WBG: GLOBAL ECONOMIC GROWTH 3.1%

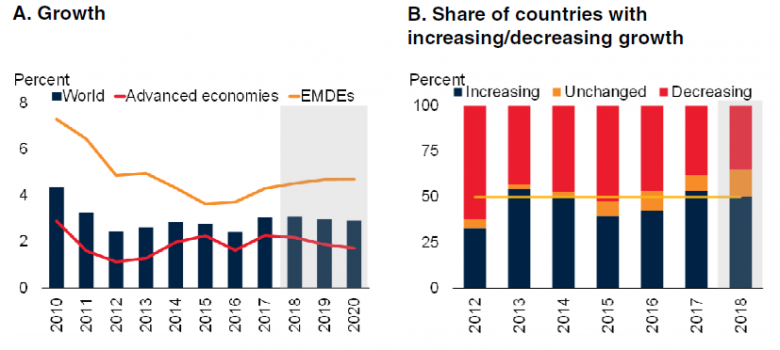

WBG - The World Bank forecasts global economic growth to edge up to 3.1 percent in 2018 after a much stronger-than-expected 2017, as the recovery in investment, manufacturing, and trade continues, and as commodity-exporting developing economies benefit from firming commodity prices.

However, this is largely seen as a short-term upswing. Over the longer term, slowing potential growth—a measure of how fast an economy can expand when labor and capital are fully employed—puts at risk gains in improving living standards and reducing poverty around the world, the World Bank warns in its January 2018 Global Economic Prospects.

Growth in advanced economies is expected to moderate slightly to 2.2 percent in 2018, as central banks gradually remove their post-crisis accommodation and as an upturn in investment levels off. Growth in emerging market and developing economies as a whole is projected to strengthen to 4.5 percent in 2018, as activity in commodity exporters continues to recover.

"The broad-based recovery in global growth is encouraging, but this is no time for complacency," World Bank Group President Jim Yong Kim said. "This is a great opportunity to invest in human and physical capital. If policy makers around the world focus on these key investments, they can increase their countries' productivity, boost workforce participation, and move closer to the goals of ending extreme poverty and boosting shared prosperity."

2018 is on track to be the first year since the financial crisis that the global economy will be operating at or near full capacity. With slack in the economy expected to dissipate, policymakers will need to look beyond monetary and fiscal policy tools to stimulate short-term growth and consider initiatives more likely to boost long-term potential.

The slowdown in potential growth is the result of years of softening productivity growth, weak investment, and the aging of the global labor force. The deceleration is widespread, affecting economies that account for more than 65 percent of global GDP. Without efforts to revitalize potential growth, the decline may extend into the next decade, and could slow average global growth by a quarter percentage point and average growth in emerging market and developing economies by half a percentage point over that period.

"An analysis of the drivers of the slowdown in potential growth underscores the point that we are not helpless in the face of it," said World Bank Senior Director for Development Economics, Shantayanan Devarajan. "Reforms that promote quality education and health, as well as improve infrastructure services could substantially bolster potential growth, especially among emerging market and developing economies. Yet, some of these reforms will be resisted by politically powerful groups, which is why making this information about their development benefits transparent and publicly available is so important."

Risks to the outlook remain tilted to the downside. An abrupt tightening of global financing conditions could derail the expansion. Escalating trade restrictions and rising geopolitical tensions could dampen confidence and activity. On the other hand, stronger-than-anticipated growth could also materialize in several large economies, further extending the global upturn.

"With unemployment rates returning to pre-crisis levels and the economic picture brighter in advanced economies and the developing world alike, policymakers will need to consider new approaches to sustain the growth momentum," said World Bank Development Economics Prospects Director Ayhan Kose. "Specifically, productivity-enhancing reforms have become urgent as the pressures on potential growth from aging populations intensify."

In addition to exploring developments at the global and regional levels, the January 2018 Global Economic Prospects takes a close look at the outlook for potential growth in each of the six global regions; lessons from the 2014-2016 oil price collapse; and the connection between higher levels of skill and education and lower levels of inequality in emerging market and developing economies.

Regional Summaries:

East Asia and Pacific: Growth in the region is forecast to slip to 6.2 percent in 2018 from an estimated 6.4 percent in 2017. A structural slowdown in China is seen offsetting a modest cyclical pickup in the rest of the region. Risks to the outlook have become more balanced. Stronger-than-expected growth among advanced economies could lead to faster-than-anticipated growth in the region. On the downside, rising geopolitical tension, increased global protectionism, an unexpectedly abrupt tightening of global financial conditions, and steeper-than-expected slowdown in major economies, including China, pose downside risks to the regional outlook. Growth in China is forecast to moderate to 6.4 percent in 2018 from 6.8 percent in 2017. Indonesia is forecast to accelerate to 5.3 percent in 2018 from 5.1 percent in 2017.

Europe and Central Asia: Growth in the region is anticipated to ease to 2.9 percent in 2018 from an estimated 3.7 percent in 2017. Recovery is expected to continue in the east of the region, driven by commodity exporting economies, counterbalanced by a gradual slowdown in the western part as a result of moderating economic activity in the Euro Area. Increased policy uncertainty and a renewed decline in oil prices present risks of lower-than-anticipated growth. Russia is expected to expand by 1.7 percent in 2018, unchanged from its estimated growth rate in 2017. Turkey is projected to moderate to 3.5 percent this year from 6.7 percent in the year just ended.

Latin America and the Caribbean: Growth in the region is projected to advance to 2 percent in 2018, from an estimated 0.9 percent in 2017. Growth momentum is expected to gather as private consumption and investment strengthen, particularly among commodity-exporting economies. Additional policy uncertainty, natural disasters, a rise in trade protectionism in the United States, or further deterioration of domestic fiscal conditions could throw growth off course. Brazil is expected to pick up to 2 percent in 2018, from an estimated 1 percent in 2017. Mexico is anticipated to accelerate to 2.1 percent this year, from an estimated 1.9 percent last year.

Middle East and North Africa: Growth in the region is expected to jump to 3 percent in 2018 from 1.8 percent in 2017. Reforms across the region are expected to gain momentum, fiscal constraints are expected to ease as oil prices stay firm, and improved tourism is anticipated to support growth among economies that are not dependent on oil exports. Continued geopolitical conflicts and oil price weakness could set back economic growth. Growth in Saudi Arabia is forecast to accelerate to 1.2 percent in 2018 from 0.3 percent in 2017, while growth is anticipated to pick up to 4.5 percent in the Arab Republic of Egypt in FY 2018 from 4.2 percent last year.

South Asia: Growth in the region is forecast to accelerate to 6.9 percent in 2018 from an estimated 6.5 percent in 2017. Consumption is expected to stay strong, exports are anticipated to recover, and investment is on track to revive as a result of policy reforms and infrastructure upgrades. Setbacks to reform efforts, natural disasters, or an upswing in global financial volatility could slow growth. India is expected to pick up to a 7.3 percent rate in fiscal year 2018/19, which begins April 1, from 6.7 percent in FY 2017/18. Pakistan is anticipated to accelerate to 5.8 percent in FY 2018/19, which begins July 1, from 5.5 percent in FY 2017/18.

Sub-Saharan Africa: Growth in the region is anticipated to pick up to 3.2 percent in 2018 from 2.4 percent in 2017. Stronger growth will depend on a firming of commodity prices and implementation of reforms. A drop in commodity prices, steeper-than-anticipated global interest rate increases, and inadequate efforts to ameliorate debt dynamics could set back economic growth. South Africa is forecast to tick up to 1.1 percent growth in 2018 from 0.8 percent in 2017. Nigeria is anticipated to accelerate to a 2.5 percent expansion this year from 1 percent in the year just ended.

-----

Earlier:

2018, January, 12, 13:00:00

ТРАНСФОРМАЦИЯ МИРОВОГО РЫНКАМИНЭНЕРГО РОССИИ - На энергетическом рынке происходят существенные трансформации, появляются новые технологии, что в итоге приводит к изменению энергобаланса. В частности, за последние 10 лет добыча газа в мире выросла на 20% -- до 580 млрд м3, его доля в энергобалансе расширилась с 21 до 22%. При этом мировая торговля газом за тот же период увеличилась на 42%, или на 313 млрд м3.

|

2017, December, 18, 12:35:00

INEVITABLE OIL CHANGESOPEC - Sustainable oil market stability is crucial to attract the level of investment necessary for future demand growth; In the longer term, oil will remain a vital and integral part of the energy mix; Global energy and oil demand will grow in the long term;

|

2017, November, 9, 14:00:00

OPEC: 2040 GLOBAL ENERGY CHANGESWithin the grouping of Developing countries, India and China are the two nations with the largest additional energy demand over the forecast period, both in the range of 22–23 mboe/d.

|

2017, November, 9, 13:50:00

EIA: NUCLEAR ENERGY WILL UPEIA projects that global nuclear capacity will grow at an average annual rate of 1.6% from 2016 through 2040, led predominantly by countries outside of the Organization for Economic Cooperation and Development (OECD). EIA expects China to continue leading world nuclear growth, followed by India. This growth is expected to offset declines in nuclear capacity in the United States, Japan, and countries in Europe.

|

2017, September, 15, 08:55:00

WORLD ENERGY CONSUMPTION UP TO 28%The U.S. Energy Information Administration projects that world energy consumption will grow by 28% between 2015 and 2040. Most of this growth is expected to come from countries that are not in the Organization for Economic Cooperation and Development (OECD), and especially in countries where demand is driven by strong economic growth, particularly in Asia. Non-OECD Asia (which includes China and India) accounts for more than 60% of the world's total increase in energy consumption from 2015 through 2040.

|

2017, September, 13, 15:10:00

IMF: SOUTHEAST ASIA'S TRANSFORMATIONIMF - When we think about Asia’s economic future, we know that this future is being built on strong foundations—on the richness and diversity of its cultures, on the incredible energy and ingenuity of the people who have changed the world by transforming their own economies. China and India have been driving the greatest poverty reduction in human history by creating the world’s largest middle classes. In a single generation, Vietnam has moved from being one of the world’s poorest nations to being a middle-income country.

|

2017, September, 6, 18:15:00

СТРАТЕГИЧЕСКАЯ ЗНАЧИМОСТЬ ЭНЕРГЕТИКИМы признаем, что устойчивое развитие, доступ к энергетике и энергетическая безопасность являются ключевыми факторами общего процветания и будущего нашей планеты. Мы признаем, что чистая энергетика и возобновляемые источники энергии должны быть доступны для всех. Мы будем способствовать развитию открытых, гибких и транспарентных рынков энергетического сырья и технологий в области энергетики. |