EXXON STRATEGY - 2025: TWICE

EXXONMOBIL - ExxonMobil Outlines Aggressive Growth Plans to More than Double Earnings

- Earnings and cash flow from operations projected to approximately double by 2025

- Strongest investment opportunities in two decades to drive results, improve returns

- Profitable production growth with low-cost-of-supply tight oil, liquefied natural gas and deepwater

ExxonMobil outlined an aggressive growth strategy to more than double earnings and cash flow from operations by 2025 at today's oil prices.

"We've got the best portfolio of high-quality, high-return investment opportunities that we've seen in two decades," Darren W. Woods, chairman and chief executive officer, said at the company's annual meeting of investment analysts at the New York Stock Exchange.

"Our plan takes full advantage of the company's unique strengths and financial capabilities, using innovation, technology and integration to drive long-term shareholder value and industry-leading returns."

Growth plans include steps to increase earnings by more than 100 percent – to $31 billion by 2025 at 2017 prices – from last year's adjusted profit of $15 billion, which excluded the impact of U.S. tax reform and impairments.

Woods said this plan projects double-digit rates of return in all three segments of ExxonMobil's business – upstream, downstream and chemical – which are all three world-class businesses in their own right.

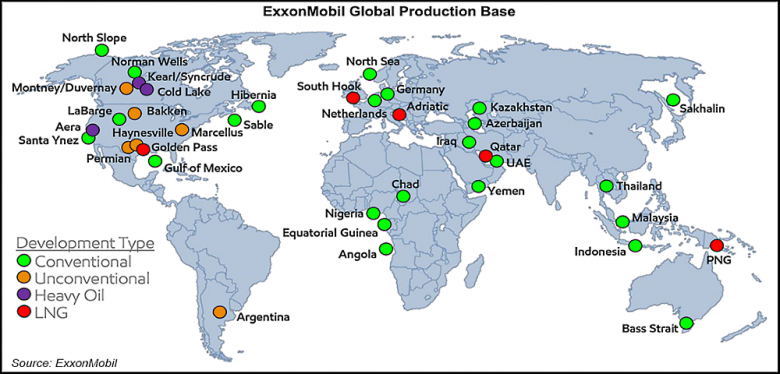

In the upstream, the company expects to significantly increase earnings through a number of growth initiatives involving low-cost-of-supply investments in U.S. tight oil, deepwater and liquefied natural gas (LNG). Growth coming online from new and existing projects is expected to increase production from 4 million oil-equivalent barrels per day to about 5 million.

The company plans to increase tight-oil production five-fold from the U.S. Permian Basin and start up 25 projects worldwide. Those startups will add volumes of more than 1 million oil-equivalent barrels per day. In LNG, the company expects to bring on new production to meet a projected increase in global demand.

Upstream growth will benefit from ExxonMobil's industry-leading exploration success and strategic acquisitions. In 2017 alone, the company added 10 billion oil-equivalent barrels to its resource base in locations including the Permian, Guyana, Mozambique, Papua New Guinea and Brazil.

Key drivers of growth are in Guyana, where exploration success has added 3.2 billion gross oil equivalent barrels of recoverable resource and plans are in place for development and further exploration, and in the Permian, where the company has increased the size of its resource to 9.5 billion oil-equivalent barrels from less than 3 billion in the past year.

Through its acquisition of several Bass entities in 2017, ExxonMobil added an estimated resource of 5.4 billion oil-equivalent barrels in the Permian. The original resource estimate of 3.4 billion barrels at the time of the purchase was increased through technical evaluation and successful delineation in the Delaware Basin, reducing the acquisition cost to just above $1 per oil-equivalent barrel.

The contiguous stacked pays from the New Mexico acquisition are now estimated to provide more than 4,800 drilling locations with an average lateral length of more than 12,000 feet, enabling capital-efficient execution of Permian volumes growth and the potential to further increase future volumes.

"We are in a solid position to maximize the value of the increased Permian production as it moves from the well head to our Gulf Coast refining and chemical operations, where we are focusing on manufacturing higher-demand, higher-value products," Woods said.

ExxonMobil's downstream business is projected to double earnings by 2025 by upgrading its product slate through strategic investments at refineries in Baytown and Beaumont in Texas and Baton Rouge, Louisiana, Rotterdam, Antwerp, Singapore, and Fawley in the U.K.

These projects are expected to result in double-digit returns by enabling increased production of higher-value products, such as ultra-low sulfur diesel, chemicals feedstocks and basestocks for lubricants. As a result of these improvements, the company's 2025 downstream margins are projected to increase by 20 percent.

Expansion is supported by projected demand growth in emerging markets, and includes entries into new markets such as Mexico and Indonesia. It is supported by integration with chemical manufacturing and upstream production.

In its chemical business, ExxonMobil expects to grow manufacturing capacity in North America and Asia Pacific by about 40 percent. That growth will be achieved in part by adding 13 new facilities, including two world-class steam crackers in the United States. These investments would enable the company to meet increasing demand in Asia and other growing markets.

"We are uniquely positioned to take advantage of the global demand growth for higher-value products in the downstream and chemical," Woods said. "Our combined strengths in innovative technology, resource and market access, marketing product leadership and integration improve profitability and create significant shareholder value."

Woods said the company's overall growth strategy is designed with a key goal in mind – fully leveraging our competitive advantages to grow shareholder value across all three of our world-class businesses. Through higher returns from increased investments, the company has the potential to increase its return on capital employed to about 15 percent by 2025.

"Our existing business and plans for growth are robust to a wide range of price environments, allowing us to maintain a growing dividend and a strong balance sheet while returning excess cash to our shareholders," said Woods.

-----

Earlier:

2018, March, 4, 11:20:00

EXXON LEAVES RUSSIAROSNEFT - The decisions of ExxonMobil to abandon certain projects that fall under the legislative limitations once again imposed by the US government despite their successful development fully comply with the position of the American regulator that changed the way we collaborate on these projects. |

2018, February, 9, 10:30:00

EXXON'S RESERVES 21.2 BLNEXXONMOBIL said it added 2.7 billion oil-equivalent barrels of proved oil and gas reserves in 2017, replacing 183 percent of production. ExxonMobil's proved reserves totaled 21.2 billion oil-equivalent barrels at year-end 2017. Liquids represented 57 percent of the reserves, up from 53 percent in 2016. ExxonMobil’s reserves life at current production rates is 14 years.

|

2018, February, 5, 07:45:00

EXXON ENERGY OUTLOOK - 2040EXXONMOBIL - Despite efficiency gains, global energy demand will likely increase nearly 25 percent. Nearly all growth will be in non-OECD countries (e.g. China, India), where demand will likely increase about 40 percent, or about the same amount of energy used in the Americas today.

|

2018, February, 5, 07:15:00

EXXON NET INCOME $19.7 BLNEXXONMOBIL - ExxonMobil Earns $19.7 Billion in 2017; $8.4 Billion in Fourth Quarter

|

2017, November, 13, 10:20:00

EXXON INCREASES COMPETITIVENESSThe world’s biggest oil explorer by market value recently finished four wells in North Dakota’s Bakken region that extend sideways for 3 miles (4.8 kilometers), Barclays Plc analyst Paul Cheng said in a research note after meeting Exxon executives, and it’s closing in on the 4-mile mark.

|

2017, September, 15, 08:35:00

EXXON И РОССИЯ СОГЛАСИЛИСЬ12 сентября было подписано мировое соглашение между Россией и компанией ExxonMobil в рамках судебного разбирательства по иску о взыскании денежных средств по соглашению о разделе продукции по проекту "Сахалин-1". Стороны достигли взаимовыгодного компромисса. От имени Российской Федерации мировое соглашение подписал Министр финансов Антон Силуанов.

|

2017, July, 5, 12:20:00

AGAINST RUSSIA SANCTIONSExxon Mobil Corp. and other energy companies have joined President Donald Trump in expressing concerns over a bill to toughen sanctions on Russia, arguing that it could shut down oil and gas projects around the world that involve Russian partners. |