RUSSIA'S UPSIDE POTENTIAL

BLOOMBERG - Russia's oil producers are enjoying near record crude prices -- in rubles -- and having their best start to the year since 2015. As the nation prepares to discuss its deal with OPEC allies in Oman this weekend, analysts say the good times will continue. Here are the key trends to watch.

Party Like It's 2014

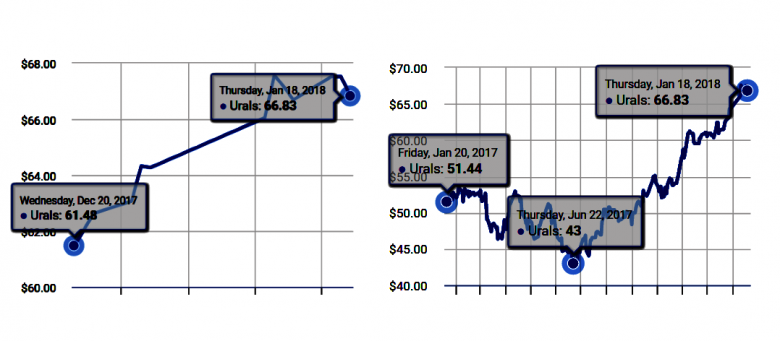

For the global market, Brent is still $50 below the high of 2014, yet for Russian producers the price of the benchmark crude in rubles is close to a record thanks to a weaker currency. A new government program of foreign-currency purchases is expected to limit the upward potential for the ruble this year, and in the coming weeks even trigger its temporary weakness, analysts at UBS Group AG said in a Jan. 11 report.

Upside Potential

Russia's oil and gas index may gain another 20 to 30 percent this year as investors have yet to price in Brent at $70 per barrel, according to Sberbank CIB. "The sell side is assuming an average oil price of $55 per barrel for 2018," the bank's analysts said in a Jan. 15 note. "Should the oil price stay at the current level, we will see a wave of earnings upgrades."

Dividend Appeal

The appeal of Russian oil and gas shares has increased, relative to European rivals, since the beginning of the year. Citigroup Inc. said 2018 is set to become the second "year of the dividend" for the Russian stocks amid improved earnings outlooks.

Risk of Headwinds

While an investor favorite, Russia's oil and gas industry still faces the risk of headwinds. The first may blow at the end of January, should the U.S. Treasury publish a report on potential new sanctions against Russia. However, the risk of a tougher stance on the Russian economy and corporate sector is low, according to a Bank of America Merrill Lynch report.

Other potential risks include oil and ruble volatility, plus the imposition of a higher tax burden on Russian producers, according to Citigroup. The fiscal threat may materialize after presidential elections in March as the Kremlin mulls boosting spending on health, education and infrastructure. The energy industry is the traditional cash cow for such budget splurges.

Capacity Limitations

Russian producers are also less well placed than their Arabian Gulf allies to take advantage of a gradual exit from the oil output curbs agreed with the Organization of Petroleum Exporting Countries. The nation's spare production capacity doesn't compare to that of OPEC, according to analysts at Aton LLC in Moscow and Rystad Energy AS in Oslo.

The U.S. Energy Information Administration estimates that OPEC's spare capacity -- production that can be brought online within 30 days and sustained for at least 90 days -- stood at 2.11 million barrels a day in the fourth quarter, all in the Middle East. The International Energy Agency had a higher figure -- 3.41 million barrels a day as of November.

Russia, which agreed to cut production to 10.95 million barrels from a post-Soviet high of 11.25 million barrels in October 2016, has less immediate firepower at its disposal.

Russia could increase output to about 11.1 million barrels a day within a month of the curbs being lifted and ramp-up production to pre-cut levels within an additional two to three months, said Rystad analyst Veronika Akulinitseva. BMI Research has a similar estimate -- some 310,000 barrels a day that could be brought to the market within six months.

-----

Earlier:

2018, January, 12, 12:55:00

RUSSIA'S NUCLEAR RECORDROSATOM - Russian NPPs exceeded the record of 2016 in the volume of generated electricity by increasing cumulative production by more than 6.5 billion kWh, up to 202.868 billion kWh (against 196.366 billion kWh in 2016). |

2018, January, 12, 12:50:00

RUSSIAN GAS RETURNINGBLOOMBERG - Ukraine imported 14 billion cubic meters of gas from the EU last year, comparable to Belgium’s annual consumption. From this year, state-owned NAK Naftogaz Ukrainy should import 5 billion cubic meters annually under its contract with Russia’s Gazprom PJSC through 2019, and has to pay for at least 80 percent of that, according to the court.

|

2018, January, 5, 23:50:00

RUSSIA'S GAS RECORDBLOOMBERG - Russia needs to strengthen its position in the global gas market as it’s considered a leading global energy power, President Vladimir Putin said last month. Already the world’s largest exporter of the fuel, the nation is working to boost output with new LNG plants stretching from the Baltic region to the Pacific coast. That will pit the country against the biggest producers of the super-chilled fuel, including Qatar and Australia.

|

2018, January, 3, 15:55:00

RUSSIA - CHINA OIL FRIENDSHIPBLOOMBERG - After a glut sparked the biggest price crash in a generation and starved Russia of oil revenues, the nation sought to boost market share in the world’s top importer. It’s now supplanted Saudi Arabia as the top exporter to China, even as the two producers lead efforts to shrink the global oversupply by curbing output. A pipeline that transports crude from the East Siberia-Pacific Ocean system has helped its mission to increase volumes.

|

2017, December, 22, 22:30:00

RUSSIAN GAS FOR CHINAGAZPROM - “Today, we laid the basis for another pipeline route of Russian gas supplies to China. The project will expand the range of options for satisfying the growing demand for gas in the Chinese market,” said Alexey Miller. |

2017, December, 11, 10:20:00

RUSSIAN GAZPROM'S NEW RECORDPLATTS - Taking into account the nominated volume for Friday, Gazprom will have exported 179.8 Bcm to what it calls the Far Abroad -- Europe and Turkey, but not the countries of the former Soviet Union -- higher than last year's then record high of 179.3 Bcm.

|

2017, December, 6, 12:25:00

IMF: RUSSIA IS STABLEIMF - Overall, the system is stable. We have had a turbulent period in the last couple of years. Bad loans increased, and profits and credit growth slowed down. This period seems to have come to an end and the economy and the banking sector are getting healthier. |