OIL PRICES: $62

EIA - SHORT-TERM ENERGY OUTLOOK

Prices

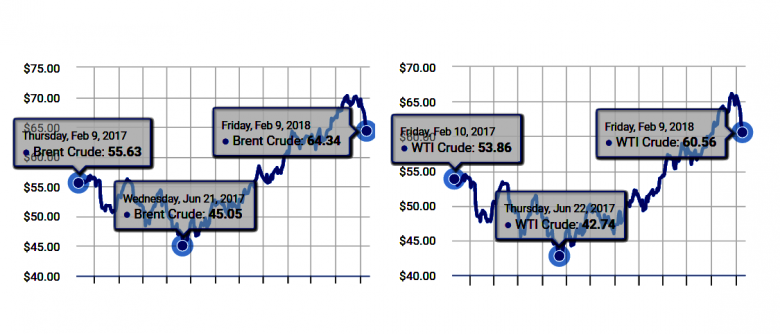

- North Sea Brent crude oil spot prices averaged $69 per barrel (b) in January, an increase of $5/b from the December level. Monthly average Brent prices have increased for seven consecutive months, and, on January 11, spot prices moved higher than $70/b for the first time since December 2014. EIA forecasts Brent spot prices will average about $62/b in both 2018 and 2019 compared with an average of $54/b in 2017.

- EIA expects West Texas Intermediate (WTI) crude oil prices to average $4/b lower than Brent prices in both 2018 and 2019. NYMEX WTI contract values for May 2018 delivery traded during the five-day period ending February 1, 2018, suggest a range of $55/b to $77/b encompasses the market expectation for May 2018 WTI prices at the 95% confidence level.

- In January, the U.S. benchmark Henry Hub natural gas spot price averaged $3.88 per million British thermal units (MMBtu), up $1.06/MMBtu from December. Cold temperatures east of the Rocky Mountains in early January contributed to high levels of natural gas consumption as well as a reduction in production because of well freeze-offs. This combination resulted in record-high natural gas inventory withdrawals in mid-January, which contributed to rising prices.

- EIA expects natural gas prices to moderate in the coming months, based on a forecast of record growth in natural gas production. EIA expects Henry Hub spot prices to average $3.34/MMBtu in February and $3.20/MMBtu for all of 2018. In 2019, EIA forecasts prices will average $3.08/MMBtu. NYMEX contract values for May 2018 delivery that traded during the five-day period ending February 1, 2018, suggest that a range of $2.26/MMBtu to $3.67/MMBtu encompasses the market expectation for May Henry Hub natural gas prices at the 95% confidence level.

Global Liquid Fuels

- North Sea Brent crude oil spot prices averaged $69 per barrel (b) in January, an increase of $5/b from the December level. Monthly average Brent prices have increased for seven consecutive months, and, on January 11, spot prices moved higher than $70/b for the first time since December 2014. EIA forecasts Brent spot prices will average about $62/b in both 2018 and 2019 compared with an average of $54/b in 2017.

- EIA expects West Texas Intermediate (WTI) crude oil prices to average $4/b lower than Brent prices in both 2018 and 2019. NYMEX WTI contract values for May 2018 delivery traded during the five-day period ending February 1, 2018, suggest a range of $55/b to $77/b encompasses the market expectation for May 2018 WTI prices at the 95% confidence level.

- EIA estimates that U.S. crude oil production averaged 10.2 million barrels per day (b/d) in January, up 100,000 b/d from the December level. EIA estimates that total U.S. crude oil production averaged 9.3 million b/d in 2017 and will average 10.6 million b/d in 2018, which would mark the highest annual average U.S. crude oil production level, surpassing the previous record of 9.6 million b/d set in 1970. EIA forecasts that 2019 crude oil production will average 11.2 million b/d.

- EIA estimates that global petroleum and other liquid fuels inventories declined by 0.5 million b/d in 2017. In this forecast, global inventories grow by about 0.2 million b/d in both 2018 and 2019.

-----

Earlier:

2018, February, 7, 08:25:00

OIL PRICE: ABOVE $67 YETBLOOMBERG - West Texas Intermediate for March delivery rose as much as 79 cents to $64.18 a barrel and traded at $63.88 as of 11:39 a.m. in Singapore. The contract fell 76 cents to $63.39 on Tuesday. Total volume traded was about 16 percent above the 100-day average. Brent for April settlement rose 46 cents to $67.32 a barrel on the London-based ICE Futures Europe exchange, snapping a three-day decline. The global benchmark crude traded at a premium of $3.73 to April WTI.

|

2018, February, 2, 12:25:00

OIL PRICE WILL BE $80BLOOMBERG - Brent will reach $75 a barrel over the next three months and will climb to $82.50 within six months, analysts including Damien Courvalin wrote in an emailed report. Their previous estimate for both time periods was $62 a barrel.

|

2018, January, 24, 12:15:00

СОГЛАШЕНИЕ ВЫПОЛНЕНО НА 107%МИНЭНЕРГО РОССИИ - АЛЕКСАНДР НОВАК: СОГЛАШЕНИЕ ОПЕК+ ПО ИТОГАМ 2017 ГОДА ВЫПОЛНЕНО НА 107%

|

2018, January, 10, 13:05:00

OIL PRICES: $60 - $61EIA - Brent crude oil prices averaged $54/b in 2017 and are forecast to average $60/b in 2018 and $61/b in 2019. West Texas Intermediate (WTI) crude oil spot prices are forecast to average $4/b less than Brent prices in both 2018 and 2019. EIA’s forecast for the average WTI price for December 2018 of $58/b should be considered in the context of NYMEX contract values for December 2018 delivery. NYMEX contract values traded during the five-day period ending January 4 suggest that a range of $40/b to $85/b encompasses the market expectation for WTI prices in December 2018 at the 95% confidence level.

|

2017, December, 15, 13:10:00

UNCERTAIN OIL PRICESEIA - The forecast for oil prices remains highly uncertain. WTI futures contracts for March 2018 delivery, traded during the five-day period ending December 7, 2017, averaged $57/b.

|

2017, December, 13, 12:30:00

OIL PRICE - 2018: $57EIA - North Sea Brent crude oil spot prices averaged $63 per barrel (b) in November, an increase of $5/b from the average in October. EIA forecasts Brent spot prices to average $57/b in 2018, up from an average of $54/b in 2017.

|

2017, November, 27, 20:05:00

OIL SUPPLY & DEMANDBLOOMBERG - Global crude inventories are declining and supply and demand are in balance, according to the head of Saudi Aramco, while the United Arab Emirates energy minister said U.S. shale oil doesn’t threaten OPEC’s efforts to support the market. |