RUSSIA'S OIL BENEFIT

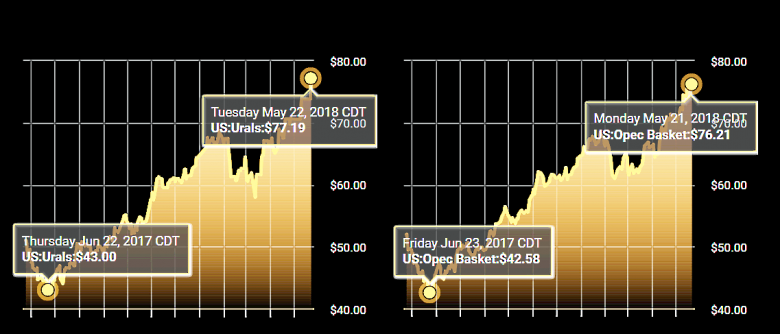

BLOOMBERG - Oil has touched a level above $80 a barrel for the first time since November 2014. OPEC's inventory target for output cuts has been met.

But even though its oil companies want to turn on the taps and its finance ministry may be worried about prices rising too far, Russia won't bring its output deal with the group to a juddering halt when the participants meet in Vienna next month. Instead, it will stand alongside its Saudi partner and continue to toe the line on production restraint.

Its participation in the output deal, agreed after negotiations that lasted for most of 2016, was a major victory for Saudi Arabia. Under former oil minister Ali Al-Naimi, the country had made it clear that it wouldn't act to prop up prices without broad and meaningful support that went beyond the members of OPEC. Russia stepped up to provide it, leading a contingent of 11 countries from outside the group to join the agreement, even if it and Oman were the only ones to offer significant cuts that went beyond naturally declining output.

The deal with OPEC offers a opportunity to take a lead role on the international stage. The forging of new alliances in the Middle East, as much as the importance of oil prices to the Russian economy, explains its active participation in the OPEC-led output cuts. The reduction in Russia's oil production is in marked contrast to its only previous collaboration with the group in 2001, when it agreed to cut supply, but actually delivered very little.

All parties in Russia could get what they want — the oil industry may still get a boost even if Russia stays in the deal. The impending return of sanctions aimed at Iran's oil exports offer the opportunity for Russia and other producers to raise output while the group as a whole remains within its overall target.

The aggregate level of production aimed for by the OPEC+ group is much more important to the deal's success than how that total is shared between them. The collapse in Venezuela's oil production — which still has further to fall — means that the group has already reduced its overall output by more than it agreed. The anticipated loss of at least some of Iran's exports will add to that over-achievement.

That gives headroom for individual producers to pump more while the group as a whole stays within its self-imposed limit. For now, though, neither Russia nor Saudi Arabia has stepped in to make up for the unexpected loss of Venezuelan oil. Far from seeking an exit from the deal, the talk has been of changing the measure of success to justify its continuation.

Oil ministers Khalid Al-Falih and Alexander Novak will meet in St Petersburg later this week and discussing the response to rising oil prices will certainly be on their agenda. But as oil prices continue to nudge $80 a barrel, don't expect Russia to give up its gains and lead a charge for the exit. Its delegates are much more likely to polish up their soundbites to voice their continued support for their new friends.

-----

Earlier:

2018, May, 21, 11:10:00

OIL PRICE: ABOVE $79 YETREUTERS - Brent crude futures were at $79.06 per barrel at 0650 GMT, up 55 cents, or 0.7 percent, from their last close. Brent broke through $80 for the first time since November 2014 last week. U.S. West Texas Intermediate (WTI) crude futures were at $71.71 a barrel, up 43 cents, or 0.6 percent, from their last settlement. |

2018, May, 21, 11:05:00

ADEQUATE OIL SUPPLIESREUTERS - Saudi Arabia said on Friday it is consulting other oil producers in and outside OPEC to ensure the world has adequate supplies to support economic growth after prices hit $80 a barrel for the first time since 2014. |

2018, May, 18, 09:10:00

TIGHT MARKET BALANCEIEA - Because of rising prices, we lowered our estimate for 2018 global oil demand growth by 40 kb/d to 1.4 mb/d, and we increased our expectation for US oil production growth this year by 120 kb/d. |

2018, May, 14, 11:35:00

GLOBAL IRAN SANCTIONSPLATTS - Trump's plan to leave the Iran nuclear deal and reimpose sanctions could have major impacts for global oil, natural gas, metals and petrochemical markets. |

2018, May, 14, 11:30:00

SAUDIS - RUSSIA COORDINATIONFT - “Any action will be taken in co-ordination with other producers,” the person said on Wednesday, adding that Saudi Arabia was already in talks with Russia and other producers, including the UAE. |

2018, May, 7, 08:35:00

IRAN NEEDS REASONABLE PRICESHANA - Iranian Minister of Petroleum Bijan Zangeneh said Tehran preferred "reasonable" price for crude oil in a bid to avoid market instability. |

2018, May, 4, 15:30:00

SAUDIS NEED $88BLOOMBERG - The IMF bolstered its estimate for the oil price the kingdom needs to balance the national budget this year to $88 a barrel, 26 percent more than an assessment made in October. |