OIL PRICE WILL BE $80

BLOOMBERG- Goldman Sachs Group Inc. hiked its short-term crude oil price forecast by as much as 33 percent, saying the market is now likely balanced.

The bank now estimates Brent will reach $75 a barrel over the next three months and will climb to $82.50 within six months, analysts including Damien Courvalin wrote in an emailed report. Their previous estimate for both time periods was $62 a barrel.

"The rebalancing of the oil market has likely been achieved, six months sooner than we had expected," Goldman's analysts wrote. "The decline in excess inventories was fast-forwarded in late 2017 by stellar demand growth, high OPEC compliance, heavy maintenance as well as collapsing Venezuela production."

Goldman joins other Wall Street banks including Morgan Stanley and JPMorgan Chase & Co. in ratcheting up its outlook, as economic growth and output cuts led by the Organization of Petroleum Exporting Countries have helped to boost prices. Morgan Stanley recently said Brent will reach $75 a barrel this year, while JPMorgan said it could rise to near $78 as oil markets tighten more rapidly than expected.

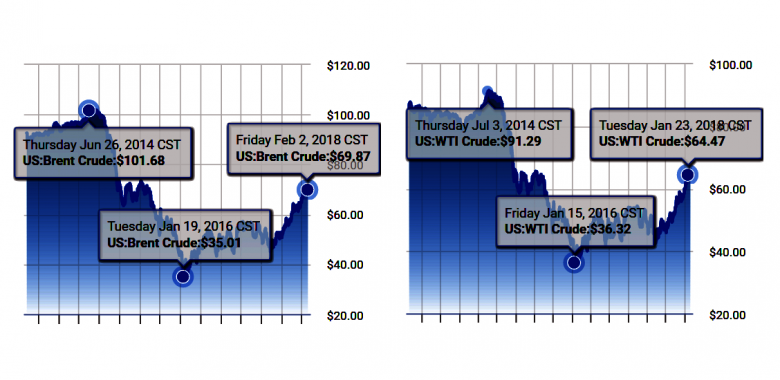

Brent for April delivery traded up 52 cents at $69.41 a barrel at 11:45 a.m. in London after earlier rising to $69.67. The global benchmark last touched $75 in late 2014.

Goldman's bullish outlook is driven by its revised demand forecasts, reflecting stronger economic growth in emerging markets. The bank also said rising U.S. shale supply will be needed to keep the market steady in the near-term, since any ramp-up in OPEC production will lag the rebalancing.

Record bullish bets in the oil market are "actually not that elevated when viewed in the context of broader portfolio allocation," according to the Goldman report. It forecast that oil will return 24 percent to investors over the next six months.

Goldman said its view was cyclical, noting that U.S. shale production, the eventual end of OPEC's oil cuts and higher non-OPEC production will eventually pull down Brent prices to $60 a barrel by 2020. Its "New Oil Order" outlook -- where shale production transforms global supply -- is on hiatus, but not finished, the bank said.

-----

Earlier:

2018, January, 31, 11:10:00

OIL PRICE: ABOVE $68 AGAINREUTERS - Brent crude futures LCOc1 for March delivery settled down 44 cents, or 0.6 percent, at $69.02 a barrel after touching a session low of $68.40. U.S. West Texas Intermediate futures CLc1 fell $1.06, or 1.6 percent, to close at $64.50 a barrel. |

2018, January, 29, 08:45:00

OIL PRICES: ABOVE $70 YETREUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $66.34 a barrel at 0144 GMT, up 20 cents, or 0.3 percent, from their last settlement. Brent crude futures LCOc1 were at $70.49 per barrel, 3 cents below their last settlement.

|

2018, January, 26, 12:40:00

OIL PRICES: ABOVE $70REUTERS - Brent crude futures were at $70.22 per barrel at 0556 GMT, down 20 cents, or 0.3 percent, from their last close. Brent the previous day marked its highest since December, 2014 at $71.28. U.S. West Texas Intermediate (WTI) crude futures were at $65.38 a barrel, down 13 cents, or 0.2 percent from their previous close. WTI also touched its highest since December, 2014 in the last session at $66.66.

|

2018, January, 24, 12:20:00

OIL PRICES: ABOVE $69 AGAINREUTERS - Brent crude futures were at $69.79 a barrel at 0749 GMT, down 17 cents from their last close. U.S. West Texas Intermediate (WTI) crude futures were at $64.45 a barrel, down 2 cents from their last settlement. |

2018, January, 24, 12:15:00

СОГЛАШЕНИЕ ВЫПОЛНЕНО НА 107%МИНЭНЕРГО РОССИИ - АЛЕКСАНДР НОВАК: СОГЛАШЕНИЕ ОПЕК+ ПО ИТОГАМ 2017 ГОДА ВЫПОЛНЕНО НА 107%

|

2018, January, 22, 08:50:00

OIL PRICES: NOT ABOVE $69 YETREUTERS - Brent crude futures were at $68.89 a barrel at 0315 GMT, up 25 cents, or 0.4 percent, from their last close. Brent on Jan. 15 rose to $70.37, its highest since December 2014. U.S. West Texas Intermediate (WTI) crude futures were at $63.61 a barrel, up 24 cents, or 0.4 percent, from their last settlement. WTI climbed to $64.89 on Jan. 16, also its highest since December 2014.

|

2018, January, 19, 12:45:00

OIL PRICES: ABOVE $68REUTERS - Brent crude futures were at $68.78 at 0128 GMT, down 53 cents, or 0.8 percent, from their last close. On Monday, they hit their highest since December, 2014 at $70.37 a barrel. U.S. West Texas Intermediate (WTI) crude futures were at $63.36 a barrel, down 59 cents, or 0.9 percent, from their last settlement. WTI marked a December-2014 peak of $64.89 a barrel on Tuesday. |