U.S. DEFICIT UP TO $128.2 BLN

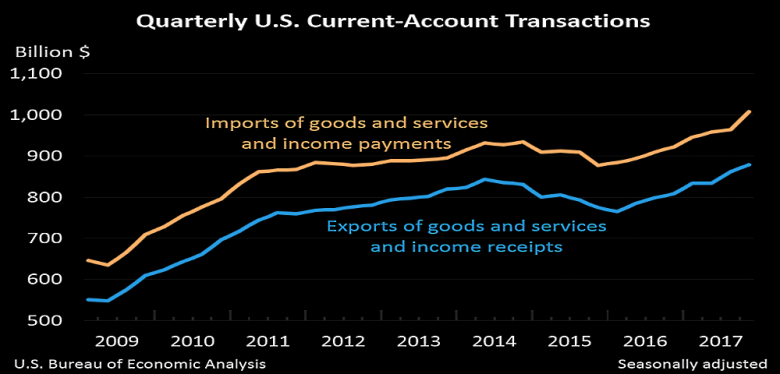

BEA - The U.S. current-account deficit increased to $128.2 billion (preliminary) in the fourth quarter of 2017 from $101.5 billion (revised) in the third quarter, according to statistics released by the Bureau of Economic Analysis (BEA). The deficit was 2.6 percent of current- dollar gross domestic product (GDP) in the fourth quarter, up from 2.1 percent in the third quarter.

The $26.7 billion increase in the current-account deficit mostly reflected increases in the deficits on goods and secondary income and a decrease in the surplus on primary income.

Exports of goods and services and income receipts

Exports of goods and services and income receipts increased $16.6 billion in the fourth quarter to $878.8 billion.

* Goods exports increased $14.2 billion to $400.7 billion, mostly reflecting an increase in industrial supplies and materials, primarily petroleum and products.

* Primary income receipts increased $6.0 billion to $243.9 billion, mostly reflecting increases in direct investment income and in portfolio investment income.

* Secondary income receipts decreased $5.9 billion to $35.3 billion, partly offsetting the increases in goods exports and in primary income receipts. The decrease in secondary income receipts mostly reflected a decrease in U.S. government transfers, primarily fines and penalties.

Imports of goods and services and income payments

Imports of goods and services and income payments increased $43.3 billion to $1,006.9 billion.

* Goods imports increased $33.1 billion to $614.9 billion, mostly reflecting increases in industrial supplies and materials, primarily petroleum and products, and in consumer goods except food and automotive.

* Primary income payments increased $7.3 billion to $186.7 billion, primarily reflecting an increase in direct investment income.

-----

Earlier:

2018, March, 21, 12:40:00

U.S. GAS EXPORT - 2017EIA - The United States exported more natural gas than it imported in 2017, marking the first time since 1957 that the United States has been a net natural gas exporter. The transition to net exporter occurred as natural gas production in the United States continued to grow, reducing pipeline imports from Canada and increasing exports, both by pipeline and as liquefied natural gas (LNG).

|

2018, March, 18, 11:10:00

U.S. INDUSTRIAL PRODUCTION UP 1.1%FRB - Industrial production rose 1.1 percent in February following a decline of 0.3 percent in January. Manufacturing production increased 1.2 percent in February, its largest gain since October. Mining output jumped 4.3 percent, mostly reflecting strong gains in oil and gas extraction.

|

2018, March, 16, 10:20:00

U.S. OIL PRODUCTION UP 5%EIA - Annual average U.S. crude oil production grew by 463,000 barrels per day (b/d) in 2017 to 9.3 million b/d after declining by 551,000 b/d in 2016.

|

2018, March, 16, 10:15:00

U.S. PETROLEUM DEMAND: 20.3 MBDAPI - Led by gasoline and seasonal demand for heating fuels, U.S. petroleum demand hit 20.3 million barrels per day (MBD) in February. Demand was up by more than a million barrels per day from February of last year, nearing record highs not seen for more than a decade.

|

2018, March, 11, 11:20:00

U.S. UNEMPLOYMENT RATE 4.1%U.S. BLS - Total nonfarm payroll employment increased by 313,000 in February, and the unemployment rate was unchanged at 4.1 percent, the U.S. Bureau of Labor Statistics reported today. Employment rose in construction, retail trade, professional and business services, manufacturing, financial activities, and mining.

|

2018, March, 9, 13:05:00

U.S. DEFICIT UP TO $56.6 BLNBEA - The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $56.6 billion in January, up $2.7 billion from $53.9 billion in December, revised.

|

2018, March, 4, 10:35:00

U.S. GDP UP 2.5%BEA - Real gross domestic product (GDP) increased at an annual rate of 2.5 percent in the fourth quarter of 2017, according to the "second" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 3.2 percent. |