U.S. OIL INVENTORIES DOWN

BLOOMBERG - Oil extended gains from the highest close in more than three years as U.S. industry data signaled crude stockpiles dropped an eighth week.

Futures climbed as much as 0.9 percent in New York after rising 2.5 percent the previous two sessions. Inventories fell by 11.2 million barrels last week, the American Petroleum Institute was said to report on Tuesday. If the draw is replicated in Energy Information Administration data Wednesday, it will be the biggest decline for this time of the year since 1999.

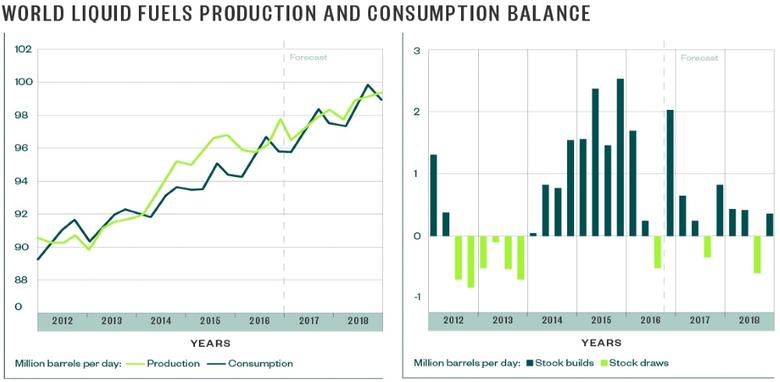

Oil is continuing its advance after a second annual gain as the Organization of Petroleum Exporting Countries and its allies trim supply to drain a global glut. The OPEC-led group is facing the challenge of rising U.S. crude output, which is forecast by the EIA to expand above 10 million barrels a day as soon as next month and top 11 million in November 2019.

"There are signs of another good drop in stockpiles and the market seems to believe that we're going to see inventory tightening at a fairly decent rate," said Ric Spooner, a Sydney-based analyst at CMC Markets. "The positive trend remains in place."

West Texas Intermediate for February delivery rose as much as 57 cents to $63.53 a barrel on the New York Mercantile Exchange, and was at $63.43 at 7:52 a.m. in London. Total volume traded was about 16 percent above the 100-day average. Prices advanced $1.23 to $62.96 on Tuesday, the highest close since December 2014.

Brent for March settlement climbed as much as 44 cents, or 0.6 percent, to $69.26 a barrel on the London-based ICE Futures Europe exchange after advancing 1.5 percent on Tuesday to the highest since December 2014. The global benchmark crude was at a premium of $5.82 to March WTI.

U.S. crude inventories probably dropped by 3.75 million barrels last week, according to a Bloomberg survey before the EIA report. Stockpiles at Cushing, Oklahoma, the delivery point for WTI and the nation's biggest oil-storage hub, probably slid by 1.5 million barrels, an estimate compiled by Bloomberg shows.

-----

Earlier:

2017, December, 18, 12:40:00

OPTIMISTIC OIL PRICESBLOOMBERG - OPEC’s Secretary General Mohammad Barkindo said the producer group is close to its goal of rebalancing markets and the International Energy Agency said oil inventories in developed nations have slid to the lowest since July 2015. OPEC upped the implementation of promised cuts in November to 115 percent, the highest rate since the agreement began, according to the IEA.

|

2017, December, 11, 10:00:00

U.S. OIL INVENTORY DOWN BY 5.6 MBDUS commercial crude oil inventories, excluding the Strategic Petroleum Reserve, decreased by 5.6 million bbl for the week ended Dec. 1 compared with the previous week. The latest estimate is 448.1 million bbl, which puts oil supplies in the upper range for this time of year, the US Energy Information Administration said.

|

2017, November, 27, 20:05:00

OIL SUPPLY & DEMANDBLOOMBERG - Global crude inventories are declining and supply and demand are in balance, according to the head of Saudi Aramco, while the United Arab Emirates energy minister said U.S. shale oil doesn’t threaten OPEC’s efforts to support the market.

|

2017, October, 16, 11:40:00

OPEC EXPECTATIONThe Organization of Petroleum Exporting Countries and allies including Russia have been cutting oil production this year to bring fuel inventories in industrialized nations back in line with the five-year average.

|

2017, August, 24, 14:05:00

U.S. OIL INVENTORIES DOWN 3.3 MBDUS commercial crude oil inventories declined 3.3 million bbl during the week ended Aug. 18 compared with the previous week’s total, continuing a months-long downward trend.

|

2017, August, 17, 15:20:00

U.S. OIL INVENTORIES DOWN 9MBU.S. commercial crude oil inventories, excluding the Strategic Petroleum Reserve, decreased by 8.9 million bbl for the week ended Aug. 11 compared with the previous week, the Energy Information Administration said in its weekly oil and products inventory report.

|

2017, July, 7, 08:10:00

MARKET WILL BE BETTERNovak said prices had room to rise from current levels and said inventories in industrialized nations were expected to ease back to the five-year average thanks to the decision by OPEC and its allies to extend supply curbs from the first half of 2017 to the first quarter of 2018. |