INDONESIA'S GDP UP TO 5.1%

IMF - IMF Executive Board Concludes 2017 Article IV Consultation with Indonesia

On January 10, 2018, the Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation with Indonesia.

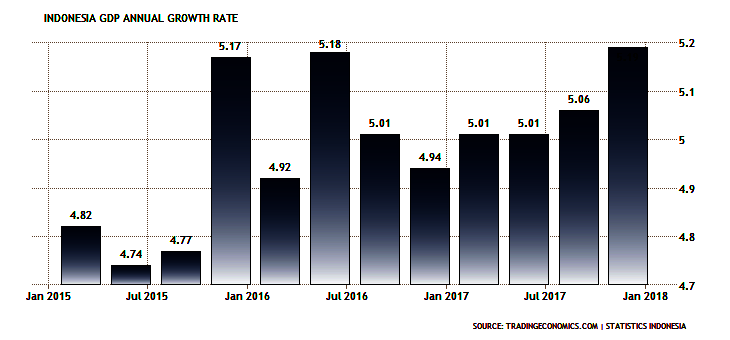

The Indonesian economy has continued to perform well. Real GDP growth accelerated slightly to 5.1 percent in Q3:2017 from 5 percent in 2016 and H1:2017, led by robust exports and fixed investment. The output gap is estimated at –0.5 percent of GDP. Inflation fell to 3.3 percent in November, at the lower half of the official target band (4±1 percent), due to the slightly negative output gap and stable food prices, which more than offset the increase in electricity prices earlier in the year due to improved targeting of subsidies. Core inflation has remained stable at around 3 percent. The current account deficit declined to 1.5 percent of GDP in Q1-Q3:2017 due to higher exports. However, credit growth remains slow reflecting both weak demand and banks' tight lending standards.

The economic outlook is positive. Real GDP growth is projected at 5.1 percent in 2017, rising gradually to 5.6 percent over the medium term, led by robust domestic demand. Inflation is projected to remain around 3.5 percent, within the official target range, due to stable food and administered prices, and well anchored inflation expectations. The current account deficit is expected to remain contained at near 2 percent of GDP due to firm commodity prices and robust exports. Risks to the outlook remain tilted to the downside, including spikes in global financial volatility, uncertainty around U.S. economic policies, lower growth in China, and geopolitical tensions. Global growth and commodity prices could surprise on the upside. Domestic risks include tax revenue shortfalls and larger fiscal financing needs due to higher interest rates.

Executive Board Assessment

Executive Directors commended the authorities for the sound economic performance, including stable economic growth, moderate inflation, and a modest current account deficit, which have contained systemic risks. They noted that the economic outlook is favorable, but encouraged the authorities to stay vigilant against risks, including from volatile capital flows. Directors stressed that achieving higher potential growth would help create jobs for the young and growing labor force. The priority should be on a self-reinforcing and well-sequenced fiscal-structural reform package that mobilizes revenues to finance development spending and supports structural reforms in the product, labor, and financial markets.

Directors welcomed the focus of the near-term policy mix on supporting growth while preserving stability. They noted that fiscal adjustment in 2018 should be gradual to protect growth while rebuilding fiscal buffers. They agreed that the current stance of monetary policy is appropriate for targeting price stability and supporting growth, and recommended further enhancing monetary transmission. Directors welcomed the authorities' commitment to maintain exchange rate flexibility and to limit foreign exchange intervention to preventing disorderly market conditions.

Directors commended the authorities' efforts to rebalance public expenditure toward priority sectors. They encouraged early implementation of a medium-term revenue strategy to finance growth-enhancing priority spending and structural reforms, as well as reduce the heavy reliance on external financing. This strategy should include frontloaded tax policy and administration reforms. Short-term measures to arrest the fall in the tax ratio should also be considered.

Directors welcomed the progress achieved in boosting infrastructure investment. They stressed that the pace of infrastructure development should be aligned with available financing and the economy's absorptive capacity. Priority should be given to financing infrastructure with domestic revenue, as well as greater private sector participation, including foreign direct investment. This would limit the buildup of corporate external debt and contingent liabilities from state-owned enterprises (SOEs). Financial deepening through developing a national strategy for capital market development would also support infrastructure investment.

Directors commended the authorities' efforts to streamline regulations. They noted that future efforts should target areas with the largest potential gains for the economy, such as reducing state control, rationalizing the role of SOEs, and greater coordination of regulations among ministries and regional governments.

Directors emphasized that improving education and easing labor market regulations would support employment. They underscored the need to raise the level and quality of education spending, streamline job protection regulations, and improve vocational training and job placement services. Enhancing female labor participation would also be important.

Directors took positive note of the authorities' efforts to strengthen financial oversight and crisis management. Going forward, they encouraged greater focus on the areas identified by the FSAP where further improvement is needed, including clarification of institutional mandates, improving supervision of financial institutions and financial conglomerates, adopting a more rigorous approach to credit risk, and continuing to strengthen the crisis management framework. Continuing to monitor foreign exchange and external debt vulnerabilities of corporates will also be important.

-----

Earlier:

2018, February, 7, 07:35:00

INDONESIA - IAEA COOPERATIONWNN - Indonesia's National Atomic Energy Agency (Batan) is promoting the introduction of nuclear power plants to help meet the county's demand for power. It envisages the start-up of conventional large light-water reactors on the populous islands of Bali, Java, Madura and Sumatra from 2027 onwards. In addition, it is planning small HTGRs (up to 100 MWe) for deployment on Kalimantan, Sulawesi and other islands to supply power and heat for industrial use.

|

2018, January, 12, 12:35:00

CHINA - INDONESIA DEVELOPMENTPLATTS - China's state-controlled oil giants are sitting on record-high cash pile of $35 billion and their free cash flow generation is close to double-digit yields, paving the way for more mergers and acquisitions along with higher oil prices over coming years,

|

2017, December, 27, 12:15:00

INDONESIA'S INVESTMENT UP BY 21%PLATTS - Indonesia's state-owned Pertamina plans to spend $3.324 billion on its upstream business in 2018, a 21.16% jump year on year.

|

2017, December, 4, 22:45:00

ROSNEFT & PETRAMINA FOR INDONESIAROSNEFT - Rosneft and Indonesian state-owned oil and gas company Pertamina completed the establishment of the joint venture for the development of Tuban grass root refinery and petrochemical complex (TGRR) in Tuban in the East Java province of Indonesia. |

2017, August, 17, 15:10:00

INDONESIAN OIL UP 12%Indonesia's state-owned Pertamina has produced 343,000 b/d of crude oil in the first-half of 2017, up 12% year on year, upstream director Syamsu Alam said late Wednesday. "I think the crude production this year can meet our 2017 target of 354,000 b/d. But gas production may be ... lower compared with the target of 2.08 Bcf/d, due to lower demand and some gas fields [not being able to] produce," he said.

|

2017, February, 10, 18:30:00

INDONESIA NEEDS $80 BLN INVESTMENTSIndonesia needs to invest $70 billion to $80 billion in gas infrastructure through 2030 to avoid a potential gas shortage, as domestic consumption growth outpaces supply, state-owned energy business Pertamina said Tuesday.

|

2016, July, 4, 18:05:00

INDONESIA & BP: 10,000 JOBSThe Tangguh Expansion Project will also bring a positive contribution to Indonesia and the Papua Barat Province starting in 2016, supporting economic growth and providing 10,000 valuable jobs spread over the project period. |