GAZPROM'S GAS FOR KOREA

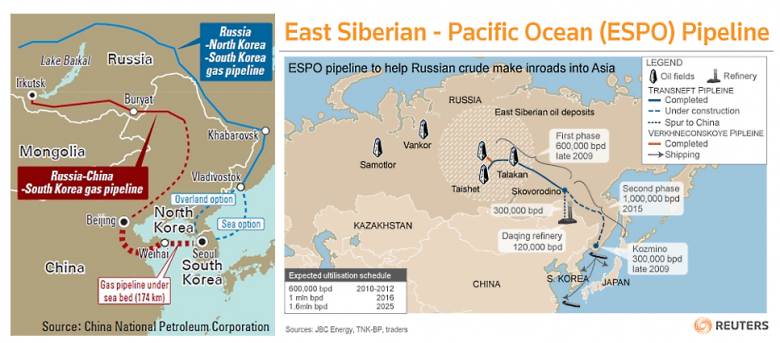

PLATTS - Gazprom has renewed talks with South Korea on a potential natural gas pipeline from Russia's Far East via North Korea in light of the improved political situation in the region, while it also expects talks with China on gas supplies to be completed by the end of the year, company officials said Friday.

Gazprom is also starting talks with Iran on potential field development there -- despite the renewed sanctions threat against Iran -- as well as on potential markets and transportation routes, including the Iran-Oman pipeline and Iran-Pakistan-India route, for gas from the four Iranian projects it has its eye on, they said.

Following the talks between US President Donald Trump and North Korean leader Kim Jong-un and improving relations between North and South Korea, the discussions about a potential pipeline through both Koreas are back on the table after years of being suspended, deputy chairman of Gazprom's management committee, Vitaly Markelov, told a press briefing.

"Today, the political situation is somewhat different. The South Korean side approached Gazprom about the revival of this project. A series of talks took place on this. These talks are continuing. We can't say anything further, but we are renewing such talks with the Korean side," Markelov said.

South Korea's state-run Korea Gas Corp. (Kogas) signed a preliminary agreement with Gazprom in 2008 to buy 10 Bcm a year of gas for 30 years beginning 2015. Under the $90-billion deal, the companies agreed to push for a pipeline across North Korea, and signed a relevant memorandum of understanding with Russia, but Gazprom soon shelved the plans because of the geopolitical risk.

Gazprom's statement of renewed talks on the project follow Russian President Vladimir Putin signaling earlier this month support the development of new economic projects with North Korea, with a focus on infrastructure projects, primarily a gas pipeline and other energy infrastructure.

South Korea is the second-largest buyer after Japan of LNG from the Gazprom-led Sakhalin-2 LNG plant on the Pacific coast. The country bought 17% of the 11.49 million mt of LNG the plant produced last year, according to Sakhalin Energy, Sakhalin-2 operator.

Gazprom so far exports pipeline gas only to Europe and Turkey, but has plans to send its first pipeline gas to China via the Power of Siberia pipeline, which Markelov said with "no doubt whatsoever" would launch on December 20 next year as planned, under a 30-year supply contract with CNPC for 38 Bcm/year.

CHINA

Gazprom has, meanwhile, been holding talks with China on building a pipeline to send 8 Bcm/year of gas from the Far East, with the result expected by the end of the year, Gazprom Export Director General Elena Burmistrova said without specifying whether the project foresees using the same reserves as the potential pipeline to South Korea.

"At the moment, talks continue with CNPC on gas supplies along the Far Eastern route. We cannot give a final time frame for such a pipeline. But the aim is preferably to complete [the talks] by the end of 2018," Burmistrova said.

These expectations have been sparked by China showing "real heightened gas demand," Gazprom deputy CEO Alexander Medvedev said, adding the prospects for demand there meant talks were also being continued on another pipeline to China, the so-called Western Route, expected to carry 30 Bcm/year of West Siberian gas to Northwest China over 30 years.

"The fact that there are prospects is pretty obvious. The question is: When will these prospects start turning into specific agreements?" Medvedev said.

While Gazprom plans to use the Chayadinskoye and Kovyktinskoye fields -- to be launched in 2019 and 2023, respectively, and produce 25 Bcm/year each at plateau -- as the reserve base for the pipeline, its reserve potential in East Siberia and the Far East is "huge" and constantly growing due to new geological exploration, Markelov said.

MIDDLE EAST

The company is also eying expanding its reserve base abroad and is stepping up talks on its participation in four Iranian fields -- Kish, North Pars, Farzad A and B -- under a memorandum with the National Iranian Oil Company, Markelov said.

"According to the memorandum, we were to prepare our proposals based on the financial-technical analysis presented by the Iranian side. Today, we have completed this work, and we are starting a series of talks with the Iranian side on these four projects. Based on this memorandum, we have to carry out analysis, hold talks, consider the contract conditions and will take further decisions accordingly," he said.

Medvedev shrugged off concerns over the potential renewal of US sanctions on Iran later this year by saying: "If you can't stand the heat, get out of the kitchen!" but added that Gazprom would assess all the technical, economic, and sanctions risks.

As the company is looking at monetization options and supply routes for future Iranian gas, it is considering deliveries via the Iran-Oman or the Iran-Pakistan-India pipelines -- the latter is still awaiting signatures from Pakistan and India -- as well as gas liquefaction, Markelov said.

Iran has offered Gazprom participation in the Iran LNG project, on which the parties have signed a memorandum, he said, adding that the company was only carrying out an audit of the project, after which it would decide on any potential involvement.

-----

Earlier:

2018, April, 16, 09:05:00

IRAN'S - S.KOREA OIL IMPORTS DOWN 39.3%REUTERS - South Korea’s March crude oil imports from Iran dropped 39.3 percent from a year earlier on slowing demand for Iranian oil, the country’s customs data showed on Sunday. |

2018, February, 27, 13:25:00

U.S. - N.KOREA SANCTIONSU.S. DT - The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) today announced the largest North Korea-related sanctions tranche to date, aimed at disrupting North Korean shipping and trading companies and vessels to further isolate the regime and advance the U.S. maximum pressure campaign. |

2018, January, 19, 12:15:00

S.KOREA'S DIVERSIFICATIONPLATTS - For full-year 2017, South Korea's crude imports from its biggest supplier Saudi Arabia fell 1.7% to 319.02 million barrels, compared with 324.45 million barrels in the previous year, customs data showed. On the contrary, South Korea has imported 1.77 million mt, or around 13 million barrels, of crude from the US in 2017, about four times higher than in 2016. Shipments from Russia grew to 140,000 b/d last year from 112,000 b/d in 2016. |

2017, December, 18, 12:30:00

S.KOREAN LNGPLATTS - South Korea aims to boost the portion of LNG in its electricity generation mix to 18.8% in 2030 from an estimated 16.9% this year as part of efforts to reduce its heavy reliance on coal and nuclear, the energy ministry said. |

2017, February, 10, 18:35:00

SOUTH KOREA'S LNG DOWNBut Lee said that South Korean demand for LNG would keep falling in the short-term due to increased electricity output from nuclear and coal-fired power plants. The country is the world's second-biggest LNG importer after Japan. |

2016, August, 25, 18:35:00

THE LARGEST LNG IMPORTERSJapan, South Korea, and China are the three largest importers of liquefied natural gas (LNG) in the world, accounting for more than half of global LNG imports in 2015. Combined LNG imports in these countries averaged 18.2 billion cubic feet per day (Bcf/d) in 2015, a 5% (0.9 Bcf/d) decline from 2014 levels and the first annual decline in these countries' combined LNG imports since the global economic downturn in 2009. |

2016, August, 18, 18:40:00

S.KOREA'S OIL UP 4.5%The world's fifth-largest crude importer has continued to buy more crude oil from Iran since sanctions were lifted in January. Shipments of Iranian crude more than doubled to 7.22 million tonnes, or 248,616 bpd, in the January-July period of 2016 from a year earlier, according to its customs office data. |