INDIA'S OIL RISK

BLOOMBERG - India sees a greater probability of global crude oil prices remaining high for a longer period, a scenario that threatens to dent growth and fan inflation in Asia's third-largest economy.

The government will have to watch crude prices before preparing any policy response, a finance ministry official told reporters in New Delhi, asking not to be identified, citing rules. Oil supplies from Iran are also likely to be constrained after the U.S. reinstated financial sanctions on the Islamic Republic, the official said.

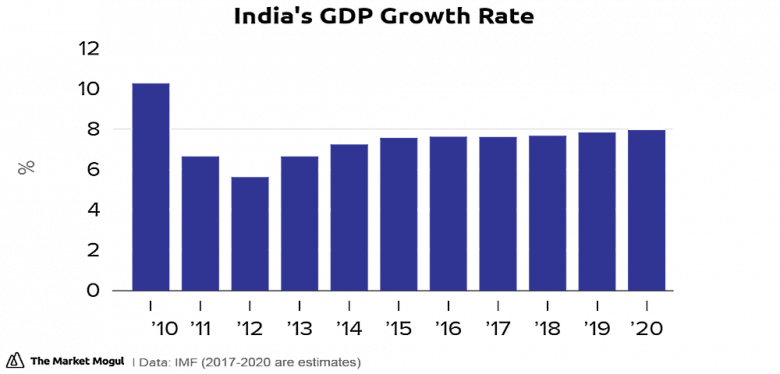

Brent crude rose as much as 3.1 percent Wednesday to $77.20 per barrel, its highest level since November 2014. India's central bank estimates oil at $78 a barrel would shave off 10 basis points from its 7.4 percent forecast for gross domestic product growth in the year to March 2019. Moreover, it expects costly crude could stoke inflation by 30 basis points.

Oil is India's biggest import and elevated prices along with a weaker rupee will widen the trade deficit, fuel imported inflation and squeeze government finances. Data due Monday will show consumer prices probably accelerated to 4.42 percent in April from 4.28 percent the previous month.

With India importing more than two-thirds of its crude requirements, the weakness in the rupee will contribute to a deterioration in its current-account deficit. If Brent averages $75 per barrel in 2018, India's current-account deficit would widen to 2.5 percent of GDP from 1.5 percent in 2017, according to analysts at Nomura Holdings Inc.

Ravindra Dholakia, a member of India's policy rate-setting panel, also flagged the risks of high oil prices on government finances. The fiscal space to accommodate future higher oil price shocks seems to be absent given the slippage in India's annual budget for the year through March 2019, Dholakia was cited as saying in the minutes of the February meeting of the Monetary Policy Committee.

-----

Earlier:

2018, April, 23, 14:35:00

INDIA'S OIL DEMAND UPPLATTS - India ended the first quarter of 2018 with robust oil products demand growth of 8.5%, the fastest quarterly growth since Q3 2016, as a renewed push on infrastructure projects and surging auto sales lifted gasoline and gasoil consumption. |

2018, April, 16, 09:25:00

WBG: SOUTH ASIA'S GROWTHWBG - South Asia has regained its lead as the fastest growing region in the world, supported by recovery in India. With the right mix of policies and reforms, growth is expected to accelerate to 6.9 percent in 2018 and 7.1 percent next year. |

2018, April, 11, 13:30:00

INDIA WANTS $50BLOOMBERG - “We are a very price-sensitive consumer,’’ Pradhan said on Tuesday. “From Indian consumers’ point of view, I will be more than happy if the price is around $50 a barrel.’’ |

2018, April, 11, 13:10:00

SAUDI - INDIA'S REFINERY: $44 BLNPLATTS - India's state-run refiners and Saudi Aramco signed an agreement Wednesday to jointly build an integrated refinery and petrochemical complex on India's west coast at a cost of $44 billion, Saudi energy minister Khalid al-Falih said. |

2018, April, 2, 09:10:00

INDIA'S OIL INVESTMENT: $22 BLNREUTERS - Indian Oil Corp plans to invest 1.43 trillion rupees ($22 billion) in next five years as the country’s top refiner seeks to raise its annual capacity to about 3.2 million barrels per day by 2030, |

2018, March, 16, 10:30:00

OIL DEMAND GROWTH - 2018: 1.5 MBDIEA - Looking at demand, our estimate for global growth in 2018 has increased by 90 kb/d taking it up to 1.5 mb/d. Although this is a modest revision, it is interesting that provisional data suggests very strong starts to the year in China and India, which, taken together, accounted for nearly 50% of global demand growth in 2017. Cold weather in some parts of the northern hemisphere in January-February saw an increase in heating demand. |

2018, February, 7, 07:55:00

INTEGRATED INDIAN OILPLATTS - "The integrated entity will have the capacity to neutralize the impact of volatility in global crude oil prices," said oil minister Dharmendra Pradhan. "The integrated entity will have the advantage of having enhanced capacity to bear higher risks and take higher investment decisions." |