OIL PRICES: ABOVE $67

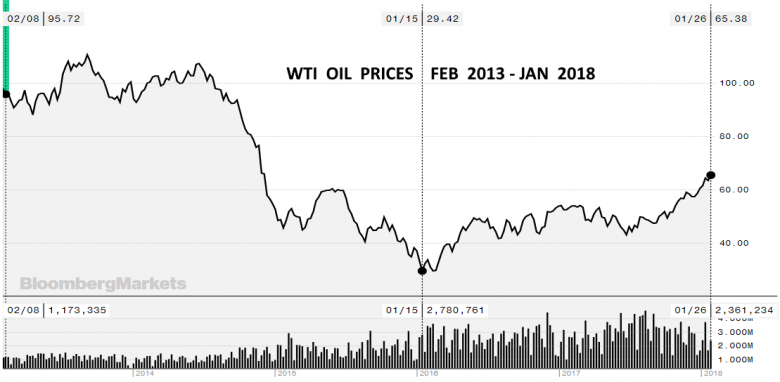

REUTERS, BLOOMBERG - Oil prices fell on Friday, dropping away from highs last seen in 2015, as soaring U.S. production undermined a 10-percent rally from lows hit in December that was driven by tightening supply and political tensions in OPEC member Iran.

U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $61.81 a barrel at 0750 GMT. That was 20 cents, or 0.3 percent, below their last close. WTI hit a $62.21 the previous day, which was its strongest since May, 2015.

Brent crude futures LCOc1 were at $67.88 a barrel, 19 cents, or 0.3 percent, below their last settlement. Brent hit $68.27 the day before, also the highest since May, 2015.

Traders said political tensions in Iran, the third-largest producer in the Organization of the Petroleum Exporting Countries (OPEC), had pushed prices higher.

"The protests in Iran add more fuel to the already bullish oil market mood," said Norbert Ruecker, head of commodity research at Swiss bank Julius Baer.

Oil prices have received general support from production cuts led by OPEC and by Russia, which started in January last year and are set to last through 2018, as well as from strong economic growth and financial markets.

That has helped tighten markets. U.S. commercial crude inventories fell by 7.4 million barrels in the week to Dec. 29, to 424.46 million barrels, according to data from the Energy Information Administration (EIA).

That is down 20 percent from their historic peaks last March and close to the five-year average of 420 million barrels.

CAN THE BULL-RUN LAST?

Yet given Iran's oil production has not been affected by the unrest, and that U.S. output will likely break through 10 million barrels per day (bpd) soon, a level so far only reached by Saudi Arabia and Russia, doubts are emerging whether the bull-run can last.

U.S. bank Jefferies said the oil price "upside from here is not obvious to us", although it added that "we believe the oil market will remain undersupplied through 2018".

Ruecker of Julius Baer said crude prices above $60 per barrel project an "overly rosy picture (as) oil production disruptions (in Iran) remain a very distant threat ... disruptions in the North Sea have been removed ... (and) U.S. oil production surpassed the 2015 highs in October and is set to climb to historic highs this year."

Lukman Otunuga, analyst at futures brokerage FXTM, struck a similarly cautious tone.

"Oil started the New Year on an incredibly bullish note ... in part due to ongoing tensions in Iran ... (and) over OPEC's supply cut rebalancing the markets," he said.

"While the current momentum suggests that further upside is on the cards, it must be kept in mind that U.S. shale remains a threat to higher oil prices."

-----

Earlier:

2018, January, 4, 12:30:00

OIL PRICES: ABOVE $68REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $62.16 a barrel at 0752 GMT, up 53 cents, or 0.9 percent, from their last close. They touched $62.21 shortly before, their highest level since May 2015. Brent crude futures LCOc1 - the international benchmark for oil prices - were at $68.23 a barrel, up 39 cents, or 0.9 percent, after revisiting a May 2015 high of $68.27 shortly before.

|

2018, January, 3, 16:05:00

OIL PRICES: ABOVE $66 YETREUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $60.50 a barrel at 1017 GMT, up 13 cents from their last close, though still not far off the $60.74 reached on the previous day that was the highest since June 2015. Brent crude futures LCOc1 - the international benchmark for oil prices - were at $66.74 a barrel, up 17 cents but still trailing Tuesday’s high of $67.29 that was the most since May 2015.

|

2017, December, 29, 11:45:00

OIL PRICES: ABOVE $66 AGAINREUTERS - U.S. West Texas Intermediate (WTI) crude futures were at $60.30 a barrel at 0504 GMT, up 46 cents or 0.8 percent from their last close, the highest since June 2015. Brent crude futures - the international benchmark - were also up, rising 45 cents or 0.7 percent to $66.61 a barrel. Brent broke through $67 earlier this week for the first time since May 2015. |

2017, December, 27, 12:40:00

OIL PRICES: ABOVE $66BLOOMBERG - Brent for February settlement lost 20 cents to $66.82 a barrel on the London-based ICE Futures Europe exchange. Prices climbed $1.77, or 2.7 percent, to $67.02 a barrel Tuesday, the highest close since May 2015. The global benchmark crude traded at a premium of $6.95 to WTI.

|

2017, December, 25, 20:45:00

OIL PRICES - 2018: VOLATILEThe price of oil in 2018 will be volatile with commodity market traders selling on signals of OPEC-Russia “cheating” or members producing more oil than the extended Algiers Agreement output quotas.

|

2017, December, 22, 23:05:00

OIL PRICE: NOT ABOVE $65REUTERS - U.S. West Texas Intermediate (WTI) crude futures were at $58.16 a barrel at 0755 GMT, down 20 cents, or 0.3 percent, from their last settlement. Brent crude futures, the international benchmark for oil prices, were at $64.81 a barrel, down 19 cents, or 0.1 percent. |

2017, December, 18, 12:35:00

INEVITABLE OIL CHANGESOPEC - Sustainable oil market stability is crucial to attract the level of investment necessary for future demand growth; In the longer term, oil will remain a vital and integral part of the energy mix; Global energy and oil demand will grow in the long term;

|