MOZAMBIQUE'S LNG DEVELOPMENT

FT - A consortium led by Anadarko Petroleum plans to give its investment approval to a large new liquefied gas export plant in Mozambique in the first half of next year after a sharp reduction in costs, the latest move in an investment boom that is expected to transform the country into a gas supplier to the world.

The US exploration and production company that discovered huge gas reserves in deep water off the coast of Mozambique in 2010, said it had made enough progress in agreeing deals with customers, securing approvals from the government, lining up financing and preparing for construction work, for it to give the green light to the development within 12 months.

The plan is a further sign that after a lull in approvals of new liquefied natural gas projects, activity is starting to pick up, as customers attempt to secure gas that they expect to need in the 2020s.

Even though large-scale oil and gas developments have picked up over the past 18 months, just one new LNG project was approved in 2017, the research firm Rystad Energy said this week. However, last month two LNG-related investments were given the green light: Cheniere Energy's expansion of its Corpus Christi LNG plant in Texas, and an A$400m (US$296m) investment by a Santos-led consortium to increase gas supplies to the Gladstone LNG plant in Queensland.

Gas developments in Mozambique have also faced delays, but Mitch Ingram, Anadarko's executive vice-president for deep water, said the company's project was in a "sweet spot", because the worldwide slowdown in approvals meant there had been less competition both for customers and for suppliers to build the facilities. He added that the project was hitting the contractors "at the low end of the cost cycle".

The development is expected to cost about $7.7bn for the gas liquefaction and export plant plus an unspecified amount for offshore wells and pipelines, after significant cost reductions over the past couple of years.

Anadarko and its partners, which include Mitsui of Japan and ONGC Videsh of India, had taken advantage of the slowdown in activity in the industry to cut the total cost of the project by $4bn, Mr Ingram said.

The onshore costs are $600 per tonne of capacity in the plant's first phase, which will have the ability to export 12.88m tonnes of LNG per year when it is completed in 2023-24. That cost is close to the numbers being suggested for the latest wave of LNG export plants proposed for the Gulf of Mexico coast of the US, which have the benefit of a more well-established supply chain and infrastructure.

EDF of France has signed a 15-year contract to buy LNG from the plant. Earlier this month, Tokyo Gas of Japan and Centrica of the UK signed heads of agreement for 20-year purchases. Together with other deals that Anadarko expects to conclude by the end of the year, those contracts should provide enough confidence in future revenues for the project to raise the financing it needs.

The consortium has already started relocating about 500 families from the site of where the plant will be, and has about 1,000 workers on site making preparations and building infrastructure such as roads. It plans to step up to 2,500 workers on site before the end of the year.

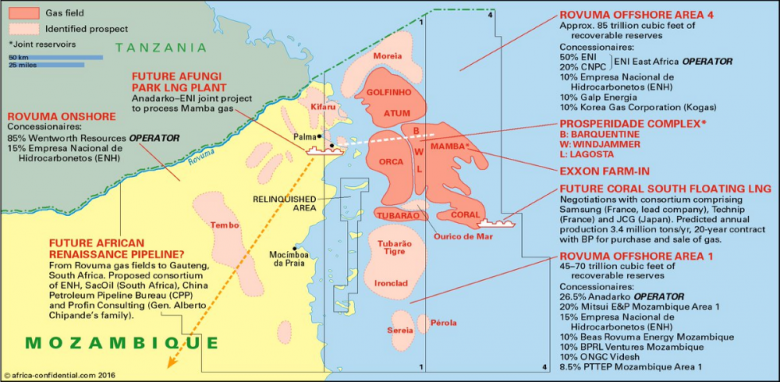

Anadarko has estimated the reserves in its Area 1 acreage off the coast of Mozambique at about 75tn cubic feet, implying a resource life of about 120 years at the initial production rate of 12.88m tonnes of LNG per year, but the consortium intends to expand the plant every five years to add more capacity.

Other companies are also planning to invest heavily in Mozambique's gas sector. A consortium led by Eni of Italy last year gave the go-ahead to an $8bn floating LNG project called Coral, with a capacity of about 3.4m tonnes per year. ExxonMobil, which bought part of Eni's Mozambique assets last year, is also looking at another onshore LNG plant.

Security concerns in the region have risen recently. Attacks by a mysterious group apparently of Islamic militants have killed at least 39 people and burnt hundreds of homes in the northern province of Cabo Delgado, which is where the LNG plant is being built.

Mr Ingram said the issue was "high on our agenda", and the company was looking at its own security and working closely with the authorities.

-----

Earlier:

2018, January, 5, 23:35:00

LNG INVESTMENTS WILL UPBLOOMBERG - Energy companies will approve investments for more than 150 million tons a year of new supply capacity over the next four years, according to the report. By comparison, global consumption was 286 million tons in 2017. Projects in Qatar, Papua New Guinea, Russia and the U.S. are most economically appealing, followed by Mozambique, Australian expansion projects and an Alaskan mega-project. |

2017, December, 18, 12:10:00

EXXON BOUGHT MOZAMBIQUEExxonMobil Development Africa B.V. has acquired a 25 percent indirect interest in Mozambique’s gas-rich Area 4 block from Eni and assume responsibility for midstream operations. |

2016, August, 1, 18:50:00

MOZAMBIQUE'S HUGE GASMozambique made one of the world's biggest gas finds in a decade in 2010 but negotiations with operators Eni and U.S. firm Anadarko have dragged on for years due to disputes over terms and concerns about falling energy prices. |

2016, May, 24, 19:30:00

CHINA - MOZAMBIQUE COOPERATIONCNPC and Mozambique’s national oil and gas company ENH have signed a cooperation framework agreement under which the two sides will reinforce cooperation in oil and gas exploration and production, and natural gas processing and marketing. |

2014, October, 31, 13:55:00

ASIA NEED MOZAMBIQUEAsian buyers line up for Mozambican LNG with new deals

|

|

2014, April, 6, 17:05:00

TO BUY MOZAMBIQUEONGC Videsh Ltd plans to raise $500-700 million to fund Mozambique acquisition |