July, 6, 18:30:00

BRITAIN'S HEADLESS CHICKENSWHILE politicians run around like headless chickens, the Bank of England, at least, is trying to stabilise the British economy. Within hours of the announcement of the EU referendum result, Mark Carney, the bank’s governor, reassured investors that the economy was sound. And on July 5th, through a piece of arcane but important financial regulation, the bank took the first real step to promote financial stability when it announced the relaxation of capital requirements for banks, in a bid to stave off a credit crunch.

|

2016, June, 10, 14:00:00

BRITAIN LOSE 120,000 JOBSAs many as 120,000 oil workers will have lost their jobs in Britain by the end of the year compared to mid-2014 when oil prices started declining and unleashed sector-wide cost cuts, the industry's lobby group said on Friday. |