NOBLE SELLS TAMAR

REUTERS - Noble Energy Inc will sell a 7.5 percent stake in the Tamar natural gas field offshore Israel to Tamar Petroleum Ltd for about $800 million in cash and shares, the U.S. oil and gas producer said on Monday.

Noble will receive $560 million in cash and 38.5 million shares of Tamar Petroleum.

The deal allows Noble to cut its holdings in Israel's only commercial gas field to 25 percent from 32.5 percent, complying with government plans to open the market to competition.

The assets being sold produced about 62 million cubic feet equivalent per day of natural gas in 2017, Houston-based Noble said.

The deal follows an initial sale by Noble of 3.5 percent of the Tamar field in mid-2016. Combined proceeds from both deals amount to nearly $1.25 billion, of which almost $1 billion will be in cash, Noble said.

-----

Earlier:

2017, December, 6, 12:15:00

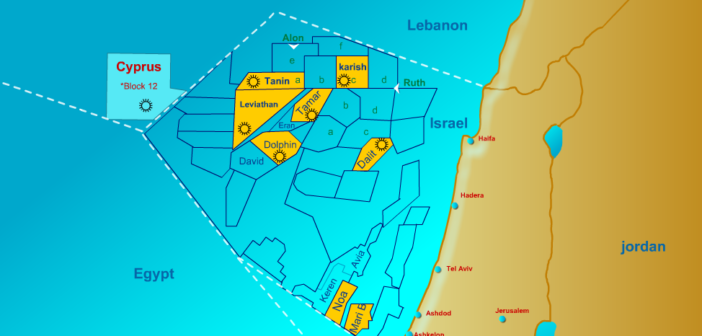

MEDITERRANEAN GAS FOR EUROPEPENNENERGY - significant deposits already discovered in the east Mediterranean, including Israel's Leviathan field are "just the tip of the iceberg" and that "it's very likely" that more gas will be found in Cypriot waters.

|

2016, May, 5, 18:20:00

NOBLE NET LOSS $287 MLNDavid L. Stover, Noble Energy's Chairman, President and CEO, commented, "We are off to a solid start this year and have made substantial progress on our goals for 2016. Our high-quality and diverse portfolio is delivering strong results, giving us the confidence to lower our full year capital and cost outlook while raising volumes substantially. We have aligned our business within cash flows and are continuing to protect our investment-grade balance sheet. Significant capital efficiency gains and outstanding operating performance, combined with robust liquidity, position us well in any price scenario."

|

2016, April, 26, 20:00:00

RUSSIA & ISRAEL GAS TALKSPutin's interest in Israeli gas is neither secret nor new. In 2012 Russia's Gazprom discussed the possible purchase of a 30% stake in Israel's offshore Leviathan gas field. In 2013 Gazprom signed a contract to purchase much of the Tamar gas field's production but the contract wasn’t approved by Israel's Energy Ministry.

|