OIL INVESTMENT THREAT

PLATTS - The global oil industry may be underestimating the pace of world's current transition away from fossil fuels to cleaner energy, with the prospect of peak oil demand in the coming decades already informing upstream investment decisions at some producers, a major industry event heard Tuesday.

Although global oil demand will continue to grow in the medium term, driven by economic expansion in developing countries, an expected drop-off in oil demand growth from around late 2030 means Australian mining giant and oil producer BHP, for one, is avoiding any long-term oil projects, its CEO Andrew Mackenzie said.

"There have to be some questions on electrification as to what that will do to demand for oil from 2030-40 onwards," Mackenzie told the FT Commodities Global Summit in Lausanne, Switzerland.

"Certainly when we look at investment on oil, we want to have ones that pay back well before that period, when I think we're in slightly dangerous waters."

BP last month became the first Western supermajor to pinpoint an inflection point in the world's need for oil, estimating that surging wind and solar power, electric cars, more frugal vehicles could see oil demand peaking in the "late 2030."

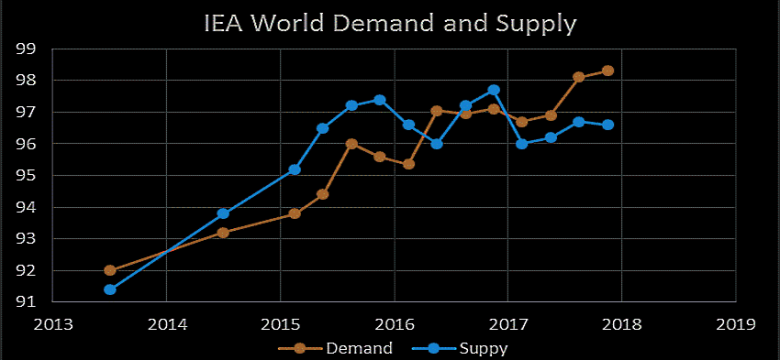

BP's main long-term outlook scenario now sees oil demand topping out at 110,000 b/d, up from about 97,000 b/d currently. A year ago it expected oil demand to rise beyond 2040.

ExxonMobil, however, remains more bullish on the future for oil, predicting that demand for oil will likely continue to grow by 19% to 117 million b/d to 2040.

HIGHER EV PENETRATION

Others are less concerned about the peak of oil demand and International Energy Agency still believes oil demand will continue to rise through 2040.

Oil trader Gunvor's CEO, Torbjorn Tornqvist, said he is also concerned that an accelerating push to electric cars and growth of new green technologies could spell the end of global oil growth sooner than many expect.

"I think that generally the oil industry has underestimated the challenges ahead. I think that electric vehicles are just the beginning, the advances create momentum which feeds that's momentum and accelerates it," Tornqvist told the event.

He said, however, that he sees global oil consumption continuing to grow for at least the coming 10 years, noting that he saw the penetration rates of renewables energies more dependent on regulatory issues rather than simple economics.

Tornqvist's concerns about a faster-than-expected impact on oil demand from EVs were largely born out out by Standard Chartered's Head of Commodities Research, Paul Horsnell.

Horsnell said economists have been hiking their expectations of the number of EVs on roads in the coming decades to around 400 million by 2030-35, a level that could make a more significant dent in OECD oil demand.

IBP last month almost doubled its estimates of electric cars on the road by 2035 to nearly 190 million units, and said electric car sales are expected to surge to reach around 320 million on the roads by 2040.

FOSSIL FUELS MARKET SHARE

Trafigura, the world's third-largest oil trading house behind Vitol Group and Glencore, is much less bullish over the impact on oil demand from the growing push to renewable, lower-carbon energy sources.

The oil trader sees continued growth in the oil markets at least until 2035 and "maybe beyond," Trafigura's CEO Jeremy Weir told the event.

Weir said Trafigura is forecasting a growth of EVs globally to a total of 40 million by 2030, up from 2-3 million units currently, a figure which would only demand oil demand by around 1 million b/d.

"From our point of view, it's not a big impact on the market place in terms of oil," Weir said.

Despite an expected continue rise in future global gas demand as a clear, transition fuel to renewable energy sources, Mercuria's CEO Marco Dunand said he still expects EVs to help erode the market share for fossil fuels in the near future.

Noting that fossil fuels currently represent about 81% of the global energy mix, largely unchanged from 30 years ago, Dunand said expects the share for oil and gas in the global energy mix to fall to 70-55% of energy market in 15-20 years.

But the future for a smaller role for oil in the global energy mix is not all bad news for some commodity producers.

With booming growth in renewable sources of energy which feed into more widespread global electrification of transport networks, however, more diversified commodity producers are likely to benefit, BHP's Mackenzie said.

"Some people believe that renewable energy will reduce the world's total commodity demand. I disagree," Mackenzie said.

"China, the world's largest consumer of commodities is also on track to become the global leader in clean energy technology. And renewable energy infrastructure will generate greater demand for commodities."

Greater demand for renewable source of power such as solar and wind would create higher demand for other commodities than for energy sourced from fossil fuels, he said.

The growing push toward electrification of energy and transport networks would mean rising demand for key conductors such as copper and battery components such as cobalt and lithium.

-----

Earlier:

2018, March, 11, 11:35:00

GLOBAL TIGHT OIL INVESTMENTEIA - Brent global benchmark crude oil price will increase throughout the projection period but will remain lower than prices during 2010–2014 in real dollar terms. For this reason, future investment growth in higher-cost resources is expected to be lower than in recent history. Global production of tight oil will increase by 3.3 million b/d, offshore deepwater by 2.7 million b/d, and oil sands by 1.4 million b/d between 2017 and 2040. Total production increases from these sources makes up nearly half of the long-term global liquids supply growth through 2040.

|

2018, March, 11, 11:30:00

U.S. OIL INVESTMENTREUTERS - “The stability in oil prices is a net positive. If energy companies can demonstrate to investors that they can generate cash flow in the current oil price environment, they can go public,” said Grant Kernaghan, Citigroup’s managing director of Canadian investment banking. “The recent volatility hasn’t resulted in markets shutting down,” he added, suggesting equity markets were still open despite a 10-session period up to Feb. 8 when the S&P 500 dropped over 10 percent.

|

2018, February, 16, 23:20:00

ADNOC INVESTMENT $109 BLNAOG - ADNOC announced that it has launched the implementation phase of its new in-country value (ICV) strategy, aimed at increasing the company’s ICV contribution and strengthening its relationship with the UAE’s private sector.

|

2018, February, 5, 07:42:00

MEXICO'S OIL INVESTMENT $100 BLNFT - Mexico secured almost $100bn in investment in its most successful oil tender to date as Anglo-Dutch oil major Royal Dutch Shell positioned itself as the biggest player in deepwater exploration and new companies including Qatar Petroleum burst on to the scene.

|

2018, January, 26, 12:25:00

CHINA'S ARCTIC ROADREUTERS - “China hopes to work with all parties to build a ‘Polar Silk Road’ through developing the Arctic shipping routes,” the paper, issued by the State Council Information Office, said.

|

2018, January, 15, 10:15:00

WBG: GLOBAL ECONOMIC GROWTH 3.1%WBG - The World Bank forecasts global economic growth to edge up to 3.1 percent in 2018 after a much stronger-than-expected 2017, as the recovery in investment, manufacturing, and trade continues, and as commodity-exporting developing economies benefit from firming commodity prices. |

2018, January, 12, 13:00:00

ТРАНСФОРМАЦИЯ МИРОВОГО РЫНКАМИНЭНЕРГО РОССИИ - На энергетическом рынке происходят существенные трансформации, появляются новые технологии, что в итоге приводит к изменению энергобаланса. В частности, за последние 10 лет добыча газа в мире выросла на 20% -- до 580 млрд м3, его доля в энергобалансе расширилась с 21 до 22%. При этом мировая торговля газом за тот же период увеличилась на 42%, или на 313 млрд м3. |