OIL PRICE 2018-19: $63

EIA - SHORT-TERM ENERGY OUTLOOK

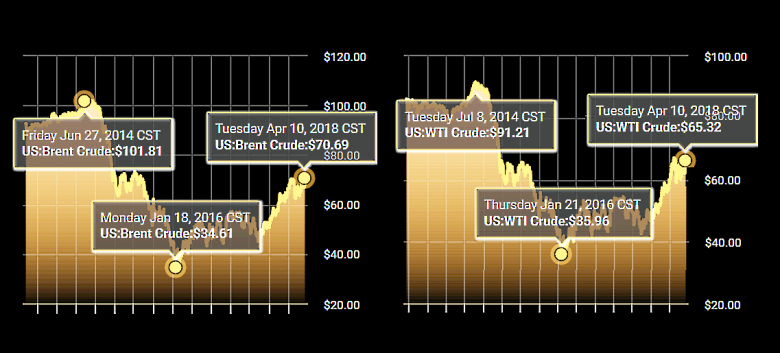

Brent crude oil spot prices averaged $66 per barrel (b) in March. EIA forecasts Brent spot prices will average about $63/b in both 2018 and 2019. EIA expects West Texas Intermediate (WTI) crude oil prices to average $4/b lower than Brent prices in both 2018 and 2019. NYMEX WTI futures and options contract values for July 2018 delivery that traded during the five-day period ending April 5, 2018, suggest a range of $52/b to $78/b encompasses the market expectation for July 2018 WTI prices at the 95% confidence level.

EIA expects Henry Hub natural gas spot prices to average $2.99/million British Thermal units (MMBtu) in 2018 and $3.07/MMBtu in 2019. The average NYMEX futures and options contract values for July 2018 delivery that traded during the five-day period ending April 5, 2018, suggest that a range of $2.30/MMBtu to $3.43/MMBtu encompasses the market expectation for July Henry Hub natural gas prices at the 95% confidence level.

EIA estimates that U.S. crude oil production averaged 10.4 million barrels per day (b/d) in March, up 260,000 b/d from the February level. Total U.S. crude oil production averaged 9.3 million b/d in 2017. EIA projects that U.S. crude oil production will average 10.7 million b/d in 2018, which would mark the highest annual average U.S. crude oil production level, surpassing the previous record of 9.6 million b/d set in 1970. EIA forecasts that 2019 crude oil production will again increase, averaging 11.4 million b/d.

U.S. dry natural gas production averaged 73.6 billion cubic feet per day (Bcf/d) in 2017. EIA forecasts dry natural gas production will average 81.1 Bcf/d in 2018, establishing a new record. EIA expects natural gas production will rise by 1.7 Bcf/d in 2019.

Growing U.S. natural gas production is expected to support both growing domestic consumption and increasing natural gas exports in the forecast. EIA forecasts U.S. consumption of natural gas to increase by 4.2 Bcf/d (5.7%) in 2018 and by 0.7 Bcf/d (0.9%) in 2019, with electric power generation the leading contributor to this increase. EIA also expects net natural gas exports to increase from 0.4 Bcf/d in 2017 to an annual average of 2.2 Bcf/d in 2018 and 4.4 Bcf/d in 2019.

-----

Earlier:

2018, April, 9, 11:45:00

OIL PRICE: NOT ABOVE $68 AGAINREUTERS - U.S. WTI crude futures CLc1 were at $62.31 a barrel at 0643 GMT, up 25 cents, or 0.4 percent, from their previous settlement. Brent crude futures LCOc1 were at $67.42 per barrel, up 31 cents, or 0.5 percent. |

2018, April, 9, 11:35:00

OPEC - RUSSIA UNLIMITEDPLATTS - Russia is willing to work with the OPEC coalition indefinitely to regulate global oil supplies and has advocated the creation of a new global body to monitor crude markets, the country's energy minister said. |

2018, April, 9, 11:25:00

OPEC OIL PRODUCTION DOWN TO 32.14 MBDPLATTS - OPEC oil output in March fell to 32.14 million b/d, its lowest level in 11 months, led by declines in seven out of the 14 member countries, |

2018, April, 6, 18:35:00

OIL PRICE: NOT ABOVE $69REUTERS - Brent crude LCOc1 for June delivery briefly traded flat at 1322 GMT at $68.33 per barrel after falling as much as 66 cents earlier. U.S. West Texas Intermediate crude for May delivery CLc1 erased some of its previous losses, but was still down 15 cents at $63.39 a barrel. |

2018, April, 4, 09:45:00

OIL PRICE: NOT ABOVE $68REUTERS - Oil prices slipped with Brent crude futures off 13 cents to $67.99 a barrel, while U.S. crude fell 11 cents to $63.40 a barrel.

|

2018, April, 4, 09:30:00

85% GLOBAL OIL DEALBLOOMBERG - The global deal to rein in oil output has removed “85 percent of the problem” of oversupply, and OPEC and allied producers are seeking ways to cooperate after the agreement ends, according to United Arab Emirates Energy Minister Suhail Al Mazrouei.

|

2018, April, 4, 09:25:00

RUSSIA EXECUTES THE AGREEMENTPLATTS - Russia is planning to fully comply with its commitment to cut oil output under the OPEC/non-OPEC deal this month, Russian energy minister Alexander Novak said Tuesday, the Prime news agency reported. |