U.S. - CHINA ENERGY TRADE

PLATTS - China and the US agreed this weekend to put a halt to their trade dispute after the former agreed to buy more US goods, key among them being LNG and oil - a move which could significantly transform global trade flows.

According to a joint statement released May 19, the US will send a team to China to work out the details of increased energy exports, although no timeline was provided. China's vice premier Liu He told local media both countries had now agreed to drop tariff threats.

The trade spat started in March when the Trump administration announced tariffs on steel and aluminum to reduce the US' $375-billion trade deficit with China. Beijing responded by threatening to impose an additional 25% duty on US propane.

STRATEGIC LNG TRADE

China-US bilateral LNG trade is strategic for both parties.

China became the largest contributor to global LNG consumption growth in 2017. It surpassed South Korea as the world's second largest LNG importer and its share of global LNG demand is expected to converge with that of Japan by 2030.

China's total regasification capacity is also set to increase to nearly 80 million mt/year in 2018 from 70.7 million mt/year in 2017 with the startup of new terminals and expansion of existing ones.

China may be on track to become the largest buyer of US LNG this year. China has imported nearly 1.25 million mt of LNG from the US in 2018 to date -- versus 1.61 million mt in all of 2017 -- only behind Mexico and South Korea, according to data from S&P Global Platts Analytics.

The US Department of Energy has approved a total LNG export capacity of 476 Bcm/year to countries with a US Free Trade Agreement, while 156 Bcm/year of projects have a license to export to non-FTA countries.

In February 2018, Cheniere Energy finalized two long-term supply deals with state-owned China National Petroleum Corp. for the supply of 1.2 million mt/year starting this year. The deal underpins development of Train 3 at Cheniere's Corpus Christi facility that is currently under construction.

The US and China in November 2017 signed preliminary agreements for LNG exports from the Delfin floating liquefaction project, which is the first US floating LNG export facility.

State-owned Sinopec along with leading Chinese banks have agreed with Alaska Gasline Development Corp, and the state of Alaska to develop a $40-billion, 20 million mt/year Alaska LNG project comprising three liquefaction trains at Nikiski in south central Alaska, an 800-mile gas pipeline, a gas treatment plant on the North Slope; and various interconnecting facilities to link the Prudhoe Bay gas complex to the treatment plant.

CRUDE OIL IMPORTS SET TO RISE

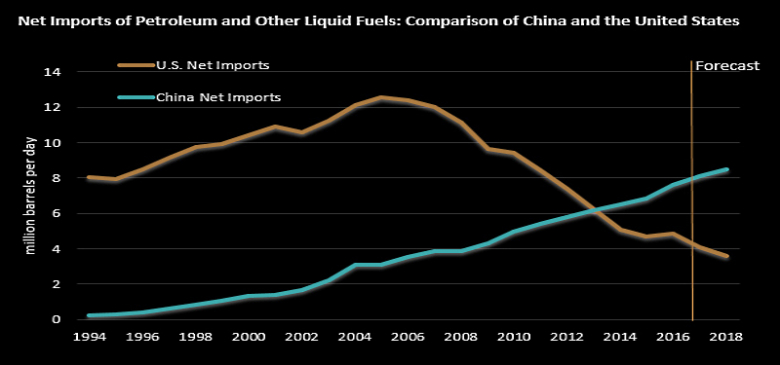

China is the largest Asian buyer of US crudes. China's crude imports from the US in the first quarter rose to 3.89 million mt, or 316,770 b/d, from 443,000 mt a year earlier and its market share rose to 3.5% from 0.4%.

China's US crude import growth has been the fastest in the world with volumes rising from almost zero to 220,000 b/d in 2017. It accounted for 20% of total US crude supplies in the year and became the second largest importer of US crude after Canada, according to data from the US Energy Information Administration.

Most of China's current crude imports from the US are medium sour grades such as Mars and Southern Green Canyon. But light sweet crudes WTI, Bryan Mound Sour and even shale oil from Eagle Ford have joined the flow.

Unipec, the trading arm of state-owned Sinopec, plans to raise its shipments from the US to China by around 80% to 10 million mt in 2018.

US crude exports to China are being facilitated by infrastructure developments. US crude exporters reconfigured export facilities on the US Gulf Coast to load larger ships, such as VLCCs, to enable economies of scale for exports to Asia. The Shaden, the first VLCC to load a crude cargo directly at the Louisiana Offshore Oil Port, departed the terminal February 18 carrying US crude to China.

International benchmark price spreads are key and will drive the future trend in US crude supplies to China. US crude exports have been supported by widening Brent/WTI and Dubai/WTI spreads.

PROPANE ALERT OFF

The US is China's second largest propane supplier after the UAE, supplying 760,939 mt worth a total $450 million in Q1. In 2017, China imported 3.54 million mt of LPG from the US, compared with 30 mt five years ago.

China's biggest US propane importer Oriental Energy recently agreed with Germany's Mabanaft to take 6 million mt of US propane for six years starting from June 2018.

US propane or LPG has emerged as one of the fastest-growing hydrocarbon exports, with billions of dollars being invested in export facilities on the East Coast by companies such as Sunoco Logistics, Enterprise Product Partners, Kinder Morgan, Phillips 66, and Occidental Petroleum.

US propane exports to Asia have grown with record movement of VLGCs, accelerated by the expansion of the Panama Canal in 2016. The transportation time from the US to China has been shortened to around 30 days after sailing through the Panama Canal, compared with around 45 days via the Cape of Good Hope.

-----

Earlier:

CHINA:

|

|

|

U.S.:

|

2018, May, 16, 12:05:00

LNG FOR EUROPE & CHINA UPBLOOMBERG - Europe and China will be comparable in significance as importing regions in the coming years, Cheniere Energy Inc. said, citing data from ... |

2018, May, 21, 10:40:00

U.S. PETROLEUM DEMAND UP BY 750 TBDAPI - American Petroleum Institute reported that the first four months of this year saw U.S. petroleum demand average 750 thousand... |

||

2018, May, 14, 11:20:00

SOUTHEAST ASIA: THE MAIN ENGINEIMF - the region remains the main engine of global growth, accounting for more than 60 per cent of the global growth. Regional output is projected to grow ... |

2018, May, 21, 10:30:00

U.S. RIGS UP 1 TO 1,046BAKER HUGHES A GE - U.S. Rig Count is up 1 rig from last week to 1,046, with oil rigs unchanged at 844, gas rigs up 1 to 200, and miscellaneous rigs ... |

||

2018, May, 8, 10:55:00

CHINA'S OIL IMPORTS UP TO 9.64 MBDBLOOMBERG - The world’s biggest oil buyer imported 9.64 million barrels a day in April, according to data released by Beijing-based General Administration of ... |

|

||

2018, May, 4, 15:25:00

CHINA'S OIL DEMAND UP 6.8%PLATTS - China ended the first quarter of 2018 with robust apparent oil demand growth of 6.8% year on year, as stronger-than-expected GDP growth ... |

2018, May, 2, 13:15:00

U.S. GAS PRODUCTION UP 10%EIA - In February 2018, for the ninth consecutive month, dry natural gas production increased year-to-year from the same month a year ago. ... |

||

2018, April, 27, 11:00:00

ЭНЕРГИЯ РОССИИ И КИТАЯМИНЭНЕРГО РОССИИ - «Россия и Китай имеют большой потенциал снижения энергоемкости экономики и проводят последовательную политику в этом направлении. ... |

2018, April, 16, 09:15:00

U.S. GAS INVESTMENT: $170 BLNBLOOMBERG - Gas output will expand by 24 billion cubic feet, or 32 percent, through 2025 from last year, according to U.S. Energy Information Administration estimates. ... |

||

2018, April, 27, 10:50:00

NEW CHINA'S OILEIA - As Asia-Pacific oil demand continues to grow, some market participants believe the region needs an oil price benchmark based on local supply and ... |

2018, April, 9, 11:30:00

U.S. - CHINA CONCESSIONSREUTERS - On Tuesday, Washington unveiled some $50 billion worth of proposed tariffs on Chinese imports and on Thursday Trump upped the ante, ... |

||

2018, April, 25, 10:10:00

RUSSIA - CHINA OIL MAXIMUMREUTERS - Russia was China’s largest crude oil supplier in March, data showed on Tuesday, retaining the lead spot for a 13th consecutive month. |

2018, March, 28, 11:10:00

U.S. LNG EXPORTS UPEIA - U.S. exports of liquefied natural gas (LNG) reached 1.94 billion cubic feet per day (Bcf/d) in 2017, up from 0.5 Bcf/d in 2016. As LNG exports ... |