OIL DEMAND UP TO 1.5 MBD

IEA - Political uncertainty in the Middle East has returned to the fore in recent days. As we write, uncertainty about the next steps in Syria and Yemen have helped propel the price of Brent crude oil back above $70/bbl. It remains to be seen if recently elevated prices are sustained and if so what are the implications for the market demand and supply dynamics.

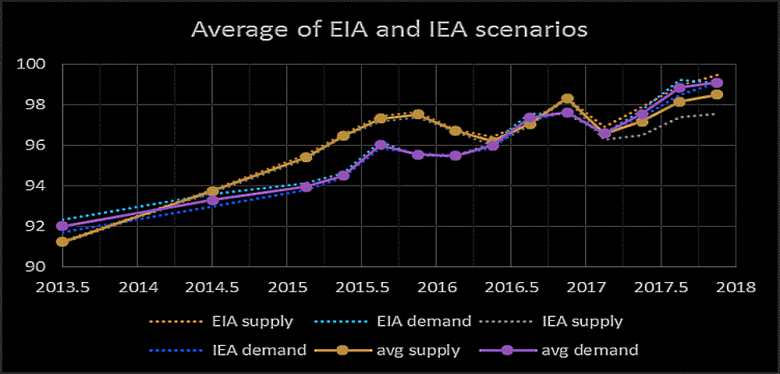

In the meantime, our overall view of global demand and supply growth in 2018 is unchanged from last month. For demand, early in 2018 stronger growth in the US was partially offset by weaker growth in China. India has seen a strong start to the year. Globally, we expect oil demand to grow by 1.5 mb/d in 2018. However, there is an element of risk to this outlook from the current tension on trade tariffs between China and the US.

For supply, our outlook for non-OPEC growth remains unchanged at 1.8 mb/d. Data for US production show that in January output fell by a modest 24 kb/d, much in line with our forecast with adverse weather playing a part. We retain our view that US crude production in 2018 will increase by 1.3 mb/d versus last year. However, there is concern about bottlenecks in takeaway capacity that have seen recent discounts for WTI Midland versus Houston widen to a record at nearly $9/bbl. This issue applies in Canada as well as in the US.

As far as the OPEC/non-OPEC output cuts are concerned, some countries party to the 2016 Vienna agreement, have, for different reasons, seen production fall by more than they promised. These extra cutbacks total over 800 kb/d. To all intents and purposes, more than a second Saudi Arabia has been added to the output agreement. The overall state of the cuts in March shows OPEC's compliance rate at 163% with its non-OPEC partners achieving a rate of 90%. With just under half of global oil supply subject to restraint and oil demand growing steadily, the impact on stocks has been substantial. The text of the Vienna agreement notes that OECD and non-OECD stocks were above the five-year average and states that they should fall to "normal" levels. Normal is assumed to mean, although it does not explicitly say so, the five-year average. There is less clarity with regard to non-OECD stocks, so five-year average OECD stocks have become the de facto target to measure success of the output cuts.

Since May last year they have fallen constantly the average and new data for February show a larger than usual fall in volume terms with stocks now only 30 mb above the five-year level, and product stocks actually below it. Our balances show that if OPEC production were constant this year, and if our outlooks for non-OPEC production and oil demand remain unchanged, in 2Q18-4Q18 global stocks could draw by about 0.6 mb/d. With markets expected to tighten, it is possible that when we publish OECD stocks data in the next month or two they will have reached or even fallen below the five-year average target. It is not for us to declare on behalf of the Vienna agreement countries that it is "mission accomplished", but if our outlook is accurate, it certainly looks very much like it.

-----

Earlier:

2018, April, 13, 18:10:00

OIL PRICE: ABOVE $72REUTERS - Recovering from earlier losses, Brent crude LCOc1 was up 28 cents at $72.30 a barrel by 1301 GMT and set for a weekly gain of almost 8 percent, or about $5.U.S. crude for May delivery CLc1 rose 28 cents to $67.35, up more than 8 percent, or about $5, for the week.

|

2018, April, 13, 18:05:00

OPEC - RUSSIA COOPERATION TO 2019REUTERS - “There is growing confidence that the declaration of cooperation will be extended beyond 2018,” Barkindo told. “Russia will continue to play a leading role.”

|

2018, April, 9, 11:25:00

OPEC OIL PRODUCTION DOWN TO 32.14 MBDPLATTS - OPEC oil output in March fell to 32.14 million b/d, its lowest level in 11 months, led by declines in seven out of the 14 member countries,

|

2018, April, 4, 09:30:00

85% GLOBAL OIL DEALBLOOMBERG - The global deal to rein in oil output has removed “85 percent of the problem” of oversupply, and OPEC and allied producers are seeking ways to cooperate after the agreement ends, according to United Arab Emirates Energy Minister Suhail Al Mazrouei.

|

2018, March, 26, 08:00:00

NEW OPEC RECORD: 138%OPEC - Participating OPEC and non-OPEC producing countries have set a new record in February with their voluntary production adjustments, achieving a level of 138%, according to the OPEC-non-OPEC Joint Ministerial Monitoring Committee (JMMC).

|

2018, March, 16, 10:30:00

OIL DEMAND GROWTH - 2018: 1.5 MBDIEA - Looking at demand, our estimate for global growth in 2018 has increased by 90 kb/d taking it up to 1.5 mb/d. Although this is a modest revision, it is interesting that provisional data suggests very strong starts to the year in China and India, which, taken together, accounted for nearly 50% of global demand growth in 2017. Cold weather in some parts of the northern hemisphere in January-February saw an increase in heating demand.

|

2018, January, 26, 12:35:00

СПРОС НА НЕФТЬ: 100 МЛН.МИНЭНЕРГО РОССИИ - «На сегодня 100 млн баррелей в сутки - общемировой спрос на нефть, а сланцевая нефть- это всего 5,7 млн барр в сутки. Это лишь один из способов удовлетворения спроса рынка». |