OIL PRICES: ABOVE $69

REUTERS, BLOOMBERG - Oil prices hit their highest levels since 2014 on Wednesday due to ongoing production cuts led by OPEC as well as healthy demand, although analysts cautioned that markets may be overheating.

A broad global market rally, including stocks, has also been fuelling investment into crude oil futures.

U.S. West Texas Intermediate (WTI) crude futures were at $63.40 a barrel at 0100 GMT - 44 cents, or 0.7 percent, above their last settlement. They marked a December-2014 high of $63.53 a barrel in early trading.

Brent crude futures were at $69.15 a barrel, 33 cents, or 0.5 percent, above their last close. Brent touched $69.29 in late Tuesday trading, its strongest since an intra-day spike in May 2015 and, before that, in December 2014.

"The extension of the OPEC agreement ... and declining inventories are all helping to drive the price higher," said William O'Loughlin, investment analyst at Australia's Rivkin Securities.

In an effort to prop up prices, the Organization of the Petroleum Exporting Countries (OPEC) together with Russia and a group of other producers last November extended an output cut deal that was due to expire in March this year to cover all of 2018.

The cuts, which have mostly targeted Europe and North America, was aimed at reducing a global supply overhang that had dogged oil markets since 2014.

The American Petroleum Institute said late on Tuesday that crude inventories fell by 11.2 million barrels in the week to Jan. 5, to 416.6 million barrels.

Official U.S. Energy Information Administration data is due at 1530 GMT on Wednesday.

OVERHEATED?

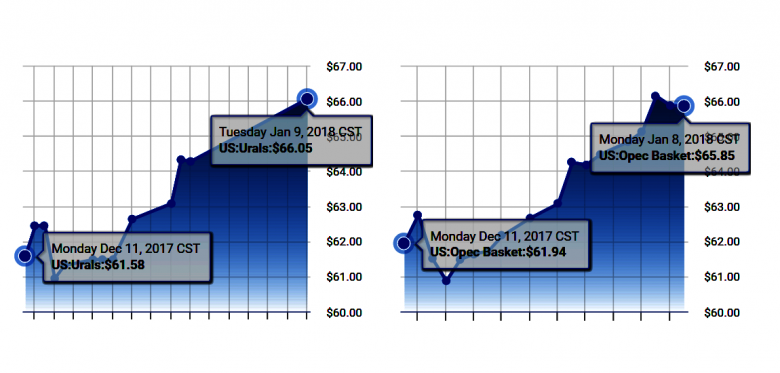

Amid the general bull-run, which has pushed up crude prices by more than 13 percent since early December, there are indicators of an overheated market.

In the United States, crude oil production C-OUT-T-EIA is expected to break through 10 million barrels per day (bpd) this month, reaching levels only Russia and Saudi Arabia have.

In Asia, the world's biggest oil consumer region, refiners are suffering from high prices and ample fuel supplies.

"One area of concern, particularly in Asia, is that of (low) refining margins ... This drop in margins could reduce Asian refiners' demand for incremental crude in the near term and weigh on global prices," said Sukrit Vijayakar, director of energy consultancy Trifecta.

Average Singapore refinery margins DUB-SIN-REF this week fell below $6 per barrel, their lowest seasonal value in five years, due to high fuel availability but also because the recent rise in feedstock crude prices dented profits.

Asian oil prices are higher than in the rest of the world.

While Brent and WTI are still below $70 per barrel, the average price for Asian crude oil grades has already risen above that level, to $70.62 per barrel, Thomson Reuters Eikon data showed.

-----

Earlier:

2018, January, 5, 23:55:00

OIL PRICES: ABOVE $67REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $61.81 a barrel at 0750 GMT. That was 20 cents, or 0.3 percent, below their last close. WTI hit a $62.21 the previous day, which was its strongest since May, 2015. Brent crude futures LCOc1 were at $67.88 a barrel, 19 cents, or 0.3 percent, below their last settlement. Brent hit $68.27 the day before, also the highest since May, 2015.

|

2018, January, 4, 12:30:00

OIL PRICES: ABOVE $68REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $62.16 a barrel at 0752 GMT, up 53 cents, or 0.9 percent, from their last close. They touched $62.21 shortly before, their highest level since May 2015. Brent crude futures LCOc1 - the international benchmark for oil prices - were at $68.23 a barrel, up 39 cents, or 0.9 percent, after revisiting a May 2015 high of $68.27 shortly before.

|

2018, January, 3, 16:05:00

OIL PRICES: ABOVE $66 YETREUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $60.50 a barrel at 1017 GMT, up 13 cents from their last close, though still not far off the $60.74 reached on the previous day that was the highest since June 2015. Brent crude futures LCOc1 - the international benchmark for oil prices - were at $66.74 a barrel, up 17 cents but still trailing Tuesday’s high of $67.29 that was the most since May 2015.

|

2017, December, 29, 11:45:00

OIL PRICES: ABOVE $66 AGAINREUTERS - U.S. West Texas Intermediate (WTI) crude futures were at $60.30 a barrel at 0504 GMT, up 46 cents or 0.8 percent from their last close, the highest since June 2015. Brent crude futures - the international benchmark - were also up, rising 45 cents or 0.7 percent to $66.61 a barrel. Brent broke through $67 earlier this week for the first time since May 2015. |

2017, December, 27, 12:40:00

OIL PRICES: ABOVE $66BLOOMBERG - Brent for February settlement lost 20 cents to $66.82 a barrel on the London-based ICE Futures Europe exchange. Prices climbed $1.77, or 2.7 percent, to $67.02 a barrel Tuesday, the highest close since May 2015. The global benchmark crude traded at a premium of $6.95 to WTI.

|

2017, December, 25, 20:45:00

OIL PRICES - 2018: VOLATILEThe price of oil in 2018 will be volatile with commodity market traders selling on signals of OPEC-Russia “cheating” or members producing more oil than the extended Algiers Agreement output quotas.

|

2017, December, 22, 23:05:00

OIL PRICE: NOT ABOVE $65REUTERS - U.S. West Texas Intermediate (WTI) crude futures were at $58.16 a barrel at 0755 GMT, down 20 cents, or 0.3 percent, from their last settlement. Brent crude futures, the international benchmark for oil prices, were at $64.81 a barrel, down 19 cents, or 0.1 percent. |