OIL PRICE: NOT ABOVE $74

REUTERS - Oil prices held firm on Friday near three-year highs reached earlier this week as ongoing OPEC-led supply cuts as well as strong demand gradually draw down excess supplies.

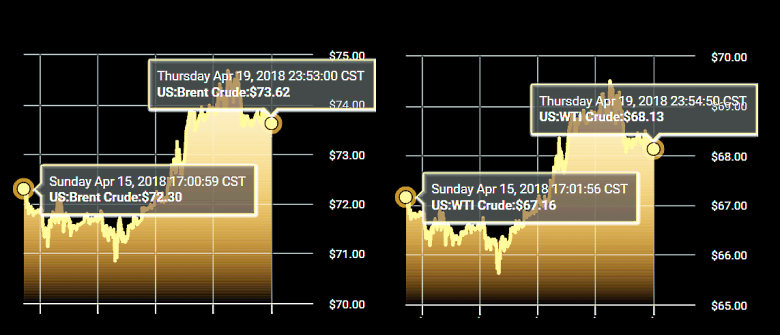

Brent crude oil futures LCOc1 were at $73.79 per barrel at 0440 GMT, up 1 cent from their last close.

U.S. West Texas Intermediate (WTI) crude futures CLc1 down 2 cents at $68.40 a barrel.

Both Brent and WTI hit their highest levels since November 2014 on Thursday, at $74.75 and $69.56 per barrel respectively. WTI is set for its second weekly gain, gaining 1.3 percent this week, while Brent is also poised to rise for a second week, adding 1.6 percent this week.

Oil prices have been pushed up by a gradually tightening market.

Led by top exporter Saudi Arabia, the Organization of the Petroleum Exporting Countries (OPEC), has been withholding production since 2017 to draw down a global supply overhang that had depressed crude prices between 2014 and 2016.

"Commercial inventories in the OECD are now essentially at their 5-year average, and drawdowns likely accelerate as refineries emerge from maintenance ahead of peak seasonal demand," U.S. investment bank Jefferies said on Friday.

"OECD commercial inventories could fall back to... a level not seen since the oil price collapse that began in 3Q14. On a days of forward demand basis, we believe cover could drop below 57 days later this year, a level last seen in 2011," it added.

The tighter oil market is feeding into refined products.

"Signs of tightness are emerging in product markets as stocks saw the largest week-on-week draw since October, 2016 ... The U.S. led the draws but was also aided by draws in Singapore," said U.S. bank Morgan Stanley.

This tightness is also a result of healthy oil demand.

"Global oil demand data so far in 2018 has come in line with our optimistic expectations, with 1Q18 likely to post the strongest year-on-year growth since 4Q10 at 2.55 million barrels per day," U.S. bank Goldman Sachs said in a note published late on Thursday.

Beyond OPEC's supply management, crude prices have also been supported by an expectation that the United States will re-introduce sanctions on OPEC-member Iran.

"The first key geopolitical issue is the expiration of the current U.S. waiver of key sanctions against Iran," said Standard Chartered Bank in a note this week, referring to a deadline on May 12 when U.S. President Donald Trump will decide whether or not to re-impose sanctions.

One factor that could start weighing on prices is rising U.S. production C-OUT-T-EIA, which has jumped by a quarter since the middle of 2016 to 10.54 million barrels per day (bpd), making the United States the world's second-biggest producer of crude oil behind only Russia, which pumps almost 11 million bpd.

-----

Earlier:

2018, April, 18, 13:14:00

OIL PRICE: ABOVE $72 AGAINREUTERS - Brent crude oil futures LCOc1 were at $72.07 per barrel at 0659 GMT, up 49 cents, or 0.7 percent, from their last close. U.S. West Texas Intermediate (WTI) crude futures CLc1 were up 49 cents, or 0.7 percent, at $67.01 a barrel. |

2018, April, 18, 13:12:00

RUSSIA - OPEC DIMENSIONPLATTS - Russia is committed to its OPEC pact with Saudi Arabia and will continue supplying Europe energy despite tensions with the West after US-led strikes on Bashar al-Assad's Syrian regime, said Vladimir Putin's spokesman. |

2018, April, 13, 18:10:00

OIL PRICE: ABOVE $72REUTERS - Recovering from earlier losses, Brent crude LCOc1 was up 28 cents at $72.30 a barrel by 1301 GMT and set for a weekly gain of almost 8 percent, or about $5.U.S. crude for May delivery CLc1 rose 28 cents to $67.35, up more than 8 percent, or about $5, for the week.

|

2018, April, 11, 13:40:00

OIL PRICE: ABOVE $71REUTERS - Brent crude has gained 5.7 percent this week, rising to $71.34 a barrel on Tuesday, the highest since late 2014, although the price has since fallen back and was $70.98 a barrel by 0907 GMT LCOc1, down 6 cents.U.S. crude futures CLc1 were at $65.55 a barrel, up 4 cents on the day. |

2018, April, 11, 13:35:00

RUSSIA - OPEC UNLIMITEDPLATTS - Maintaining a long-term oil management alliance with Russia and other allies will allow OPEC producers to react more quickly to changing fundamentals and stabilize the market,

|

2018, April, 11, 13:30:00

INDIA WANTS $50BLOOMBERG - “We are a very price-sensitive consumer,’’ Pradhan said on Tuesday. “From Indian consumers’ point of view, I will be more than happy if the price is around $50 a barrel.’

|

2018, April, 11, 13:25:00

OIL PRICE 2018-19: $63EIA - Brent crude oil spot prices averaged $66 per barrel (b) in March. EIA forecasts Brent spot prices will average about $63/b in both 2018 and 2019. EIA expects West Texas Intermediate (WTI) crude oil prices to average $4/b lower than Brent prices in both 2018 and 2019. NYMEX WTI futures and options contract values for July 2018 delivery that traded during the five-day period ending April 5, 2018, suggest a range of $52/b to $78/b encompasses the market expectation for July 2018 WTI prices at the 95% confidence level.

|