85% GLOBAL OIL DEAL

BLOOMBERG - The global deal to rein in oil output has removed "85 percent of the problem" of oversupply, and OPEC and allied producers are seeking ways to cooperate after the agreement ends, according to United Arab Emirates Energy Minister Suhail Al Mazrouei.

The world economy is benefiting from the cuts, he said at a Bloomberg Businessweek Middle East conference in Dubai. Mazrouei, who also serves this year as president of the Organization of Petroleum Exporting Countries, isn't concerned that a potential international trade war might upset the crude market, he said.

"I'm not that concerned about a trade war getting to the oil market," Al Mazrouei said in the interview. "It may affect the cost of drilling, the cost of completion, but I think overall the effect is going to be minor to the oil prices."

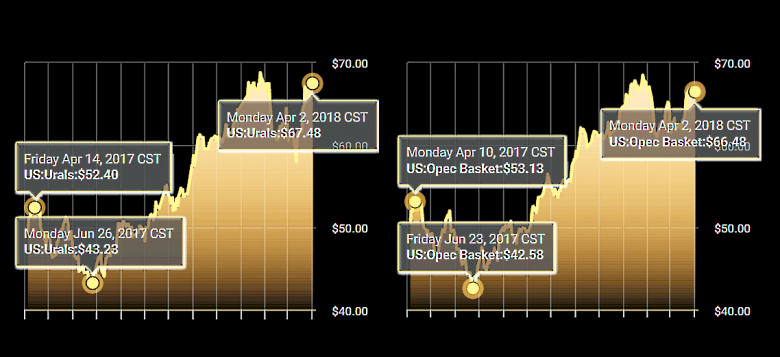

Participants in the oil-cuts accord plan to meet later this month in Jeddah, Saudi Arabia, to assess their progress toward clearing a glut and re-balancing the market. Saudi Arabia, Russia, the U.A.E. and other producers agreed in November to extend the deal through this year. Brent crude has gained 1.5 percent in 2018 and was 25 cents higher at $67.89 a barrel at 11:55 a.m. in London.

'Great Partner'

The benchmark fell 2.5 percent on Monday after China imposed retaliatory tariffs on U.S. goods, the latest move in an escalating trade dispute between the world's largest economies.

Russia has been a "great partner" in the cuts agreement, and the majority of participants in the deal are supportive of a longer-term cooperation between OPEC and non-OPEC producers, Mazrouei said.

Producers should first achieve their goal of reducing crude inventories in developed economies to the five-year average before they consider adopting a different measurement for when the oil market is re-balanced, he said. OPEC and its allies have held talks about changing the way they gauge the impact of their production cuts, including possibly using use a seven-year inventory average, according to delegates from the group.

"I would prefer to focus on achieving the mission first," Al Mazrouei told.

-----

Earlier:

2018, April, 2, 09:25:00

LONG-TERM OPEC COOPERATIONSHANA - Leaders of the UAE, OPEC’s biggest producer Saudi Arabia and non-OPEC member Russia support extending energy cooperation beyond 2018. Cooperation on the part of a politically influential oil producer like Russia would add to the weight and influence of OPEC in global energy markets, both politically and in terms of decision-making.

|

2018, March, 30, 11:25:00

OPEC - RUSSIA ALLIANCEREUTERS - “We are working to shift from a year-to-year agreement to a 10 to 20 year agreement,” the crown prince told Reuters in an interview in New York late on Monday. “We have agreement on the big picture, but not yet on the detail.”

|

2018, March, 26, 08:00:00

NEW OPEC RECORD: 138%OPEC - Participating OPEC and non-OPEC producing countries have set a new record in February with their voluntary production adjustments, achieving a level of 138%, according to the OPEC-non-OPEC Joint Ministerial Monitoring Committee (JMMC).

|

2018, March, 5, 11:30:00

RESPONSIBILITY TO THE MARKETREUTERS - “We all should look with responsibility to the market in order to keep the balance in the market as much as we can so as not to harm investors,” said Ali Nazar, Iraq’s national representative to OPEC.

|

2018, February, 27, 14:00:00

OPEC - RUSSIA COOPERATIONPLATTS - "I think we are seeing more cooperation, and my hope is that this group of OPEC and non-OPEC will incentivize the adequate investments among themselves to ensure we have adequate supply in the market," he said. "My worry is not an oversupply. My worry is an undersupply. Everyone is expecting that we will have more demand coming in the future."

|

2018, February, 14, 10:10:00

RUSSIA - OPEC RELATIONSHIPPLATTS - "We understand that global demand for oil will continue to grow rapidly and this demand will need to be met, so we will likely need to work together, including on upstream technology and joint projects to meet this growing demand," Novak said.

|

2018, January, 22, 08:40:00

OPEC'S CONSTRUCTIVE ROLEOPEC - HH Sheikh Sabah praised all 24 participating countries, both OPEC and non-OPEC, for their joint efforts towards restoring much needed oil market stability, as well as keeping faith in the collaborative approach which is at the heart of the ‘Declaration of Cooperation’. |