RUSSIA - SAUDIS DISCUSSION

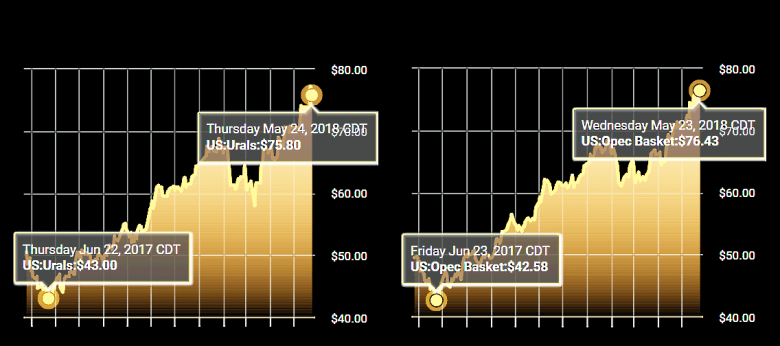

FT - Russia and Saudi Arabia's energy ministers will discuss a potential relaxation of the global oil output cap agreed between Opec and Moscow amid calls for them to boost output after their supply cuts helped drive prices to $80 a barrel.

The historic agreement that came into effect in January 2017 between the previous oil market rivals — curbing global output by 1.8m barrels a day — helped arrest the three year slump in crude prices.

But collapsing oil production in crisis-hit Venezuela and fears renewed US sanctions against Iran's energy sector will curb exports further have seen prices jump to the highest level since 2014, sparking calls for an exit from the deal.

Russia's Alexander Novak will meet his Saudi counterpart Khalid al-Falih in St Petersburg on Thursday evening to discuss the oil market and debate a possible easing of the caps that were agreed among 24 countries.

"We will discuss the current situation, the outlook and possible further actions to be taken within the framework of our deal. Speaking of relaxing the deal: it is possible but should be based on a thorough analysis of the situation," Mr Novak told the Financial Times. "Generally speaking, we are quite flexible."

Opec, Russia and other producing countries will next meet fomally in Vienna on June 22 to decide the future of the deal as pressure mounts from consumer nations to amend the strict curbs, even as most oil-exporting economies have benefited from rising prices.

Opec and its allies have cut production by more than their initial targets, removing far more barrels from the market than originally planned.

The price of benchmark Brent crude slipped 1 per cent on Thursday to a low of $78.57 on speculation that Opec and Russia's deal could be amended.

Ahead of the US withdrawal from the Iranian nuclear deal, President Donald Trump's administration held discussions with big producer countries — widely believed to have included Saudi Arabia — about alleviating any supply shortages.

Mr Trump last month also accused Opec of "artificially" boosting the price.

While Mr Al Falih said last week the market had "ample" supplies, he also said he was in communication with countries such as the US and Russia "to co-ordinate global action to ease oil market anxiety".

Indian government officials have expressed concern about the impact of higher prices on the fast-growing Asian economy, which is a big oil consumer. The International Energy Agency, meanwhile, warned demand growth would take a hit.

"$80 per barrel is way higher than expected ... it is surprising and unexpected for us," Mr Novak said in an interview.

"We cannot argue that higher prices are always a good thing for producers. When prices are way too high, it leads to the market being overheated and it results in destabilisation and excess supply," he added.

Some countries are afraid such a high price will encourage more investment in the US shale industry, which they fear has the potential to once again crash the price should more supplies come on too fast.

"We need to thoroughly analyse the reasons behind this price development. We need to understand whether it is a result of basic fundamental balance shift between supply and demand, or a one-time issue that will not last," Mr Novak added. "Our ultimate goal was not to set a specific price."

Gulf officials too have said they want to ensure the rally is not temporary, fearing a renewed price drop should they ease supply curbs too soon, two people familiar with the matter said.

Vagit Alekperov, head of Russia's second-largest oil producer Lukoil, said on Thursday that Russian producers should be allowed to increase their output. Mr Alekperov said the deal should remain but be made more "flexible."

Mr Novak said that any easing would take place across all members of the deal and would be "gradual", to avoid a rush by producers to increase their market share.

"It will be a gradual process in order to prevent market destabilisation. Maybe it will involve reduction of quotas step by step, and at any time it could be adjusted according to the state of the market," he said.

"We want to continue our co-operation beyond 2018. What we are talking about right now is the format."

-----

Earlier:

2018, May, 23, 10:50:00

OIL PRICE: ABOVE $79 ANEWREUTERS - Brent LCOc1 futures fell 43 cents, or 0.5 percent, to $79.14 a barrel by 0218 GMT, after climbing 35 cents on Tuesday. Last week, the global benchmark hit $80.50 a barrel, the highest since November 2014. U.S. West Texas Intermediate (WTI) crude CLc1 futures eased 25 cents, or 0.4 percent, to $71.95 a barrel, having climbed on Tuesday to $72.83 a barrel, the highest since November 2014. |

2018, May, 23, 10:45:00

HARD OIL MARKETFT - Most oil majors can now cover dividends and capital expenditure at prices around $50 per barrel, meaning that, at $80, they make a healthy surplus. |

2018, May, 23, 10:30:00

RUSSIA'S OIL BENEFITBLOOMBERG - Oil has touched a level above $80 a barrel for the first time since November 2014. OPEC’s inventory target for output cuts has been met. |

2018, May, 21, 11:05:00

ADEQUATE OIL SUPPLIESREUTERS - Saudi Arabia said on Friday it is consulting other oil producers in and outside OPEC to ensure the world has adequate supplies to support economic growth after prices hit $80 a barrel for the first time since 2014. |

2018, May, 18, 09:10:00

TIGHT MARKET BALANCEIEA - Because of rising prices, we lowered our estimate for 2018 global oil demand growth by 40 kb/d to 1.4 mb/d, and we increased our expectation for US oil production growth this year by 120 kb/d. |

2018, May, 16, 12:30:00

OIL MARKET BALANCEPLATTS - "It is too early to say [what the impact of the US decision on the oil market will be]. In any case, we have all the tools that could be used to balance the market," Novak said, commenting on the potential impact of the move on the oil markets. |

2018, May, 16, 12:20:00

ЦЕНА URALS: $ 71,87525МИНФИН РОССИИ - Средняя цена на нефть Urals за период мониторинга с 15 апреля по 14 мая 2018 года составила $ 71,87525 за баррель, или $ 524,7 за тонну. Согласно расчетам Минфина России экспортная пошлина на нефть в РФ с 1 июня 2018 года повысится на $ 13,3 и составит $ 131,8 за тонну. |