CHINA'S OIL DEMAND UP 4.6%

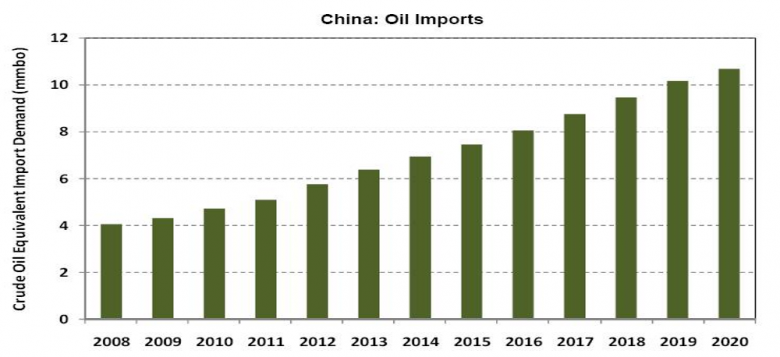

PLATTS - China's apparent oil demand is expected to rise 4.6% year on year to hit 600 million mt (12.05 million b/d) in 2018, with net crude imports to increase 7.7% to 451 million mt, according to a report released Tuesday by state-owned China National Petroleum Corp.'s Economics and Technology Research Institute.

China's oil product exports are forecast to surge 30.7% year on year to 46.8 million mt amid strong growth in output but slow domestic demand.

The projections are based on the assumption that Chinese GDP will grow 6.7% in 2018, slower than the 6.9% that the institute estimated for 2017.

In contrast, the institute's estimate for apparent oil demand was 590 million mt for 2017, up 5.9% from the previous year.

In 2017, for the first time China surpassed US to become the world's largest crude oil importer, with the dependency on imported oil hitting 67.4%, according to the report.

"If domestic crude output recovers, China's dependency on imported petroleum will reach 68.8% in 2018," the institute said in the report.

At the same time, the institute expects China to add 36 million mt/year (723,000 b/d) of refining capacity in 2018 to reach 808 million mt/year.

The independent sector accounts for about 69.4% of the capacity increase, and the sector's total capacity would account for 33% of the country's total refining capacity, rising to 36% in 2020.

Supported by the additional capacity, China is forecast to produce 378 million mt of oil products this year, up 4.8% year on year.

This would leave a surplus of about 46.8 million mt of oil product in the domestic market available to export, given that the estimate for country's apparent oil products was 331 million mt.

The apparent demand growth for oil products was forecast at 1.9% this year, slower than the 3.2% estimated demand for 2017 due to the structural reform in China's economy, with tighter environmental control and developments of alternative energy sources, the institute said.

The institute cited several factors depressing oil demand growth.

Gasoline demand would face challenges from the rise of new energy vehicles, with slower sales of gasoline-fueled car sales, an expansion of the vehicle-sharing business and more ethanol-based gasoline to flow into the market.

The expanding high-speed train network would continue to pose a threat not only to gasoline consumption but also to jet fuel demand, it said. Cooling residential construction while LNG increasingly replacing other fuels in the industry and transportation sectors will also push down the country's gasoil demand, the institute said.

China's apparent consumption of natural gas is expected to see healthy year-on-year growth of 10% in 2018 to 258.7 Bcm, although slower than the 17% growth estimated for 2017.

The institute said the fastest growth will continue to come from residential users, with gains seen in other sectors such as industry, chemicals and power generation.

To meet demand, China was likely to surpass Japan to become the world's largest natural gas importer in 2018, with total natural gas imports to rise 13.4% year on year to 105 Bcm.

LNG imports are forecast to reach 41.04 million mt, up 14.2% on year.

Domestic gas production is forecast to rise 8.8% year on year to 160.6 Bcm in 2018.

-----

Earlier:

2018, January, 12, 12:35:00

CHINA - INDONESIA DEVELOPMENTPLATTS - China's state-controlled oil giants are sitting on record-high cash pile of $35 billion and their free cash flow generation is close to double-digit yields, paving the way for more mergers and acquisitions along with higher oil prices over coming years,

|

2018, January, 5, 23:40:00

IRAQI OIL TO CHINAPLATTS - China's crude oil imports from Iraq in November surged 47.2% on year and 58.8% on month to hit a record high of 4.21 million mt or an average 1.03 million b/d, making the Persian Gulf producer its third-largest supplier, data from China's General Administration of Customs showed.

|

2018, January, 3, 15:55:00

RUSSIA - CHINA OIL FRIENDSHIPBLOOMBERG - After a glut sparked the biggest price crash in a generation and starved Russia of oil revenues, the nation sought to boost market share in the world’s top importer. It’s now supplanted Saudi Arabia as the top exporter to China, even as the two producers lead efforts to shrink the global oversupply by curbing output. A pipeline that transports crude from the East Siberia-Pacific Ocean system has helped its mission to increase volumes.

|

2018, January, 3, 15:50:00

CHINA'S LNG IMPORTS UP 48.4%PLATTS - Chinese imports of LNG in 2017 totaled 37.89 million mt, up 48.4% year on year, while imports by South Korea totaled 36.51 million mt, up 10.81% year on year.

|

2017, December, 22, 22:30:00

RUSSIAN GAS FOR CHINAGAZPROM - “Today, we laid the basis for another pipeline route of Russian gas supplies to China. The project will expand the range of options for satisfying the growing demand for gas in the Chinese market,” said Alexey Miller. |

2017, December, 8, 17:35:00

CHINA STRENGTHENS FINANCEIMF - The system’s increasing complexity has sown financial stability risks. Given the centrality of banks to the financial system, the FSAP team recommended a gradual and targeted increase in bank capital. The authorities have recognized these risks, including at the highest level, and are proactively taking important measures to address them. These include the strengthening of systemic risk oversight, further improving regulation, and moving toward functional supervision.

|

2017, December, 8, 17:30:00

CHINA'S GAS IMPORTS RECORDREUTERS - China’s natural gas imports in November rose to a record as domestic demand surged while crude imports were the second-highest ever, as refiners ramped up output to cash in on strong profits as fuel prices soar, customs data showed on Friday. |