OIL PRICE: ABOVE $79 ANEW

REUTERS - Oil prices edged lower on Wednesday with the possibility of higher OPEC output weighing on the market, although geopolitical risks are expected to keep prices near multi-year highs.

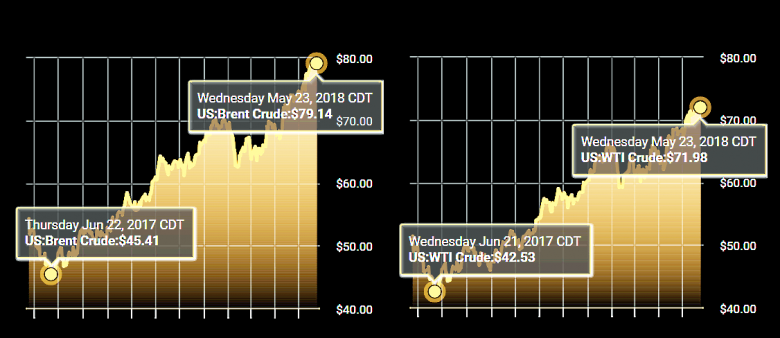

Brent LCOc1 futures fell 43 cents, or 0.5 percent, to $79.14 a barrel by 0218 GMT, after climbing 35 cents on Tuesday. Last week, the global benchmark hit $80.50 a barrel, the highest since November 2014.

U.S. West Texas Intermediate (WTI) crude CLc1 futures eased 25 cents, or 0.4 percent, to $71.95 a barrel, having climbed on Tuesday to $72.83 a barrel, the highest since November 2014.

"Looks like the market is pausing at current levels," said Michael McCarthy, Chief Market Strategist at brokerage CMC Markets.

"If sanctions are introduced against Iran, most of the OPEC producers would like to be pumping more oil, particularly giving the higher prices."

The Organization of the Petroleum Exporting Countries (OPEC) may decide to raise oil output as soon as June due to worries over Iranian and Venezuelan supply and after Washington raised concerns the oil rally was going too far, OPEC and oil industry sources familiar with the discussions told Reuters.

The OPEC-led supply curbs have largely cleared an inventory surplus in industrialized countries based on the deal's original goals, and stocks continue to decline.

"...Investors are mindful of upcoming talks between Russia and Saudi Arabia about whether they should look at a controlled relaxation of over-compliance with their output cut agreement," ANZ said in a note.

Rising supply in the United States, where shale production is forecast to hit a record high in June, has limited the upward move in prices.

Concerns about a potential drop in Iranian oil exports following Washington's exit from a nuclear arms control deal with Tehran have driven prices to multi-year highs.

On Monday, the United States demanded Iran make sweeping changes - from dropping its nuclear program to pulling out of the Syrian civil war - or face severe economic sanctions.

Iran dismissed Washington's ultimatum and one senior Iranian official said it showed the United States is seeking "regime change" in Iran.

In addition, Venezuela's crude output could drop further following a disputed presidential election.

The United States is actively considering oil sanctions on Venezuela, where output has dropped by a third in two years to its lowest in decades.

U.S. crude and distillate stockpiles fell last week, while gasoline inventories increased unexpectedly, data from industry group the American Petroleum Institute showed on Tuesday.

-----

Earlier:

2018, May, 21, 11:10:00

OIL PRICE: ABOVE $79 YETREUTERS - Brent crude futures were at $79.06 per barrel at 0650 GMT, up 55 cents, or 0.7 percent, from their last close. Brent broke through $80 for the first time since November 2014 last week. U.S. West Texas Intermediate (WTI) crude futures were at $71.71 a barrel, up 43 cents, or 0.6 percent, from their last settlement. |

2018, May, 21, 11:05:00

ADEQUATE OIL SUPPLIESREUTERS - Saudi Arabia said on Friday it is consulting other oil producers in and outside OPEC to ensure the world has adequate supplies to support economic growth after prices hit $80 a barrel for the first time since 2014. |

2018, May, 18, 09:20:00

OIL PRICE: ABOVE $79REUTERS - Brent crude futures LCOc1 were at $79.57 per barrel at 0310 GMT, up 27 cents, or 0.3 percent from their last close. Brent broke through $80 for the first time since November 2014 on Thursday. U.S. West Texas Intermediate (WTI) crude futures were at $71.62 a barrel, up 13 cents, or 0.2 percent, from their last settlement. |

2018, May, 18, 09:10:00

TIGHT MARKET BALANCEIEA - Because of rising prices, we lowered our estimate for 2018 global oil demand growth by 40 kb/d to 1.4 mb/d, and we increased our expectation for US oil production growth this year by 120 kb/d. |

2018, May, 16, 12:35:00

OIL PRICE: ABOVE $77 ANEWREUTERS - Brent crude futures were at $78.22 per barrel at 0644 GMT, down 21 cents, or 0.3 percent, from their last close. U.S. West Texas Intermediate (WTI) crude futures were at $71.03 a barrel, down 28 cents, or 0.4 percent, from their last settlement. |

2018, May, 16, 12:30:00

OIL MARKET BALANCEPLATTS - "It is too early to say [what the impact of the US decision on the oil market will be]. In any case, we have all the tools that could be used to balance the market," Novak said, commenting on the potential impact of the move on the oil markets. |

2018, May, 16, 12:20:00

ЦЕНА URALS: $ 71,87525МИНФИН РОССИИ - Средняя цена на нефть Urals за период мониторинга с 15 апреля по 14 мая 2018 года составила $ 71,87525 за баррель, или $ 524,7 за тонну. Согласно расчетам Минфина России экспортная пошлина на нефть в РФ с 1 июня 2018 года повысится на $ 13,3 и составит $ 131,8 за тонну. |