OIL INVENTORIES DOWN

PLATTS - OECD crude oil inventories have fallen below the five-year average -- OPEC's key measure for its production cut agreement -- for the first time since the producer group began cutting back output, a senior OPEC source told S&P Global Platts Sunday.

Commercial oil inventories were 20 million barrels below the five-year average, the source said, as officials from OPEC kingpin Saudi Arabia and key non-OPEC producer, Russia indicated Friday they would begin increasing output in the second half of the year.

The OPEC alliance has lowered stocks close to its five-year average goal much quicker than expected due to supply outages in Venezuela and strong compliance to the 1.8 million b/d output cut deal. The group's Joint Ministerial Monitoring Committee said Friday compliance was 152% for April.

The inventory figure is significantly lower than OPEC's most recent estimate of OECD stocks at 2.829 billion barrels as of the end of March. That was just 9 million barrels above the five-year average that OPEC is targeting.

OPEC and 10 non-OPEC producers, led by Russia, are in the midst of a 1.8 million b/d supply cut deal that runs through the end of 2018 to support prices and reduce the global overhang of oil in storage.

The producers have been searching for a new way to measure oil market stability, beyond its current fixation on average stocks levels. Russian energy minister Alexander Novak said Friday OPEC is leaning towards switching to looking at the number of days of stock consumption, rather than the number of barrels stored, and could also extend the observation period from five to 10 years.

Platts' own estimate of OPEC crude production for April slid to a one-year low of 32 million b/d, largely due to Venezuela's continued output deterioration. That is down 140,000 b/d from March, and around 730,000 b/d below OPEC's notional ceiling of about 32.73 million b/d, when every country's quota under its production cut agreement is added up.

With their inventory goals achieved, the group will meet June 22 in Vienna to discuss the deal, amid speculation that it may have to increase output to make up for any Iranian barrels shut-in due to the US' decision to re-impose sanctions. Venezuela, a major OPEC member whose production is already in decline, also faces the prospect of additional US sanctions.

However, analysts at BNP Paribas said in research note Friday they expected the production cuts to be maintained for the rest of the year.

"With Saudi Arabia stressing the need for more capex to meet future oil demand and replace the natural decline from aging fields, and thus presumably a higher price to incentivize investment, supply cuts, in one form or another, may be extended to 2019," the note said.

-----

Earlier:

2018, May, 18, 09:15:00

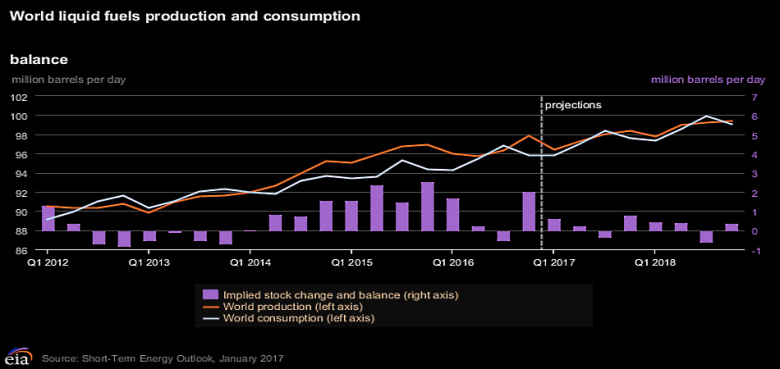

MARKETS IN BALANCEEIA - The extended period of oversupply in global petroleum markets that began before the Organization of the Petroleum Exporting Countries (OPEC) November 2016 agreement to cut production has ended, and the large buildup of global inventories during that period has now been drawn down. As OPEC plans to reconvene on June 22, markets now appear more in balance, but uncertainty remains going forward. |

2018, March, 9, 13:40:00

OPEC OIL PRICE: $66.85OPEC - The OPEC Reference Basket increased for the fifth-straight month in January, gaining a sharp 7.7% to average $66.85/b, the highest monthly average since November 2014. Oil prices were supported by continuing efforts by OPEC and participating non-OPEC producers to balance the market and ten consecutive weeks of crude inventory draws amid healthy economic growth and improving oil demand. |

2018, January, 10, 12:55:00

U.S. OIL INVENTORIES DOWNBLOOMBERG - Futures climbed as much as 0.9 percent in New York after rising 2.5 percent the previous two sessions. Inventories fell by 11.2 million barrels last week, the American Petroleum Institute was said to report on Tuesday. If the draw is replicated in Energy Information Administration data Wednesday, it will be the biggest decline for this time of the year since 1999. |

2017, December, 18, 12:40:00

OPTIMISTIC OIL PRICESBLOOMBERG - OPEC’s Secretary General Mohammad Barkindo said the producer group is close to its goal of rebalancing markets and the International Energy Agency said oil inventories in developed nations have slid to the lowest since July 2015. OPEC upped the implementation of promised cuts in November to 115 percent, the highest rate since the agreement began, according to the IEA. |

2017, December, 11, 10:00:00

U.S. OIL INVENTORY DOWN BY 5.6 MBDUS commercial crude oil inventories, excluding the Strategic Petroleum Reserve, decreased by 5.6 million bbl for the week ended Dec. 1 compared with the previous week. The latest estimate is 448.1 million bbl, which puts oil supplies in the upper range for this time of year, the US Energy Information Administration said. |

2017, November, 27, 20:05:00

OIL SUPPLY & DEMANDBLOOMBERG - Global crude inventories are declining and supply and demand are in balance, according to the head of Saudi Aramco, while the United Arab Emirates energy minister said U.S. shale oil doesn’t threaten OPEC’s efforts to support the market. |

2017, October, 16, 11:40:00

OPEC EXPECTATIONThe Organization of Petroleum Exporting Countries and allies including Russia have been cutting oil production this year to bring fuel inventories in industrialized nations back in line with the five-year average. |