HARD OIL MARKET

FT - Investors in the world's largest oil and gas companies are eyeing a windfall from rising crude prices as the sector heads towards its strongest financial performance in a decade, while keeping a tight rein on spending.

Companies including Total and BP have already launched share buyback programmes, and Royal Dutch Shell is preparing to follow suit in a sign of the industry pushing to improve investor returns as it bounces back from a long downturn.

"The oil market is tightening and we now see it as appropriate to factor in at least some of the windfall profitability that higher prices are generating," said Lydia Rainforth, analyst at Barclays, in a report that said Europe's integrated oil and gas groups were on course to deliver excess free cash flow for the first time since 2008.

US groups, such as ExxonMobil and Chevron, are also benefiting from this year's faster-than-expected upturn in oil prices because of rising global demand, supply disruptions in Venezuela and political tensions in the Middle East.

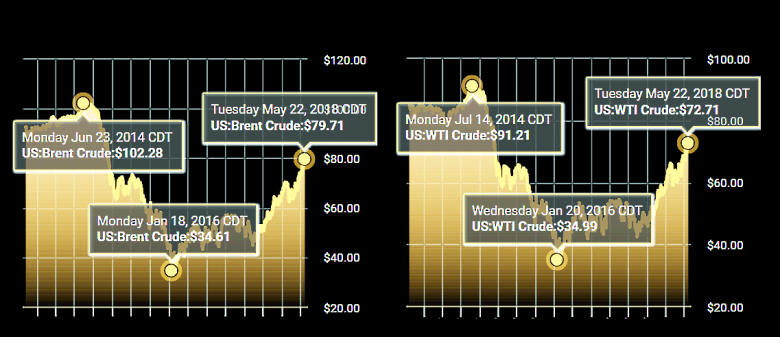

Brent crude, the international benchmark, hit $80 per barrel last week for the first time since 2014.

Many oil producers are generating more free cash at current prices than they did at $100 per barrel before the market crashed four years ago.

This is because of deep cost cuts during the downturn, with average operating expenses per barrel down a third and development costs halved by the same measure since 2014.

Most oil majors can now cover dividends and capital expenditure at prices around $50 per barrel, meaning that, at $80, they make a healthy surplus.

Having spent the downturn battling to balance the books, oil executives are adjusting to a new environment in which they face choices over how to use spare cash.

The message from most has been consistent: there will be no return to the runaway spending of the $100 oil era. Instead, companies are focusing on debt reduction and shareholder returns.

Debts rose sharply during the downturn as companies borrowed to avoid cutting dividends and leverage remains high. Shell, for example, has trimmed net debt by $10bn in the past year but still owes $66bn, a debt-to-capital ratio of 25 per cent.

Jessica Uhl, Shell chief financial officer, indicated last month that she wanted gearing closer to 20 per cent before launching a promised $25bn share buy-back programme.

The recent surge in oil prices has increased investor expectations that this will happen in the second half of this year.

BP said this month that it, too, was prioritising debt reduction after announcing a 71 per cent increase in first-quarter earnings.

But Brian Gilvary, chief financial officer, said the group would start looking at options for further share buybacks or a dividend increase as the balance sheet improved in the second half.

Mr Gilvary said that BP remained intent on reducing its break-even point further to below $40 per barrel by 2021. Equinor, the Norwegian group previously known as Statoil, gave a similar commitment.

"Costs are coming down and efficiency is going up in all parts of our business and we have been able to sustain that," Eldar Saetre, chief executive, told the Financial Times.

Increased spending by national oil companies in Asia and the Middle East is forecast to lift industry-wide capital expenditure by 11.5 per cent this year, according to BMI Research.

Yet the listed international oil groups (IOCs) such as Shell and BP are on course to buck this trend with a combined 1.1 per cent decrease.

This reflects an increasingly selective approach to new projects, with only the most profitable going ahead and only then after costs have been squeezed.

Shell, for example, halved the budget for its Kaikias development in the Gulf of Mexico before giving it a green light last year, by simplifying designs and haggling with suppliers.

"The industry has gone through a significant mindset shift," said Andrew Smart, managing director of Accenture's energy practice.

"During the $100 oil era, nothing was too hard or expensive; every target was worth attacking. Companies are now exposing investments to a lot more commercial rigour."

After big cost overruns on megaprojects such as Kashagan in Kazakhstan and Gorgon in Australia over the past decade, there has been a shift towards smaller, lower risk projects.Frontier exploration in undeveloped regions is being shunned in favour of "brownfield" projects — Shell's Kaikias, for example — near existing fields with proven resources and established infrastructure.

The average budget for new upstream projects approved last year was $2.7bn, the lowest for a decade and half the $5.5bn average over that period, according to Wood Mackenzie, the consultancy.

"Companies are signalling to investors that they don't need to invest more to deliver production growth," said one fund manager with Shell and BP among his biggest holdings.

The exception to this restraint is ExxonMobil, which has increased capital expenditure by a quarter since 2016 and last year approved the $4.4bn Liza megaproject in Guyana as part of efforts to improve its sluggish growth outlook.

Investors have so far not rewarded this approach. Shares in ExxonMobil are down 3 per cent this year, compared with a 10 per cent increase for the S&P global oil index.

Some analysts worry that spending restraint has gone too far. "The big question is whether the industry is actually spending enough," said Angus Rodger, research director at Wood Mackenzie. "We cannot rely on small projects forever."

Others argue that tight budgets are here to stay as the oil and gas majors face growing competition from abundant US shale resources, as well as from the long-term shift to cleaner technologies such as renewable power and electric vehicles.

"Companies need to keep maximum flexibility to compete with shale and maximum financial headroom to build new business models," said Mr Smart. "We're in a very different paradigm to this stage in previous oil cycles."

-----

Earlier:

2018, May, 21, 11:10:00

OIL PRICE: ABOVE $79 YETREUTERS - Brent crude futures were at $79.06 per barrel at 0650 GMT, up 55 cents, or 0.7 percent, from their last close. Brent broke through $80 for the first time since November 2014 last week. U.S. West Texas Intermediate (WTI) crude futures were at $71.71 a barrel, up 43 cents, or 0.6 percent, from their last settlement. |

2018, May, 21, 11:05:00

ADEQUATE OIL SUPPLIESREUTERS - Saudi Arabia said on Friday it is consulting other oil producers in and outside OPEC to ensure the world has adequate supplies to support economic growth after prices hit $80 a barrel for the first time since 2014. |

2018, May, 18, 09:15:00

MARKETS IN BALANCEEIA - The extended period of oversupply in global petroleum markets that began before the Organization of the Petroleum Exporting Countries (OPEC) November 2016 agreement to cut production has ended, and the large buildup of global inventories during that period has now been drawn down. As OPEC plans to reconvene on June 22, markets now appear more in balance, but uncertainty remains going forward. |

2018, May, 18, 09:10:00

TIGHT MARKET BALANCEIEA - Because of rising prices, we lowered our estimate for 2018 global oil demand growth by 40 kb/d to 1.4 mb/d, and we increased our expectation for US oil production growth this year by 120 kb/d. |

2018, May, 16, 12:30:00

OIL MARKET BALANCEPLATTS - "It is too early to say [what the impact of the US decision on the oil market will be]. In any case, we have all the tools that could be used to balance the market," Novak said, commenting on the potential impact of the move on the oil markets. |

2018, May, 14, 11:20:00

SOUTHEAST ASIA: THE MAIN ENGINEIMF - the region remains the main engine of global growth, accounting for more than 60 per cent of the global growth. Regional output is projected to grow by 5.6 per cent in 2018 and 2019; 5.6 per cent is about 0.1 percentage point higher than we expected in last October, supported by trade as well as accommodative global financial conditions. |

2018, May, 10, 13:20:00

OIL PRICES 2018 - 19: $71 - $66EIA - Brent crude oil spot prices averaged $72 per barrel (b) in April, an increase of $6/b from the March level and the first time monthly Brent crude oil prices have averaged more than $70/b since November 2014. EIA forecasts Brent spot prices will average $71/b in 2018 and $66/b in 2019, which are $7/b and $3/b higher, respectively, than in the April |