GAS PRICES: $3.185/MMBTU

PLATTS - After see-sawing around Thursday's settle, the NYMEX February natural gas futures contract ultimately settled Friday at $3.185/MMBtu, 0.4 cent lower as an increasingly bearish demand picture forms through the end of January.

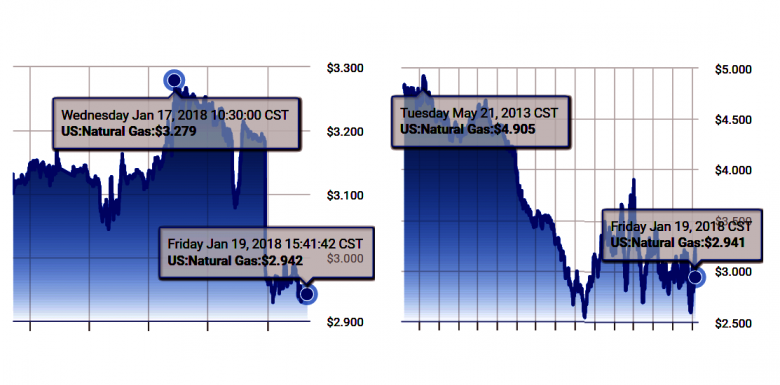

The February contract traded between $3.133/MMBtu and $3.246/MMBtu.

US National Weather Service forecasts through the end of January took a bearish turn Thursday with key Northeast and Upper Midwest demand markets projected to experience a high probability of above-average temperatures through February 1.

Platts Analytics' Bentek Energy demand projections mirrors this development, with US demand over the next 14 days expected to average just below 88 Bcf/d, possibly ending a wild January from a demand perspective with a whimper.

If projections shake out, January would close nearly 23 Bcf/d below the January-to-date average of 110.8 Bcf/d.

While the prompt-month contract held firm into the weekend, contracts down the curve weakened by larger margins, widening the deficit to the current prompt-month trading level.

The March futures contract ceded the most ground, shrinking 4.7 cents to $2.941/MMBtu while, deeper into the summer strip, July ceded 1.8 cents Friday to $2.858/MMBtu.

A contributing factor in the tepid movement of contracts down the curve comes as an updated extended weather service outlook Thursday shows above-average temperatures expected from February through May over the Northeast and Southeast, painting a bleak demand picture for the final days of winter.

Weaker demand levels could lessen the strain on national storage stocks currently sitting more than 12% below both year-ago and five-year-average levels, minimizing its impact on market movements, while production levels are expected to hold at 76 Bcf/d into February, more than 5 Bcf/d above last January, likely weighing on contracts down the curve.

-----

Earlier:

2018, January, 3, 16:00:00

GAS PRICES UP TO $2.990/MMBTUPLATTS - NYMEX February natural gas futures extended gains overnight in the US leading up to Tuesday's open, on the back of current and midrange weather support. At 7:20 am ET (1220 GMT) the contract was gripping the upside at $2.990/MMBtu, up 3.7 cents on the session.

|

2017, December, 29, 11:40:00

GAS PRICES DOWN TO $2.643/MMBTUPLATTS - After dropping 2.4 cents Tuesday to settle at $2.643/MMBtu, NYMEX January natural gas futures dipped then rallied ahead of Wednesday's open and the contract's expiry at the close of business, as traders mulled the likely impact on demand from weather outlooks.

|

2017, December, 6, 12:05:00

GAS PRICES DOWN TO $2.933PLATTS - Colder weather outlooks for major heating regions support the upside, while the recent and impending lackluster pace of storage erosion is keeping downward pressure on the market. At 6:50 am ET (1150 GMT) the contract was 5.2 cents lower at $2.933/MMBtu.

|

2017, December, 1, 12:40:00

GAS PRICES DOWN TO $3.097/MMBTUPLATTS - Having gained over 5 cents yesterday as the new front month contract, NYMEX January 2018 natural gas futures were lower ahead of Thursday's open and the morning release of the weekly storage data. At 6:45 am ET (1145 GMT), the contract was down 8.2 cents to $3.097/MMBtu.

|

2017, November, 29, 09:30:00

NYMEX GAS PRICE: $2.928/MMBTUPLATTS - A bullish weather forecast for much of the US provided a boost for gas futures coming out of the four-day Thanksgiving holiday, with NYMEX December settling Monday at $2.928/MMBtu, up 11.5 cents from Friday's close.

|

2017, October, 13, 13:00:00

PRICES: OIL $52-54; GAS $3.03-3.19EIA forecasts Brent spot prices to average $52/b in 2017 and $54/b in 2018, which is $1/b higher in 2017 and $2/b higher in 2018 compared with last month's forecast. West Texas Intermediate (WTI) average crude oil prices are forecast to be $3.50/b lower than Brent prices in 2018.

|

2017, September, 20, 09:00:00

GAS PRICES UP TO $3.146The NYMEX October natural gas futures contract jumped 12.2 cents Monday to settle at $3.146/MMBtu, with warmer-than-average weather expected to persist through the end of September across major demand areas. |