OIL MARKET BALANCE

PLATTS - The OPEC coalition has "all the tools to balance the market" following the US decision to withdraw from the Iran nuclear deal, Russia's acting energy minister Alexander Novak said.

"It is too early to say [what the impact of the US decision on the oil market will be]. In any case, we have all the tools that could be used to balance the market," Novak said, commenting on the potential impact of the move on the oil markets.

In early May, President Donald Trump announced the US is withdrawing from the Iran nuclear deal. This is likely to have an immediate impact of about 200,000 b/d of Iranian crude being shut-in, rising to perhaps 500,000 b/d after six months as the deadline nears. Some of them put the disruption to the market closer to 1 million b/d of crude oil.

Iran is OPEC's third-largest producer with 3.83 million b/d of output in April. It exports around 2.5 million b/d of crude oil.

US sanctions against Iranian crude customers go back into force November 5 and the US Treasury Department has instructed countries to make significant cuts to their imports over the next six months.

Although most of the other signatory countries to the 2015 nuclear agreement -- the UK, France, Germany, Russia and China -- have said they will uphold the deal with Iran, many multinational companies that do business with Iran are expected to comply with the US sanction regime to avoid any financial penalties.

Novak expects to discuss the issue with Saudi Arabia's energy minister Khalid al-Falih next week, during a meeting on the sidelines of the St Petersburg International Economic Forum.

"We've agreed that we'll meet in St Petersburg and discuss more in detail [the situation around the US decision]," Novak said, referring to his recent phone conversation with Falih.

Novak was cautious about commenting on how the new US sanctions on Iran could impact oil prices.

"Fundamentally, the market is rebalancing, the stocks have been falling and this is a very good result [of the production cut deal by the OPEC coalition]. It is hard to say what share the geopolitical risks take in the price," he said, adding that this issue requires further in-depth analysis.

"We have to monitor whether these prices are long-term and stable. It is impossible to say as of now if they're stable, because geopolitics is drastically influencing the prices," he said. "We'll monitor the situation," he added.

The OPEC coalition's technical monitoring committee is due to meet next week, before the ministers of countries participating in the deal discuss the future of the production cut agreement in late June.

The deal between 14 OPEC and 10 non-OPEC countries to remove 1.8 million b/d of crude oil from the market is effective from January 2017 through 2018 currently. The key initial goal of the deal to remove stock surpluses over the average five-year levels has mainly achieved, according to the deal's participants and many independent market observers.

Nonetheless, the coalition is now discussing new targets, with some proposing that the deal be rolled over into 2019. Broader long-term cooperation between the OPEC and non-OPEC countries is also being discussed.

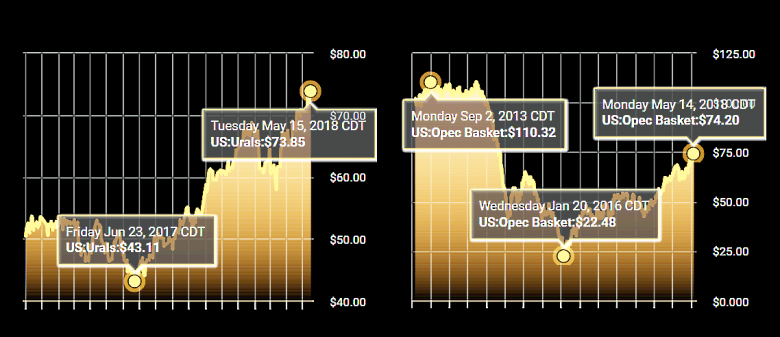

Oil prices have risen by around 40% since the production cut deal was implemented at the start of 2017, with the US decision to withdraw from the Iran nuclear deal adding further impetus last week, when benchmark Brent exceeded $77/b.

-----

Earlier:

2018, May, 14, 11:40:00

OIL PRICE: ABOVE $76REUTERS - Brent crude futures LCOc1 were at $76.79 per barrel at 0648 GMT, down 33 cents, or 0.4 percent, from their last close. U.S. West Texas Intermediate (WTI) crude futures were at $70.44 a barrel, down 26 cents, or 0.3 percent. |

2018, May, 14, 11:30:00

SAUDIS - RUSSIA COORDINATIONFT - “Any action will be taken in co-ordination with other producers,” the person said on Wednesday, adding that Saudi Arabia was already in talks with Russia and other producers, including the UAE. |

2018, May, 10, 13:10:00

OIL MARKET STABILITYPLATTS - Saudi Arabia's energy minister Khalid al-Falih said Wednesday that the country would work closely with OPEC as well as non-OPEC producers to mitigate the impact of any shortages that might arise following the US' decision to withdraw from the Iran nuclear deal. |

2018, May, 7, 08:35:00

IRAN NEEDS REASONABLE PRICESHANA - Iranian Minister of Petroleum Bijan Zangeneh said Tehran preferred "reasonable" price for crude oil in a bid to avoid market instability. |

2018, May, 4, 15:30:00

SAUDIS NEED $88BLOOMBERG - The IMF bolstered its estimate for the oil price the kingdom needs to balance the national budget this year to $88 a barrel, 26 percent more than an assessment made in October. |

2018, April, 27, 11:15:00

БАЛАНС МИРОВОГО РЫНКАМИНЭНЕРГО РОССИИ - Александр Новак, говоря о перспективах соглашения о балансировке рынка, отметил, что участники рассматривают несколько вариантов дальнейшего сотрудничества. «Главная задача – не создать условия для дисбаланса на рынке», - заключил Министр. |

2018, April, 23, 14:50:00

РОССИЯ - ОПЕК: 149%МИНЭНЕРГО РОССИИ - страны ОПЕК и государства, не входящие в ОПЕК, выполнили соглашение по добровольной корректировке объемов добычи нефти на 149%, что является самым высоким показателем в истории соглашения. |