GLOBAL ECONOMY GROWTH 3.9%

IMF - Address to St. Petersburg International Economic Forum By Christine Lagarde, IMF Managing Director

Good afternoon. It is a great joy to come back to St. Petersburg, which is one of my favorite places. It is hard to top the beauty of the surroundings, the elegance of the architecture, the magnificence of the art, and the warmth of the people.

I believe that St. Petersburg has a great legacy and a great message to the world. This city was built by a visionary, Peter the Great, who understood that Russia could only achieve lasting prosperity by opening itself to the world, and seeking cooperation for mutual benefit—especially through the dynamic of trade. This vision represents Russia at its best, and it is baked into the very bricks and mortar of St. Petersburg.

Of course, today's challenges are very different. But the core lesson endures—challenges are best solved in an ethos of cooperation, by deepening ties among the family of nations, and by heightening collaboration in the service of the global common good.

Against this backdrop, let me discuss three topics: (i) a quick update on where things stand with the global and Russian economies; (ii) the longer-term challenges facing policymakers; and (iii) what a renewed multilateralism to deal with these problems might look like.

The Global and Russian Outlook

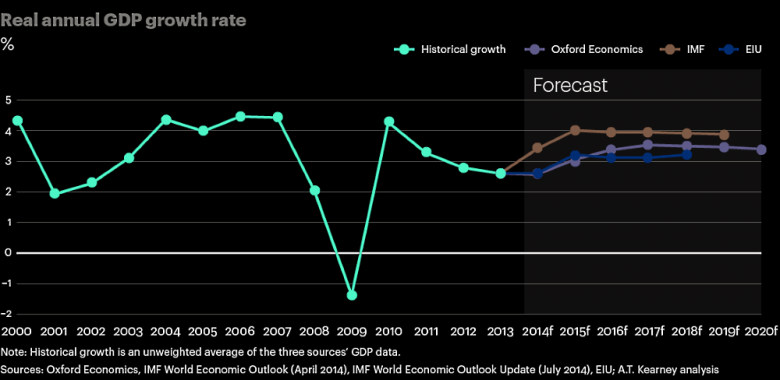

Let me start with the global economy. I have some good news for you here. The global economy is in position of strength. Last year, global growth was 3.8 percent, the fastest since 2011. And countries rose together—120 countries saw stronger growth, accounting for three‑quarters of global GDP.

We expect growth to stay strong this year and next—at 3.9 percent. This is being driven by stronger investment and a rebound in trade. Once again, the momentum is broad-based, encompassing the United States, Europe, Japan, China, Russia, and many other emerging market and developing countries.

This is the good news. The not-so-good news is that there is a risk of storms in the forecast. Global debt is at a record high—public and private debt together has reached $164 trillion, or 225 percent of global GDP. Financial stability is also looking fragile, due to high debt and rising financial market volatility—especially from the increasing risk of capital flow reversals in emerging markets. And there are darkening clouds from the risk of a retreat from global trade and multilateral cooperation.

What about Russia? As we noted just two days ago at the end of our consultation with the Russian authorities, there is some good news here too.

Russia has put in place an admirable macroeconomic framework—saving for a rainy day, letting the exchange rate float, introducing inflation targeting, and shoring up the banking system. As a result, it was able to weather tough times well, and today it has virtually no fiscal deficit, a solid current account balance, and very little debt. And now it needs to continue with its modernization program to boost productivity and dynamism—including by diversifying out of oil, boosting investment in health and education, reducing market concentration, and integrating more into the global economy.

Longer-Term Challenges

Let me now shift gears and move to the longer-term challenges faced by the global economy. We live in times of heightened anxiety, marked by an erosion of trust in institutions and a fading commitment to the ethos of multilateralism.

There are numerous fault lines behind this disruption. One is the long arm of the global financial crisis—in many ways, this event defines the life experience of so many young people today, in a way that I do not think has been fully appreciated by the older generation.

A second fault line, bubbling up for a while now, is the perception, and the reality, that the rewards of globalization are not being shared fairly. Yes, globalization has allowed hundreds of millions to lift themselves out of poverty, and has created a thriving middle class in many emerging markets. But it has also created immense wealth for a privileged few, while leaving far too many behind.

The third fault line is technology. What will the rise of automation and artificial intelligence mean for work? And work, remember, is not just about a paycheck—it is one of the main ways people find meaning and purpose and contribute to society. The displacement here could prove severe—analysis by McKinsey suggests that up to 375 million workers will be cast adrift by 2030. IMF research also suggests that while automation will boost productivity, it could come at the cost of higher inequality and a lower labor share of income. All of this could seriously undermine social cohesion.

Added to this, the new digital economy is leading to a surge in market power and corporate concentration. A handful of technology companies control much of the global movement of data and information. This could add further fuel to popular disaffection, especially if these companies are seen to undermine the values of global citizenship.

The fourth fault line is climate change—and unless we take action, this fault line is likely to grow wider, deeper, and more dangerous with each passing year. The scale of the challenge is daunting—the Paris Agreement calls on countries to reach zero greenhouse gas emissions by the second half of the century. But at the moment, action is lagging commitment.

A Renewed Multilateralism

None of the problems I have described can be solved by one country alone. They all require a renewed commitment to international cooperation, to multilateralism—and this is my third point.

This is not a new insight, of course. In the first half of the 20 th century, the rejection of cooperation and the turn toward insularity led to catastrophic consequences—economic ruin and devastating war.

You know this well in St. Petersburg. You have seen the utter destruction of this city by war—or at least your parents or grandparents have.

The world learned the right lesson from that time and renewed its commitment to multilateralism. The second half of the century was a dramatic improvement on the first. It was not a perfect time, for sure. But many countries saw decades of strong and broadly-shared growth, and convergence accelerated—indeed, more progress for more people than at any time in human history.

If we are to grapple with more modern challenges, we need a renewed commitment to this tried-and-tested ethos of multilateralism. Think about the regulatory framework needed to manage the digital economy and financial stability in the era of fintech. Think about the policy responses to the future of work. Think about how to make globalization work for more people, including by improving international taxation. Think about the efforts needed to fight climate change.

All countries have a role to play, but I would argue that the larger nations—including those represented here today—have a special responsibility to be good global citizens.

In all of this, it would be a grave mistake to resort to protectionism. This would be a self‑inflicted wound. Let us not forget—trade leads to higher productivity, lower prices, and improved living standards. Nobody wins a trade war—and protectionism hurts the poor especially hard, as they benefit significantly from lower cost imports. In fact, trade is estimated to have reduced the price of a poor family's consumption basket in advanced economies by two-thirds.

This is a live issue for Russia too. Russia has preferential trade agreements with countries that account for less than 4 percent of global GDP. Compare this to Korea, Mexico, Thailand, and the Philippines, which have agreements with countries representing more than 20 percent of global GDP. St. Petersburg is Russia's gate to the world—let's open it further!

Let me conclude by noting that the time to move forward on this new agenda is now. As the famous Russian author, Ivan Turgenev, put it "...if we wait for the moment when everything, absolutely everything is ready, we shall never begin."

Or as I have been saying, the time to fix the roof is when the sun is shining. And this time of the year in St. Petersburg, the sun never really sets, does it?

Thank you very much—bol'shoye spasibo!

-----

Earlier:

2018, May, 28, 11:10:00

TOTAL DECARBONIZATION OF THE GLOBAL ECONOMYGAZPROM - It seems that putting renewables ahead of everything else doesn’t accomplish anything in today’s world. And striving for a total decarbonization of the global economy is downright quixotic. One should understand that fossil fuels will continue to play an essential role in the next 20 years. |

2018, May, 23, 10:25:00

RUSSIA'S ECONOMY RECOVERYREUTERS - Retail sales, the key gauge for consumer demand, the primary driver of economic growth, were up 2.4 percent year-on-year in April after a 2.0 percent rise in the year to March. Capital investment, the next most important driver, was up 3.6 percent year-on-year in the first quarter after increasing 1.4 percent in the same period a year earlier. |

2018, May, 23, 10:15:00

NO OIL FUTURE 2040BLOOMBERG - Natural gas will probably emerge as the main fossil fuel “winner” as it balances renewables in power generation and is used as a substitute for oil in petrochemicals. Long-term gas demand is set to increase by 15 percent, or by 750 billion cubic meters, compared to business as usual, |

2018, May, 23, 10:10:00

CLEAN NUCLEAR FUTUREWNN - The United States, Canada, and Japan are launching the Nuclear Innovation: Clean Energy (NICE) Future Initiative. This global effort will make sure nuclear has a seat at the table during discussions about innovation and advanced clean energy systems of the future. |

2018, May, 14, 11:20:00

SOUTHEAST ASIA: THE MAIN ENGINEIMF - the region remains the main engine of global growth, accounting for more than 60 per cent of the global growth. Regional output is projected to grow by 5.6 per cent in 2018 and 2019; 5.6 per cent is about 0.1 percentage point higher than we expected in last October, supported by trade as well as accommodative global financial conditions.

|

2018, April, 16, 09:30:00

SOUTHEAST ASIA: ENHANCING POTENTIALWBG - Growth in developing East Asia and Pacific (EAP) is expected to remain strong and reach 6.3 percent in 2018, according to the latest World Bank economic report on the region. Prospects for a continued broad-based global recovery and robust domestic demand underpin this positive outlook. Still, emerging risks to stability and sustained growth require close attention.

|

2018, March, 28, 11:15:00

GLOBAL ENERGY DEMAND + 2.1%IEA - Global energy demand rose by 2.1% in 2017, more than twice the previous year’s rate, boosted by strong global economic growth, with oil, gas and coal meeting most of the increase in demand for energy, and renewables seeing impressive gains. |