CHINA BUYS RECORD

PLATTS- China's state-run oil trader Unipec has purchased around 16 million barrels of US crude oil for loading in June, marking the biggest volume ever to be lifted in a month by the company, informed sources said Thursday.

Unipec is expected to receive the June-loading US crude cargoes in July/August and the trading arm of Asia's biggest refiner Sinopec said it would raise its shipments from the US to China by around 80% to 200,000 b/d in 2018 from around 112,000 b/d last year.

The latest deal came on the heels of recent positive moves in US-China trade negotiations. China and the US agreed last weekend to put the brakes on their trade dispute after Beijing agreed to buy more US goods, key among them being LNG and oil.

"It is just business, and it was mainly to do with wide Brent/WTI spread," said a company source, adding that Unipec intends to continue purchasing in such large scale volumes going forward.

The state-run trading company's General Manager Chen Bo said previously the company would use VLCCs to take more crude oil priced against WTI this year as they are more competitive than other grades linked to Brent or Dubai.

Unipec took its first ever VLCC directly loaded from the US in February and expected to follow this path, which enable economies of scale for exports to Asia.

Crude has been exported on VLCCs from the US Gulf Coast via reverse lightering operations, with smaller vessels carrying the cargo to load the carriers offshore until early this year when the Louisiana Offshore Oil Port reconfigured its export facilities to load larger ships, like VLCCs.

Loading a VLCC via lightering typically requires three to four Aframaxes to perform offshore ship-to-ship transfers. Direct loading of a VLCC would cut out the lightering operations.

ARBITRAGE WINDOW

The recent widening of spreads between the benchmarks Brent and Dubai against NYMEX WTI light sweet crude contract have been encouraging more exports out of the US.

"We are also considering the opportunity of importing US crudes, given the wide spread," said a refinery source with PetroChina, the second biggest refiner in China.

The front-month July ICE Brent/NYMEX WTI spread settled at $7.96/b on Wednesday the highest since March 23, 2015, where it stood at $8.47/b, according to data from S&P Global Platts.

Meanwhile, the spread between the front-month Dubai crude swap against same-month WTI swap tumbled to a discount of $4.78/b Wednesday, the lowest since August 17, 2015 when the discount was $4.83/b.

The spread, has averaged minus $2.49/b so far in the second quarter, down from minus $1.12/b in Q1, according to Platts data.

A weaker WTI versus Dubai spread typically makes North American crude grades priced against WTI more competitive than Persian Gulf oil.

"Clearly the high discount on the WTI price as compared with Brent is making US crude oil attractive to international buyers," said Commerzbank analysts in a note.

SAUDI SUPPLY GAP

Chinese end-users may find US crude a suitable and economical substitute to fill the Saudi Arabian supply gap after Unipec said recently the company would reduce its term purchase volume from the major OPEC producer.

State-run oil giant Sinopec indicated earlier this month the company plans to cut back its nominations for Saudi crude by 40% of the total monthly allocations for May-June and even July loading in response to the higher-than-expected Saudi Aramco OSPs.

The company was believed to take around 55% of China's crude oil imports from Saudi Arabia, which was around 606,000 b/d in Q1, according to data from the General Administration of Customs.

Company sources also said previously Sinopec would get enough supplies from other producers, such as Iran, Iraq, Russia and the US.

Meanwhile, more and more Sinopec's refineries started to process US crude, most of which are medium sour grades such as Mars and Southern Green Canyon, although light sweet crudes WTI, Bryan Mound Sour and even shale oil from Eagle Ford have joined the flow.

"Mars is similar to Arab Medium from Saudi Arabia, which could be a good alternate in a certain extent," said the source with Sinopec Guangzhou refinery.

It is a medium density, high sulfur crude oil from the US, which API is around 29.5, and sulfur content around 1.89%.

China imported 3.9 million mt (317,633 b/d) of US crude in Q1 2018, this compares with only 443,000 mt in Q1 2017. US crude market share in China's total imports rose to 3.5% in the quarter from 0.4% in the same period the previous year.

-----

Earlier:

2018, May, 23, 10:35:00

U.S. - CHINA ENERGY TRADEPLATTS - China became the largest contributor to global LNG consumption growth in 2017. It surpassed South Korea as the world's second largest LNG importer and its share of global LNG demand is expected to converge with that of Japan by 2030. |

2018, May, 18, 08:30:00

SOUTH CHINA SEA DRILLINGREUTERS - “We urge relevant parties to earnestly respect China’s sovereign and jurisdictional rights and not do anything that could impact bilateral relations or this region’s peace and stability,” the spokesman, Lu Kang, told a regular news briefing on Thursday. |

2018, May, 8, 10:55:00

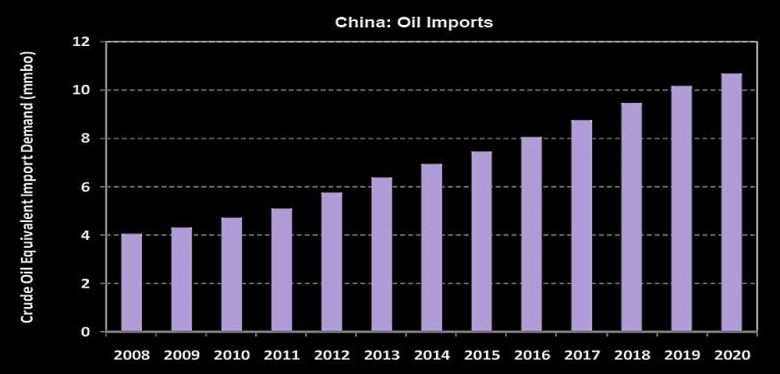

CHINA'S OIL IMPORTS UP TO 9.64 MBDBLOOMBERG - The world’s biggest oil buyer imported 9.64 million barrels a day in April, according to data released by Beijing-based General Administration of Customs on Tuesday. That’s about 4 percent higher than March and beat a previous record of 9.61 million barrels per day reached in January. For the month of April, total purchases were 39.46 million metric tons. |

2018, May, 4, 15:25:00

CHINA'S OIL DEMAND UP 6.8%PLATTS - China ended the first quarter of 2018 with robust apparent oil demand growth of 6.8% year on year, as stronger-than-expected GDP growth boosted consumption from the industrial and construction sectors and outweighed concerns over rising oil prices |

2018, April, 27, 10:50:00

NEW CHINA'S OILEIA - As Asia-Pacific oil demand continues to grow, some market participants believe the region needs an oil price benchmark based on local supply and demand conditions. Last month marked the beginning of trading for the new Shanghai crude oil futures contract in China. For the Shanghai contract to become an accepted regional benchmark, it will have to attract a wide variety of market participants, and its usage for price discovery must be established. |

2018, April, 25, 10:10:00

RUSSIA - CHINA OIL MAXIMUMREUTERS - Russia was China’s largest crude oil supplier in March, data showed on Tuesday, retaining the lead spot for a 13th consecutive month. |

2018, April, 16, 09:45:00

OIL DEMAND UP TO 1.5 MBDIEA - Globally, we expect oil demand to grow by 1.5 mb/d in 2018. However, there is an element of risk to this outlook from the current tension on trade tariffs between China and the US, |